LS Tirayutec Subsidiary Tirarobotics Announces KRW 5 Billion Rights Offering: What’s Happening?

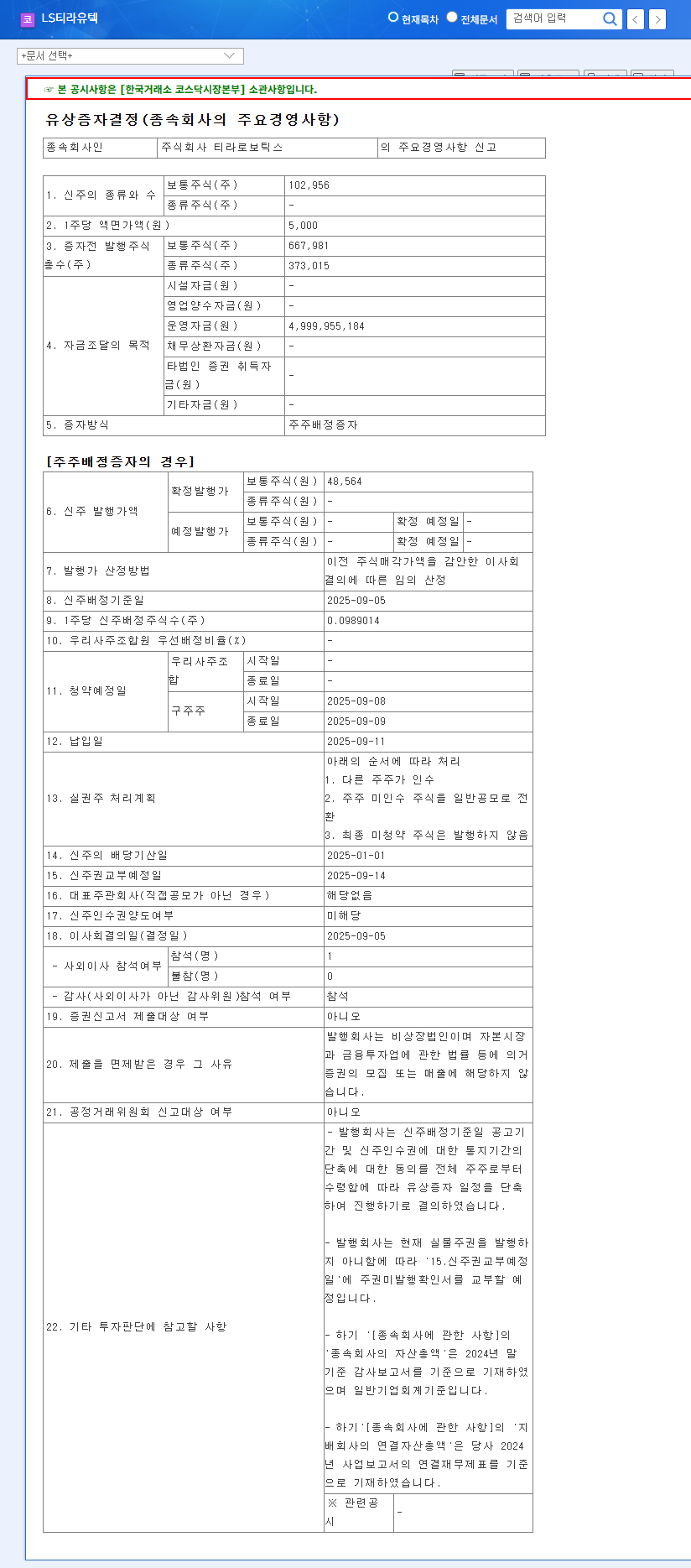

Tirarobotics, a subsidiary of LS Tirayutec, has decided to raise KRW 5 billion through a rights offering to secure operating funds. The offering is scheduled for subscription on September 9, 2025, and payment on September 11, 2025.

Why Did LS Tirayutec Decide on a Rights Offering?

LS Tirayutec, a smart factory and automation equipment manufacturer, is currently facing financial difficulties, including declining sales and sustained net losses. In this context, Tirarobotics’ rights offering is interpreted as a strategy to secure operating funds, ensuring business continuity and fostering growth.

What Impact Will the Rights Offering Have on LS Tirayutec?

This rights offering presents both positive and negative implications.

Positive Impacts

- • Strengthening Tirarobotics’ financial soundness and supporting its growth

- • Securing business continuity for Tirarobotics

- • Confirmation of LS Group’s support

Negative Impacts

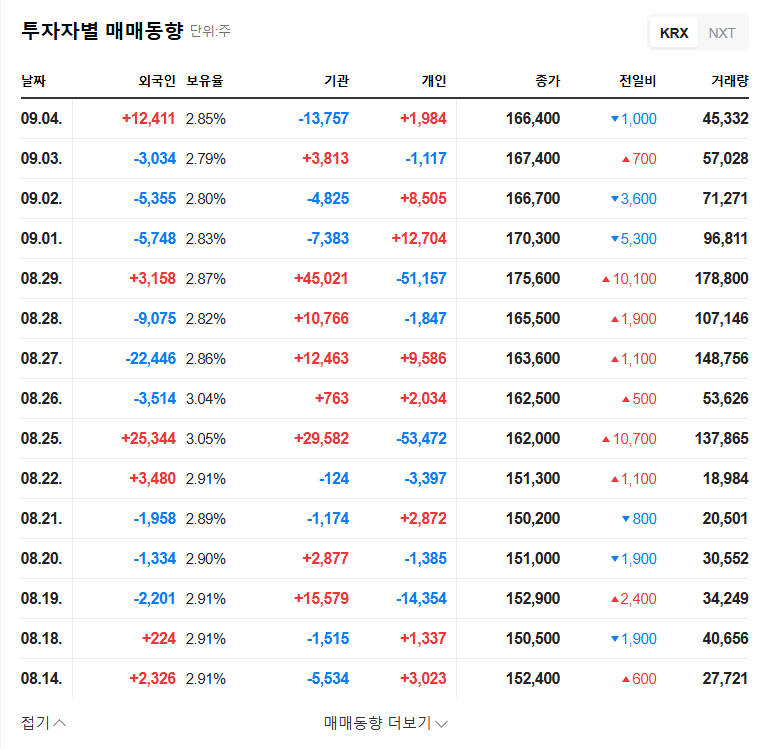

- • Potential dilution of existing shareholders’ stakes

- • Additional burden on LS Tirayutec’s cash flow

- • Uncertainty regarding improvement in Tirarobotics’ performance

What Should Investors Consider?

Investors should closely monitor the efficient use of the funds raised and the subsequent improvement in Tirarobotics’ performance. Careful investment decisions are required, considering both the short-term benefits of securing funds and the potential for increased financial burden in the long term. LS Tirayutec’s efforts to resolve its fundamental financial issues and improve its performance will also be crucial factors to consider.

FAQ

What is Tirarobotics?

Tirarobotics is a subsidiary of LS Tirayutec, specializing in the development of Autonomous Mobile Robots (AMRs) and logistics robot solutions.

What is a rights offering?

A rights offering is a way for a company to raise capital by issuing new shares to existing shareholders.

What is a subscription right?

A subscription right gives existing shareholders the right to purchase new shares proportionate to their current ownership.