1. What Happened? Genieance Disposes of ₩8.3 Billion in Treasury Stock

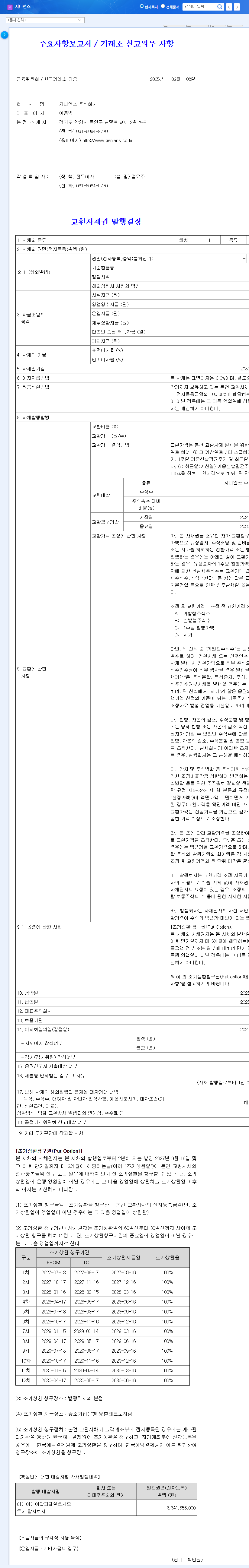

Genieance announced the disposal of 372,000 shares (approximately ₩8.3 billion) of treasury stock on September 8, 2025. This move is intended to fund the issuance of convertible bonds and marks a significant development in the company’s financial strategy.

2. Why the Disposal? – Securing Growth Momentum Through Convertible Bonds

This treasury stock disposal is aimed at raising funds for the issuance of convertible bonds. Genieance plans to utilize the acquired funds for investments in new businesses (MDR, Zero Trust) and strengthening R&D, securing future growth momentum. It’s also expected to improve the company’s financial structure and liquidity, enhancing its ability to navigate the current slowdown in earnings.

3. So, What’s the Impact? Analyzing Opportunities and Risks

Positive Impacts

- ✅ Improved Financial Structure and Liquidity

- ✅ Securing Future Growth Drivers (MDR, Zero Trust)

- ✅ Potential for Reduced Stock Volatility

Potential Risks

- ❌ Uncertainty Surrounding Convertible Bond Issuance Terms and Success

- ❌ Appropriateness of Treasury Stock Disposal Price

- ❌ Potential for Short-Term Stock Dilution

- ❌ Possibility of Inefficient Use of Funds

4. What Should Investors Do? Key Checkpoints

Investors should carefully consider the following points to make informed investment decisions.

- ➡️ Detailed analysis of convertible bond issuance terms (interest rate, maturity, conversion price, etc.)

- ➡️ Confirmation of treasury stock disposal price and official announcements of results

- ➡️ Monitoring of future earnings forecasts and performance of new businesses (MDR, Zero Trust)

- ➡️ Attention to changes in macroeconomic conditions, such as exchange rates and interest rates

FAQ

How does treasury stock disposal affect stock prices?

In the short term, there is a possibility of stock dilution due to the increase in the number of shares. However, in the long term, it can have a positive impact by strengthening the company’s financial stability and securing growth momentum.

What are convertible bonds?

Convertible bonds are bonds with the option to convert them into shares of the issuing company after a certain period.

What are Genieance’s new businesses?

Genieance is strengthening its MDR (Managed Detection and Response) service and Zero Trust-based security business.