What Happened?: Shareholder Activism Erupts at YOM

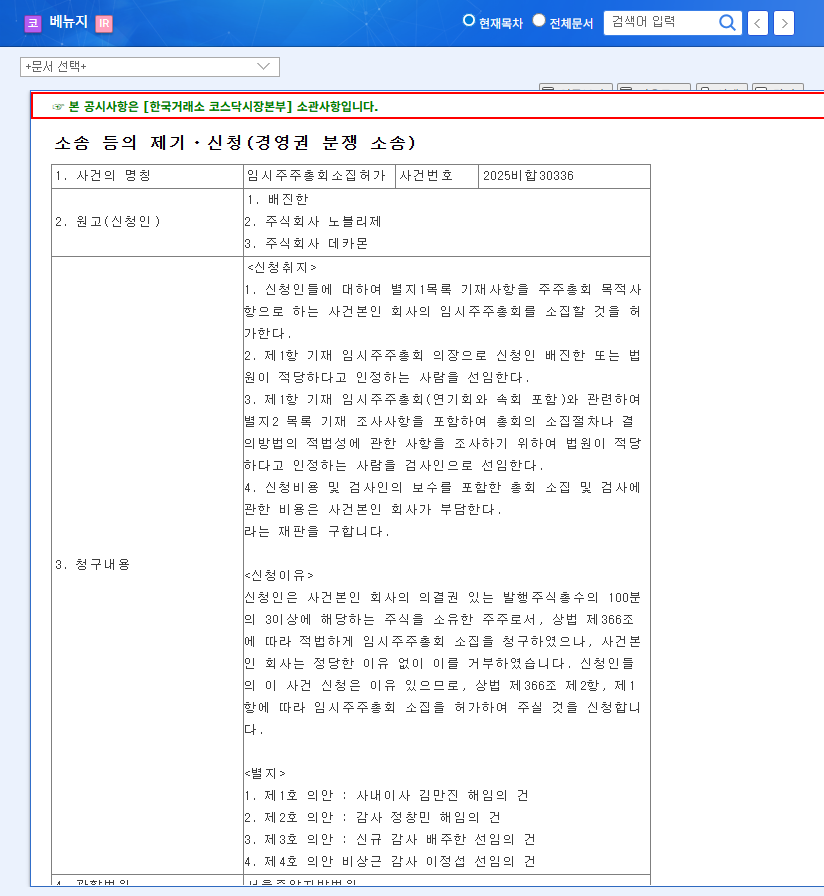

A group of minority shareholders, led by Yoo ○○ and 35 others, are seeking greater management participation through requests for access to board minutes, shareholder proposals, and calls for an extraordinary general meeting. Key proposals include the dismissal of the chairman, appointment of an interim chairman, amendment of the articles of incorporation (number of directors and auditors), and appointment of several new directors and auditors. This can be interpreted as a move to check the existing management and enhance management transparency.

Why?: Connecting Fundamentals and Activism

YOM recorded a 621.59% year-on-year increase in operating profit to KRW 9.346 billion in 2024, but posted a net loss due to valuation losses on financial assets. The debt-to-equity ratio improved significantly to 20.8%, and the current ratio remains healthy at 236.4%. Despite these positive fundamental improvements, minority shareholders seem to be questioning the management’s strategic direction, leading to more assertive shareholder activism.

