The news investors feared is now official: the Kodaco delisting has been formally confirmed. On September 30, 2025, the Korea Exchange announced its final resolution to delist all shares of Kodaco (046070), a decision that has sent shockwaves through its shareholder community. For anyone holding this stock, this event represents a critical moment that could potentially lead to a significant or total loss of investment capital. This comprehensive guide will break down the entire situation, from the underlying causes to the actionable steps you must consider to protect your assets.

This situation underscores the inherent risks in equity markets, particularly with companies facing financial distress. We will explore the timeline, the financial red flags that led to this point, and provide a clear framework for shareholder response strategies.

The Official Announcement: Kodaco’s Delisting Confirmed

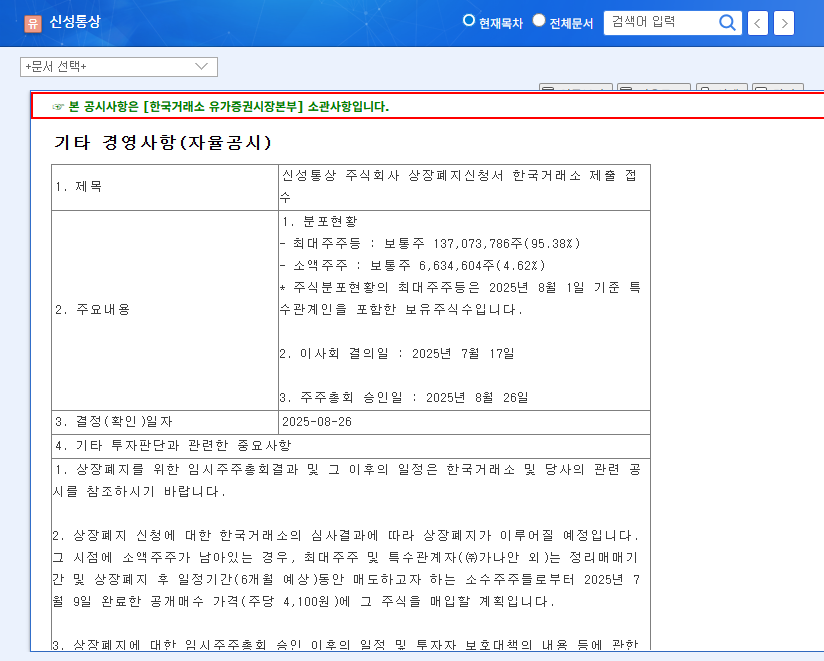

The final decision was made public on September 30, 2025, when the Korea Exchange’s Corporate Review Committee concluded its review of Kodaco (046070). The committee determined that the company had not only failed to resolve the delisting grounds from its 2023 audit but had also incurred new grounds for delisting based on its 2024 audit. The official filing can be viewed directly on the DART system (Official Disclosure). Trading of Kodaco stock had already been suspended since March 21, 2025, following a disclaimer of audit opinion and the ongoing rehabilitation procedures, but this final decision seals its fate on the public exchange.

A ‘disclaimer of opinion’ from an auditor is one of the most severe red flags for a publicly traded company. It means the auditor could not obtain sufficient evidence to form an opinion on the financial statements, indicating fundamental issues with the company’s financial records or viability.

Core Reasons Behind the Kodaco Delisting

The delisting wasn’t a sudden event but the culmination of prolonged financial and operational struggles. Understanding these root causes is crucial for any investor.

1. Catastrophic Financial Instability

At the heart of the Kodaco delisting was its precarious financial health. Despite entering a rehabilitation plan, the company failed to meet its obligations. Key indicators included:

- •Massive Debt Burden: The company’s consolidated debt-to-equity ratio reached an astronomical 1,643.46%. This signifies that its debts were over 16 times greater than its shareholder equity, a completely unsustainable level.

- •Failed Rehabilitation: Delays in repaying rehabilitation claims created severe doubts about its ability to continue as a ‘going concern’—a foundational accounting principle. You can learn more about this concept from authoritative sources like Investopedia.

- •Unsuccessful Fundraising: Efforts to raise capital through subsidiary sales and debt refinancing ultimately failed, leaving the company without the necessary cash flow to survive.

