1. What Happened?: M83 IR Meeting and Performance Analysis

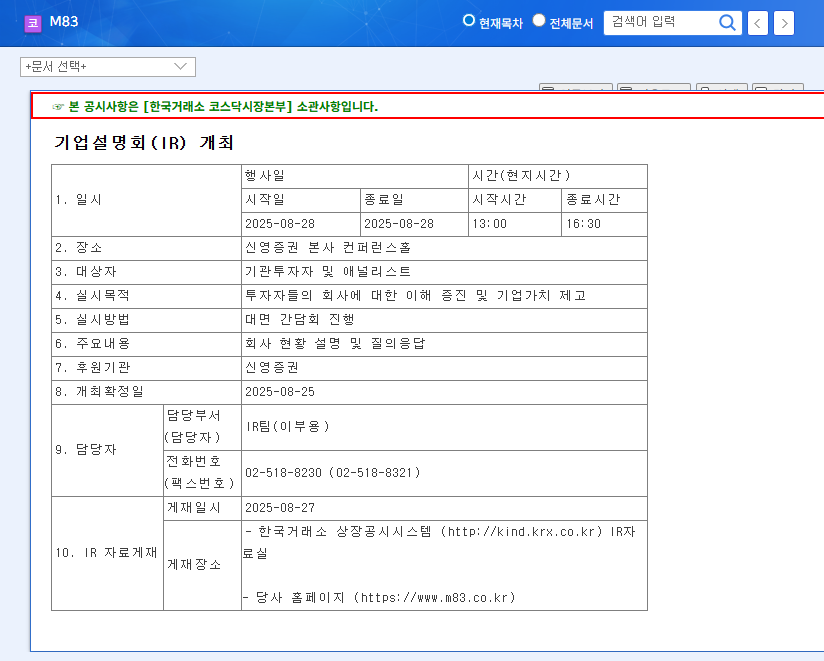

On August 28, 2025, M83 held an Investor Relations (IR) meeting to enhance investor understanding and boost corporate value. However, recent financial results, including a shift to operating losses on a consolidated basis and a sharp decline in standalone revenue, have sparked investor concerns.

2. Why Did This Happen?: Fundamental Analysis and Market Environment

M83 possesses positive factors such as VFX industry growth, overseas acquisitions, and strengthened in-house content creation capabilities. However, negative factors like high cost of sales, increasing debt, and declining stock prices cannot be ignored. Furthermore, fluctuations in exchange rates and interest rates pose significant risks to M83’s financial health.

3. What’s Next?: Key IR Takeaways and Future Outlook

The IR meeting is expected to focus on profit improvement strategies, explanations for the decline in standalone performance, global business and new content strategies, and strategies for managing exchange rate and interest rate volatility. Management’s ability to present clear strategies and demonstrate positive momentum will be crucial for restoring investor confidence.

4. What Should Investors Do?: Investment Strategy Recommendations

Currently, negative factors outweigh positive ones in M83’s short-term fundamentals. However, the situation could turn around depending on the outcome of the IR meeting and the company’s subsequent execution. Therefore, a cautious approach is recommended, with careful observation of the IR results and the company’s future performance before making investment decisions.

Frequently Asked Questions

Q1. What is M83’s main business?

M83 specializes in creating visual special effects (VFX). They provide VFX technology for various fields such as film, drama, and advertising, and are expanding their business into new media areas like virtual production, VR, and AR.

Q2. Why has M83’s recent performance deteriorated?

A combination of factors contributed to the decline, including high cost of goods sold, increased expenses related to overseas acquisitions, and rising interest expenses due to interest rate hikes. The weak performance of the standalone business also impacted the overall results.

Q3. Should I invest in M83?

A cautious approach is recommended at this time. While the growth of the VFX industry and M83’s global expansion strategy are positive, the recent financial downturn and financial risks need to be considered. It is advisable to closely monitor the results of the investor relations meeting and the company’s future performance before making any investment decisions.