SK Gas IR Key Takeaways: What Happened?

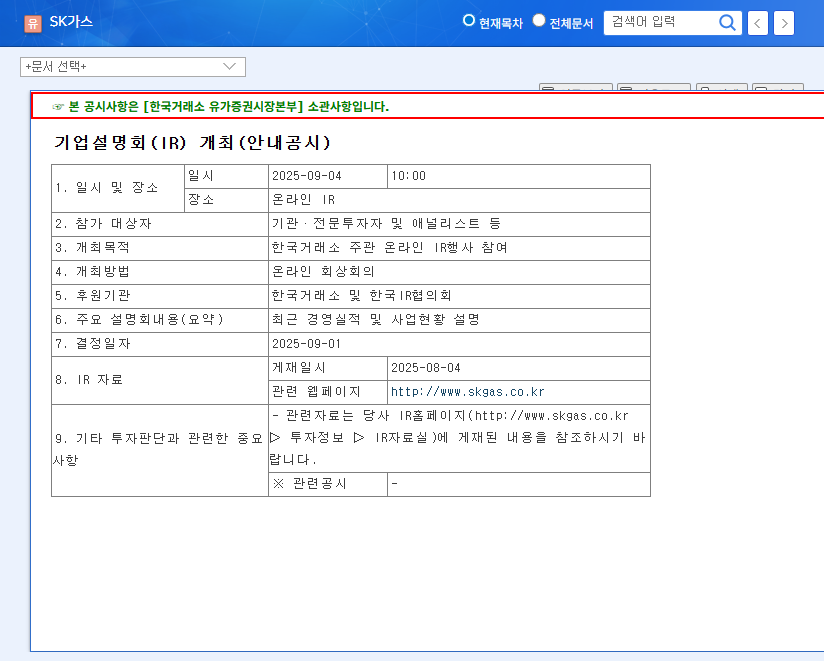

SK Gas presented its business performance and current status at an online IR event hosted by the Korea Exchange on September 4, 2025. The company reported revenue of KRW 3.7 trillion (a 12.7% decrease YoY) and operating profit of KRW 233.6 billion (a 101.9% increase YoY) for the first half of 2025. While revenue declined, the significant increase in operating profit was attributed to new business performance and cost reduction efforts in the LPG business.

Why Pay Attention to SK Gas?

SK Gas is diversifying its business portfolio beyond LPG into LNG/LPG dual power generation and LNG terminal projects, securing future growth drivers. The commercial operation of new projects, expected to commence in the second half of 2024, is anticipated to diversify revenue streams and improve profitability. Furthermore, SK Gas is pursuing sustainable growth by strengthening its ESG management.

How to Invest in SK Gas?

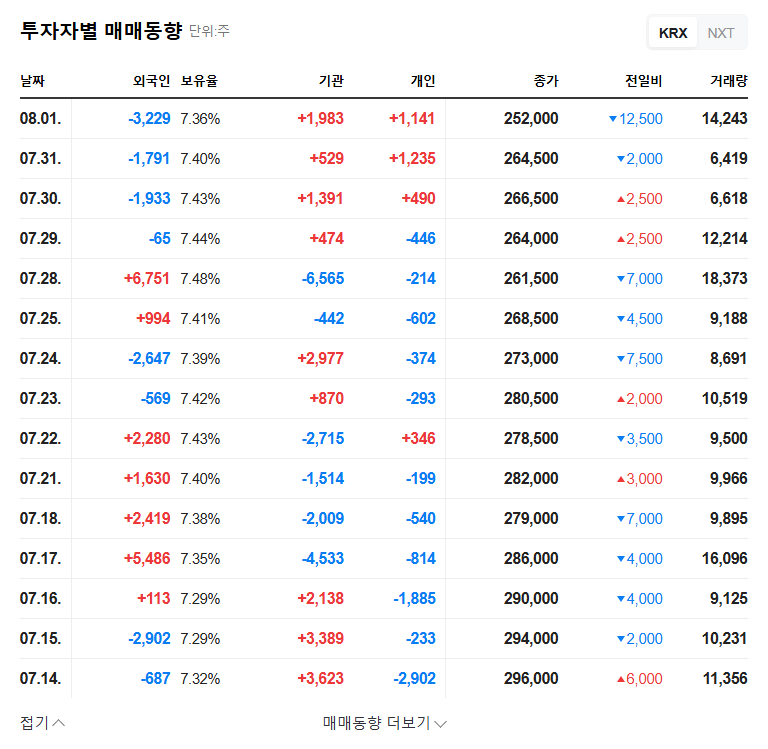

A long-term perspective is crucial when considering investment in SK Gas. While the diversification strategy and focus on new growth drivers are positive, continuous monitoring of the profitability of new businesses and improvements in financial soundness is essential. Investors should also consider the impact of macroeconomic variables like exchange rates, interest rates, and oil prices on SK Gas’s earnings, along with an assessment of the company’s risk management capabilities. Post-IR market reactions and further information should be used to reassess investment decisions. Including SK Gas as part of a diversified portfolio across different sectors and asset classes is recommended for managing investment risk.

Action Plan for Investors

- Review IR materials and analyze management commentary.

- Monitor the progress and profitability of new business ventures.

- Analyze the impact of macroeconomic variables.

- Develop a diversified investment strategy.

Frequently Asked Questions

What are SK Gas’s main businesses?

SK Gas’s core business is LPG, but it is expanding into new energy businesses such as LNG/LPG dual power generation and LNG terminal projects.

What is SK Gas’s recent financial performance?

For the first half of 2025, SK Gas reported revenue of KRW 3.7 trillion (down 12.7% YoY) and operating profit of KRW 233.6 billion (up 101.9% YoY).

What are the key investment considerations for SK Gas?

Investors should carefully monitor the company’s high debt ratio, market volatility, and macroeconomic factors. It’s also crucial to track the profitability of new businesses and improvements in financial soundness.