2. Business Limitations & Market Headwinds

While Kodaco’s core business in aluminum die-casting for automotive parts had stable sales, it wasn’t enough to overcome its financial woes. Attempts to pivot to higher-growth areas like EV and hybrid vehicle components did not gain traction. This was compounded by a harsh external environment, including a rising USD/KRW exchange rate, high interest rates, and soaring raw material costs, which further squeezed its already thin margins.

Impact on Shareholders & What to Do Now

For investors, a stock delisting is often the worst-case scenario. The termination of exchange trading means a complete loss of liquidity, making it nearly impossible to sell shares. The value of the stock will likely fall to zero. Given this irreversible decision, shareholders must act decisively.

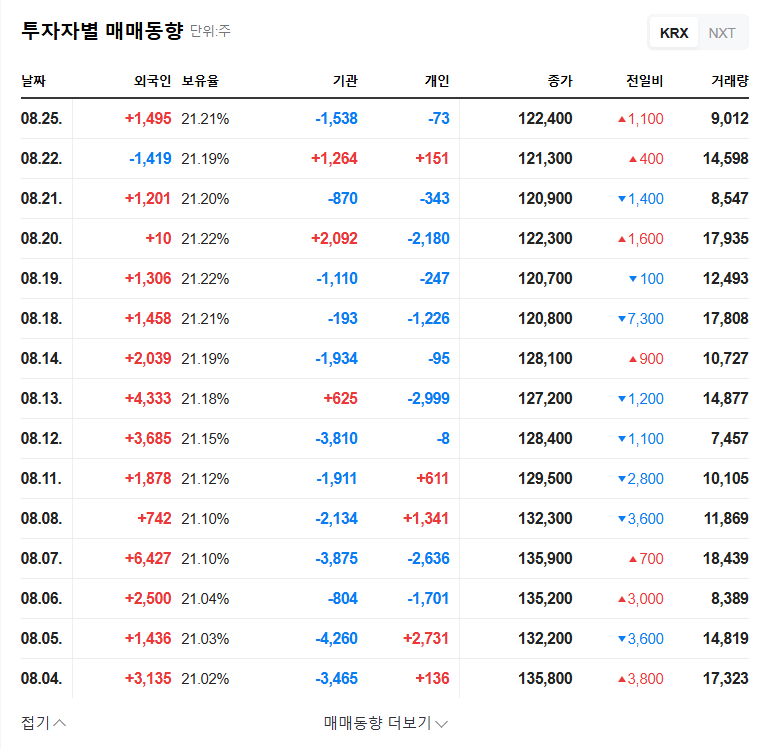

- •Assess the Delisting Trading Period: The exchange typically provides a brief period for 정리매매 (delisting trading) before the stock is fully removed. This is a highly volatile, last-chance window to sell shares, often at a steep loss. Evaluate if cutting losses here is the best path.

- •Monitor for Liquidation Value: After delisting, if the company is liquidated, shareholders are last in line to receive any remaining assets after all creditors are paid. In cases of such high debt, the chance of recovering any residual value is extremely slim, but it’s a possibility to monitor.

- •Learn and Adapt Your Strategy: Use the painful lesson from the Kodaco delisting to improve your investment process. For more information, read our internal guide on how to analyze a company’s financial health before investing.

Frequently Asked Questions

Q1: Is the Kodaco delisting decision final?

A1: Yes, the decision made on September 30, 2025, by the Korea Exchange’s Corporate Review Committee is the final resolution to delist the shares from the public market.

Q2: What was the single biggest reason for the delisting?

A2: The primary trigger was the ‘disclaimer of opinion’ from auditors for consecutive years, stemming from the company’s severe financial distress, failed rehabilitation, and inability to prove its viability as a going concern.

Q3: Do my delisted Kodaco shares have any value?

A3: Once delisted, the shares lose their market liquidity and, in most cases, their investment value converges to zero. There is a very remote chance of recovering a small fraction of value if the company is liquidated and has assets remaining after paying all debts, but this is highly unlikely.

Q4: What’s the key lesson for investors from this case?

A4: This case is a stark reminder to always conduct thorough due diligence. Pay close attention to audit reports, debt-to-equity ratios, and any mention of ‘going concern’ doubts. These are not minor details; they are critical indicators of a company’s survival risk.