1. What Happened? SMCore’s Majority Shareholder Change

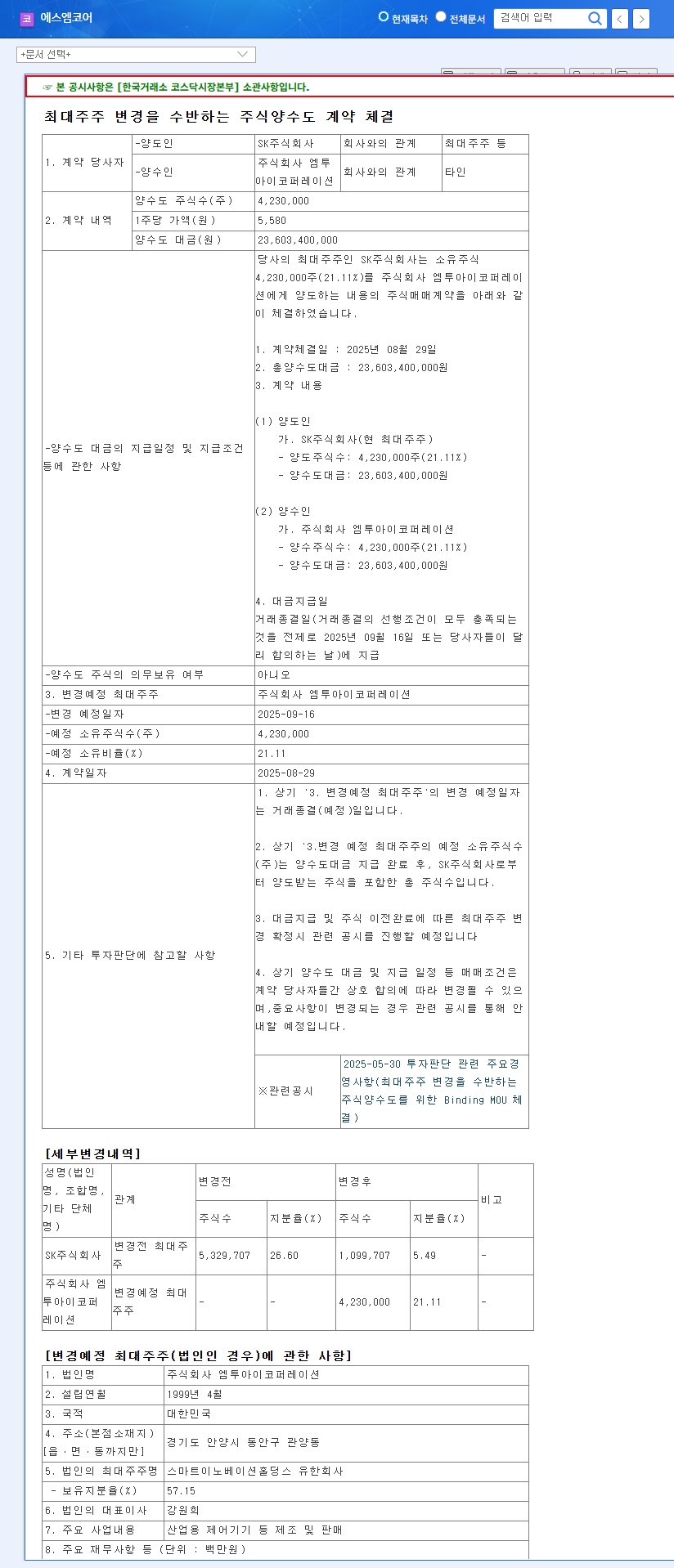

SMCore’s majority shareholder has transitioned from SK Corporation to M2i Corporation, with the stake changing from 26.69% to 21.20%. This is more than just a shift in ownership; it could be a significant turning point for SMCore’s future.

2. Why the Change? Acquisition Purpose and Background

M2i Corporation acquired SMCore for business diversification and to secure new growth engines. They anticipate synergy effects, especially in smart factory and smart logistics solutions. The change in the relationship with the SK Group is also noteworthy.

3. SMCore: A Company Overview and Fundamental Analysis

- Strengths: Expertise in logistics automation, expansion into semiconductor/secondary battery industries

- Financials: Revenue growth, return to profitability, but high cost of sales ratio

- Orders: Secured order backlog of KRW 232.97 billion (positive)

- Risks: High cost of sales ratio, exchange rate volatility, global economic fluctuations

4. Impact of the Change: Opportunities and Threats

Positive Impacts: Business synergy, improved management efficiency, increased investment. Potential Threats: Uncertainty in business direction, initial integration challenges, persistent high cost of sales and exchange rate volatility.

5. Should You Invest? Investment Opinion and Strategy

The current investment opinion is “Neutral”. Close monitoring of synergy effects, improvements in the cost of sales ratio, and exchange rate volatility management capabilities is crucial.

6. Key Points for Investors to Watch

- Synergy strategy with M2i Corporation

- Efforts to improve operating profit margin

- Exchange rate volatility management

- Vision and execution of the new management team

FAQ

What is M2i Corporation?

[Briefly explain M2i Corporation, their business areas, etc.]

What are SMCore’s main businesses?

SMCore operates in automated logistics systems, semiconductors, and secondary battery industries.

What is the outlook for SMCore’s stock price after the change in majority shareholder?

Short-term stock price volatility is expected, but the long-term outlook depends on the realization of synergies with M2i Corporation.