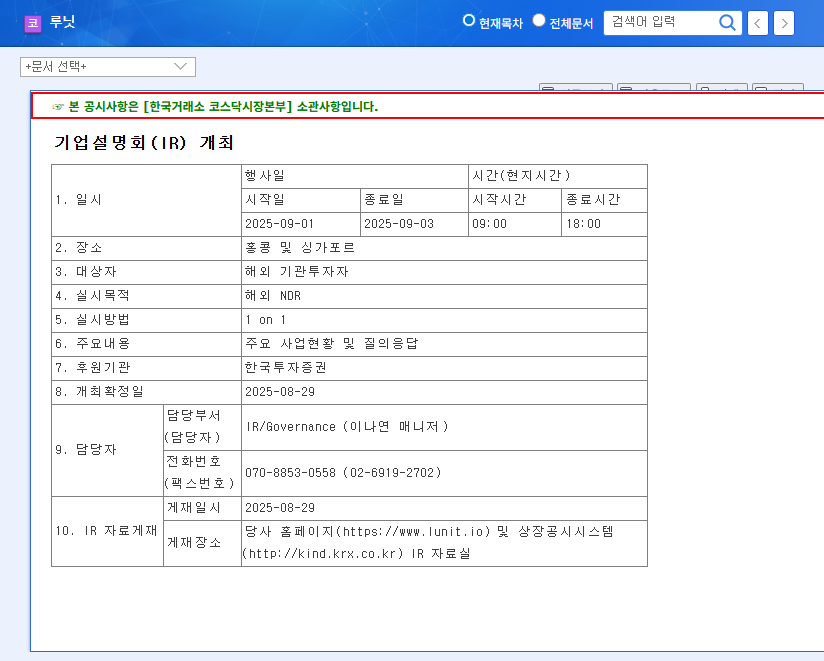

Lunit’s Overseas NDR: What was discussed?

Lunit shared its key business updates and held a Q&A session with investors during its overseas NDR on September 1, 2025. The focus was on the growth potential of their cancer diagnosis and treatment AI solutions, global partnership expansion strategies, and plans to strengthen their presence in the North American market through the acquisition of Volpara Health.

Lunit’s Growth Drivers and Investment Appeal

Lunit is a leader in deep learning-based cancer diagnosis and treatment AI solutions, with 92% of its revenue generated overseas. Its main businesses include chest X-ray and mammography image analysis solutions (Lunit INSIGHT) and histopathology slide analysis solutions (Lunit SCOPE). The company continuously invests in R&D (51.31% of revenue) to strengthen its technological competitiveness. The acquisition of Volpara Health is expected to accelerate its expansion into the North American market.

Investment Considerations

While Lunit has high growth potential, investors should be aware of the company’s continued operating losses and high debt-to-equity ratio (191.13%) resulting from the Volpara Health acquisition financing. Increased competition and changes in the regulatory environment should also be considered as risk factors.

Action Plan for Investors

Investors considering Lunit should carefully review the business strategies and financial improvement plans presented at the NDR. It is crucial to examine management’s responses to questions from overseas investors and their outlook on future profitability improvement. Short-term stock price volatility is expected depending on the NDR results and market reaction, so it is advisable to establish an investment strategy from a long-term perspective.

What are Lunit’s main businesses?

Lunit develops deep learning-based AI solutions for cancer diagnosis and treatment. Their main products include Lunit INSIGHT, a chest X-ray and mammography image analysis solution, and Lunit SCOPE, a histopathology slide analysis solution.

What are the key takeaways from Lunit’s overseas NDR?

Investors should focus on Lunit’s growth potential, global partnership expansion strategies, plans to strengthen their North American presence through the acquisition of Volpara Health, and management’s responses to concerns about ongoing losses and high debt levels.