What’s Happening? Hyundai Glovis Corporate Day!

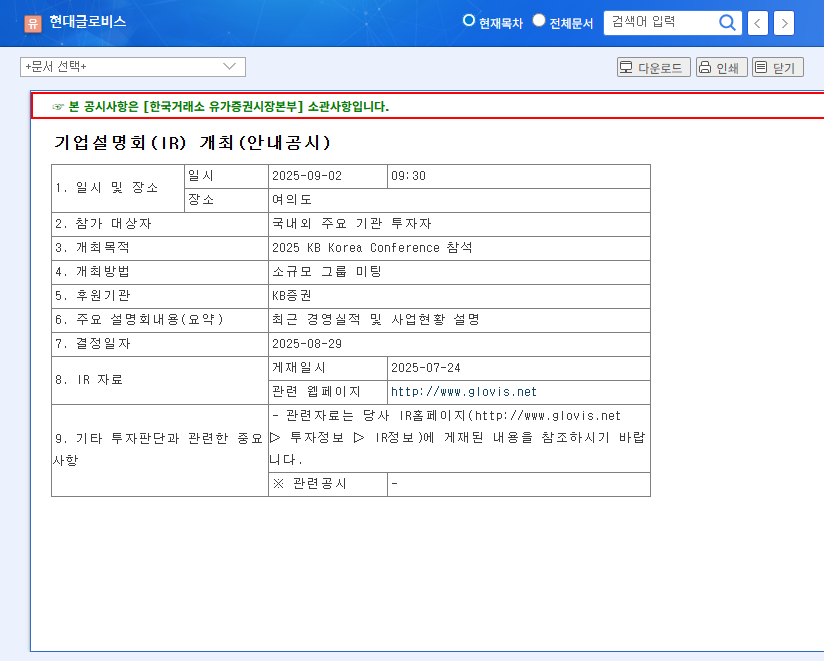

Hyundai Glovis will announce its Q3 2025 earnings and business performance at Hanwha Investment & Securities’ Corporate Day on September 16th. This presentation provides a crucial opportunity for investors to assess the company’s vision and growth potential.

Core Business and Future Growth Engines?

Hyundai Glovis exhibits steady growth based on its stable integrated logistics, distribution & sales, and shipping businesses. Notably, EV battery recycling and eco-friendly energy businesses are attracting attention as future growth drivers. With a planned investment of KRW 784 billion by 2030, Hyundai Glovis is expanding its EV battery recycling business and actively entering the eco-friendly energy sector, including LNG, ammonia, and hydrogen transportation. Investments in developing smart logistics solutions are also expected to contribute to strengthening future competitiveness.

Positive Factors for Investors?

- Solid Financial Status: High cash reserves and a stable debt ratio enhance investment stability.

- Strengthened ESG Management: Inclusion in the DJSI World Index for four consecutive years and achieving a CDP A rating enhance investment attractiveness.

- Growth Potential of New Businesses: If the corporate day presentation provides a concrete roadmap and growth strategy for new businesses, it could boost investor confidence.

Investment Considerations?

Investment always carries inherent risks. It’s essential to consider the financial burden associated with new business investments, macroeconomic uncertainties, and potential intensification of competition. Careful analysis of the information presented at the corporate day and the overall market conditions is crucial for informed investment decisions.

Investor Action Plan

Following the corporate day, thoroughly review the presentation materials and Q&A session. Monitor investor reactions and changes in market consensus to adjust your investment strategy. Pay close attention to the profitability of the EV battery recycling business, specific plans for the eco-friendly energy business, and the company’s strategies for addressing macroeconomic uncertainties.

FAQ

When is the Hyundai Glovis corporate day?

It will be held on Tuesday, September 16, 2025, at 10:30 AM at Hanwha Investment & Securities.

What are Hyundai Glovis’ main businesses?

Its core businesses are integrated logistics, distribution & sales, and shipping. The company is also focusing on securing future growth engines such as EV battery recycling and eco-friendly energy.

What are the key investment considerations?

Investors should consider potential risks such as the financial burden of new business investments, macroeconomic uncertainties, and increased competition.