What’s Next?: Analyzing Short-Term and Long-Term Impacts

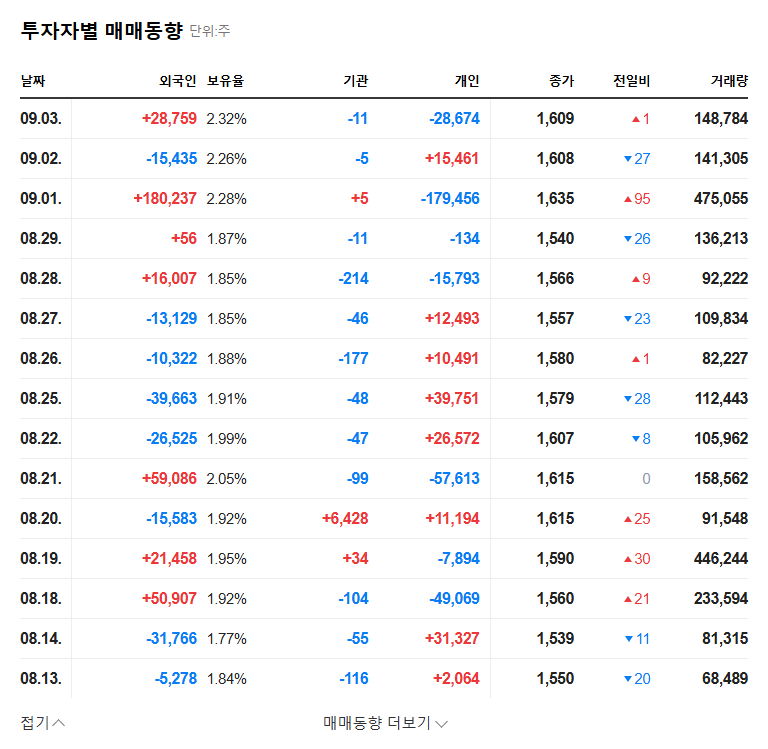

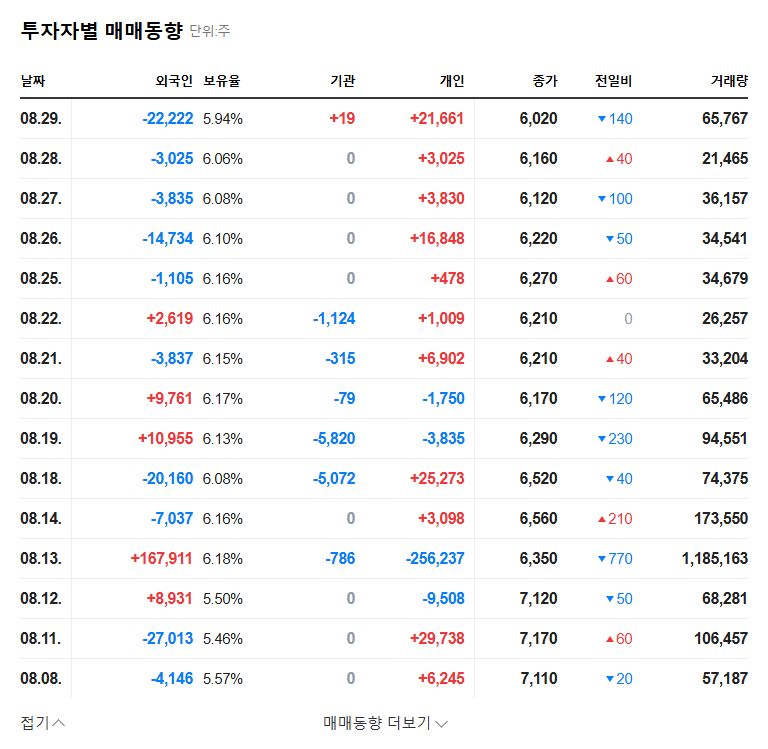

- Short-Term Impact: Potential for increased stock price volatility due to concerns over shareholder conflict and management disputes. The magnitude of the impact will depend on market interpretation.

- Long-Term Impact: Potential for enhanced management transparency, improved decision-making efficiency, and strengthened shareholder-friendly policies. If the shareholder proposals are approved, changes in management and business strategy are anticipated, significantly impacting the company’s mid- to long-term growth.

What Should Investors Do?: Action Plan

- Monitor Shareholder Meeting Outcomes: The approval or rejection of shareholder proposals will determine the company’s future direction.

- Observe Management Response: Evaluate management’s efforts to communicate and resolve conflicts with minority shareholders.

- Monitor Business Competitiveness: Observe the company’s response to changes in the external environment and its efforts to develop new businesses.

Frequently Asked Questions (FAQ)

What is the core of the shareholder activism at YOM?

Minority shareholders are actively exercising their shareholder rights, demanding changes in management and amendments to the articles of incorporation.

How will this activism affect YOM’s stock price?

In the short term, increased uncertainty may lead to higher stock price volatility. In the long term, it could lead to improved management transparency and increased shareholder value.

What should investors pay attention to?

Investors should closely monitor the outcome of the shareholder meeting, management’s response, and any subsequent changes in business strategy.