In a significant development for the global shipbuilding industry, South Korean powerhouse Hanwha Ocean has announced a major new deal. The recent Hanwha Ocean LNGC contract with a North American shipowner is not just another line on the order books; it’s a strategic move that underscores the booming demand in the Liquefied Natural Gas (LNG) carrier market and offers a clear signal to investors about the company’s future trajectory. This pivotal agreement, valued at over 353 billion KRW, solidifies Hanwha Ocean’s position as a leader in high-value vessel construction.

This article provides a comprehensive analysis of this landmark deal. We will explore the specifics of the contract, its strategic importance within the global energy transition, the bullish trends in the LNG carrier market, and provide actionable insights for anyone considering a Hanwha Ocean investment. Let’s delve into the details and what they mean for the future.

Breaking Down the Hanwha Ocean LNGC Contract

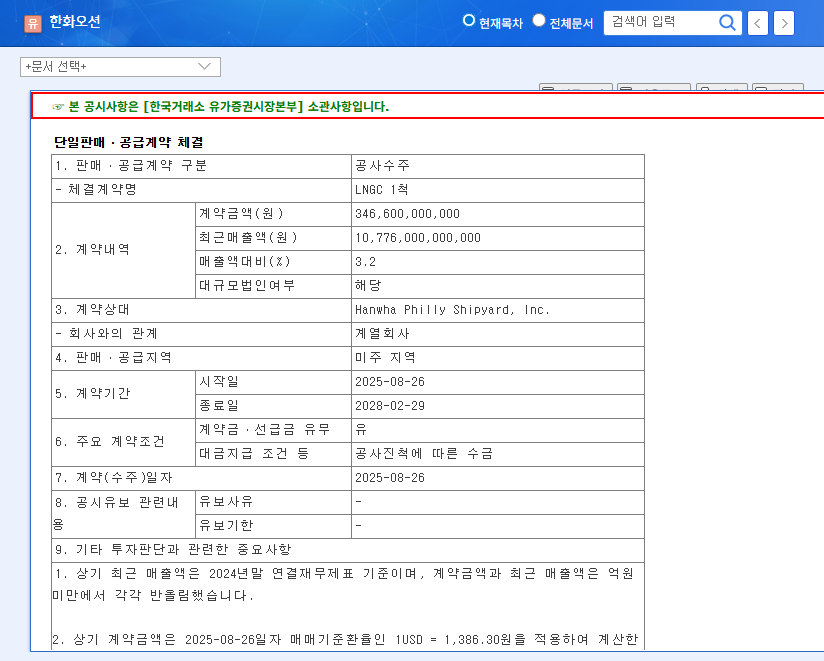

On October 1, 2025, Hanwha Ocean Co., Ltd. formally announced the signing of a substantial sales and supply contract. As confirmed in the Official Disclosure, this agreement involves the construction and delivery of one state-of-the-art Liquefied Natural Gas Carrier (LNGC) for an undisclosed North American shipowner. The deal represents a significant milestone, strengthening the company’s revenue streams and diverse business portfolio.

This contract is more than a financial transaction; it’s a testament to Hanwha Ocean’s technological prowess and a strategic alignment with the world’s shifting energy demands.

Key Contract Details

- •Scope: Construction and supply of one advanced LNGC.

- •Value: 353.4 billion KRW, representing 3.3% of recent annual revenue.

- •Timeline: The contract period runs from September 30, 2025, to May 31, 2028.

- •Strategic Importance: Deepens penetration into the lucrative North American market and reinforces leadership in the high-tech LNGC sector.

Riding the Wave: The Surging Global LNG Carrier Market

This order doesn’t exist in a vacuum. It is a direct result of powerful global trends. The global energy transition is fueling unprecedented demand for LNG as a cleaner ‘bridge fuel’ to replace coal and oil. Nations are increasingly relying on LNG for energy security, and North America, particularly the United States, has emerged as a dominant exporter. This has created a massive, sustained demand for the specialized vessels required to transport it.

According to analysis from leading bodies like the International Energy Agency, the demand for LNG is projected to continue its upward trend for the foreseeable future. This structural growth underpins the business case for companies like Hanwha Ocean, ensuring a steady stream of high-value orders and creating a favorable environment for long-term profitability in the LNG carrier market.

An Investor’s Guide to the Hanwha Ocean Opportunity

For investors, this news warrants careful consideration. The contract positively impacts Hanwha Ocean’s fundamentals and serves as a stepping stone for mid-to-long-term growth. Here’s a breakdown of the key factors to weigh.

The Bull Case: Why This is Positive News

- •Revenue Stability: This large-scale order provides predictable revenue for the next few years, strengthening the company’s financial foundation.

- •Market Leadership: Securing a contract with a North American client reconfirms Hanwha Ocean’s technological edge and competitiveness on the global stage.

- •Future Order Potential: A successful delivery strengthens relationships and positions the company favorably for repeat business as LNG export capacity expands.

Potential Risks and Headwinds to Monitor

While the outlook is bright, savvy investors must also consider potential challenges. Sustained growth depends on consistently securing new orders in a competitive landscape. Geopolitical events or sudden shifts in energy policy could impact long-term LNG demand. Furthermore, macroeconomic factors, such as sharp fluctuations in the USD/KRW exchange rate, can affect profitability on contracts denominated in US dollars. For more on this, read our complete guide to investing in the global shipbuilding sector.

Action Plan & Final Thoughts

Overall, the latest Hanwha Ocean LNGC contract is a powerful, positive indicator. It aligns perfectly with market dynamics and the company’s core strengths.

Investors should focus on the following:

- •Monitoring Order Flow: Watch for announcements of follow-up orders to gauge long-term growth momentum.

- •Analyzing Market Trends: Keep an eye on global LNG supply/demand reports and national energy policies.

- •Evaluating Competitive Edge: Assess how Hanwha Ocean’s technology and pricing stand up against global competitors.

This contract is a crucial piece of shipbuilding industry news and a clear sign of Hanwha Ocean’s strengthening position in a vital global market. It serves as a solid foundation upon which the company can build its future growth.