1. Why Did EZ Holdings Increase Its Stake?

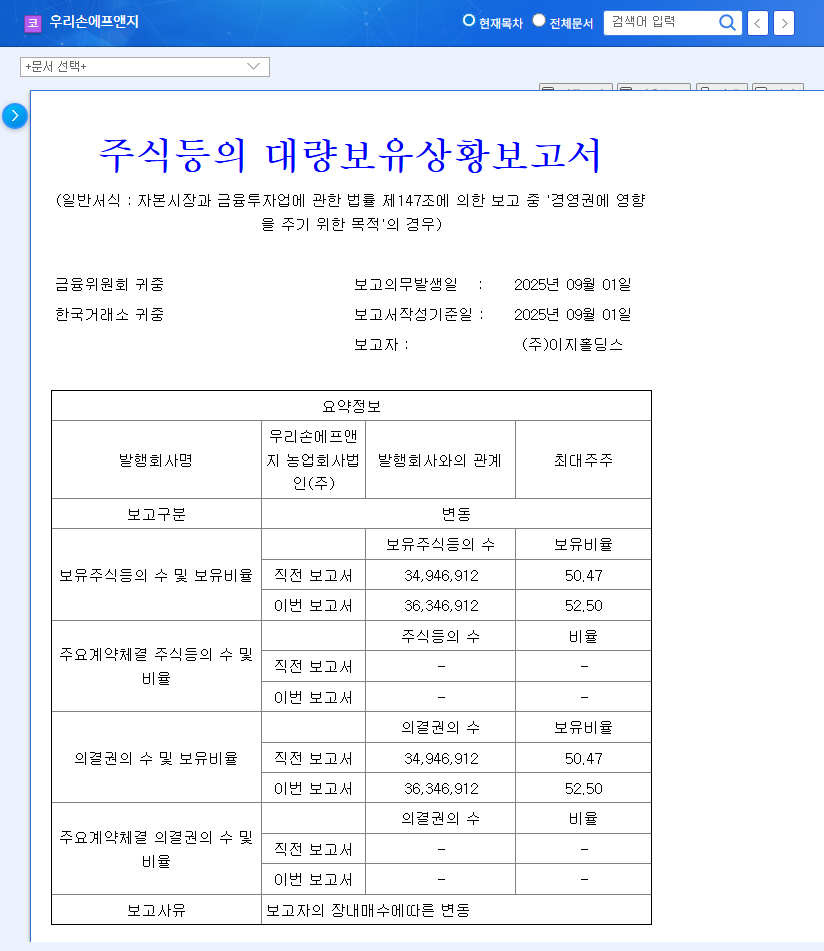

EZ Holdings increased its stake in Woori Sone F&G from 50.47% to 52.50% through open market purchases over five days. This is interpreted as a strategic move to strengthen management control and expand influence. The majority shareholder’s active investment suggests a strong belief in the company’s future growth potential.

2. What is the Current Situation of Woori Sone F&G?

Woori Sone F&G recorded solid earnings in the first half of 2025. Rising pork prices and stable operations in the processed food distribution business drove growth. However, sluggish overseas business and interest rate fluctuation risks remain challenges to overcome.

- Strengths: Strong performance in the pork business, high quality competitiveness, stable financial structure

- Weaknesses: Sluggish overseas business, interest rate fluctuation risk

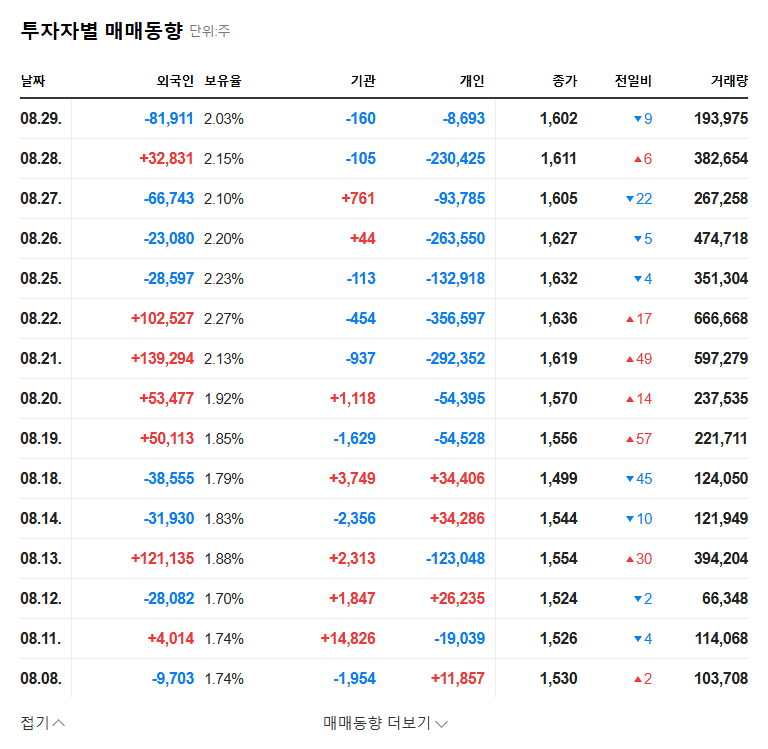

3. How Will the Stake Increase Affect the Stock Price?

EZ Holdings’ stake increase is likely to act as a short-term momentum for stock price increase. This is because expectations for management stabilization and growth can stimulate investor sentiment. In the mid-to-long term, the company’s growth strategy is expected to be implemented more effectively in a stable management environment.

4. What Should Investors Consider?

Before making an investment decision, several factors should be carefully considered. Positive aspects include the majority shareholder’s stake and solid fundamentals. However, factors such as improvement in the profitability of overseas businesses and the impact of macroeconomic variables can act as investment risks.

Key Checkpoints:

- EZ Holdings’ further stake change plans

- Woori Sone F&G’s earnings improvement and overseas business performance

- Changes in macroeconomic indicators

Frequently Asked Questions

Why did EZ Holdings increase its stake in Woori Sone F&G?

It is interpreted as a strategic move to strengthen management control and expand influence.

Will the stake increase have a positive impact on Woori Sone F&G’s stock price?

It is highly likely to act as a short-term momentum for a stock price increase. Improved investor sentiment and expectations for management stabilization can have a positive impact on the stock price.

What are the precautions for investment?

Potential risk factors such as sluggish overseas business and interest rate fluctuation risk should be considered. In addition, the sensitivity of company performance to changes in macroeconomic indicators should be continuously monitored.