The latest Pan Ocean Q3 2025 earnings report has sent a shockwave through the investment community. The shipping giant announced preliminary results that fell significantly short of market consensus, particularly in net profit, raising critical questions about the company’s trajectory and the health of the broader shipping industry. For current and prospective investors, this moment demands a clear-eyed analysis of what went wrong, the immediate impact on Pan Ocean stock, and the strategic outlook for the coming quarters.

This comprehensive breakdown examines the core numbers, dissects the underlying causes of the underperformance, and offers a strategic perspective on what’s next for Pan Ocean. We will explore everything from macroeconomic headwinds to internal cost pressures to help you make a more informed investment decision.

Deconstructing the Pan Ocean Q3 2025 Earnings Shock

On November 3, 2025, Pan Ocean released figures that painted a challenging picture. The deviation from analyst expectations was stark, with the net profit miss being the most alarming signal to the market. Here’s a closer look at the key performance indicators:

- •Revenue: KRW 1,269.5 billion, a significant 9% miss compared to the expected KRW 1,395 billion.

- •Operating Profit: KRW 125.2 billion, narrowly missing the consensus of KRW 127.5 billion by 2%.

- •Net Profit: KRW 57.9 billion, a staggering 40% below the anticipated KRW 97 billion.

While the operating profit held relatively firm, suggesting some level of cost control at the operational level, the dramatic plunge in net profit points to severe pressures further down the income statement. This discrepancy is what has investors most concerned. For a detailed, unfiltered look at the numbers, investors can review the Official Disclosure filed with DART (Source).

The 40% net profit miss is a red flag. It indicates that even if the core business is treading water, external financial pressures and non-operational costs are significantly eroding the bottom line. This is a classic sign of a tough macroeconomic environment hitting a cyclical industry.

Key Factors Behind the Disappointing Performance

The underperformance wasn’t caused by a single issue but a confluence of persistent headwinds. Understanding these factors is crucial for any shipping market analysis.

1. Continued Slump in Bulk Freight Rates

Pan Ocean’s core business remains heavily tied to the bulk shipping market. Key indicators like the Baltic Dry Index (BDI) have reflected sluggish global demand for raw materials like iron ore and coal. This sustained downturn in bulk freight rates directly compresses revenue and profit margins for the company’s primary fleet, a trend that unfortunately continued through Q3 2025.

2. Macroeconomic and Financial Pressures

The sharp decline in net profit, despite a more stable operating profit, points squarely at financial costs. Two main culprits are:

- •Exchange Rate Volatility: A rising won/dollar exchange rate (KRW 1,431.20 as of late October) increases the burden of any US dollar-denominated debt and operational costs, leading to foreign exchange losses.

- •High Interest Rates: With global central banks maintaining high-interest rates to combat inflation, the cost of financing Pan Ocean’s capital-intensive operations (e.g., vessel loans) has surged, directly impacting net profitability.

3. A Glimmer of Hope: The Non-Bulk Segment

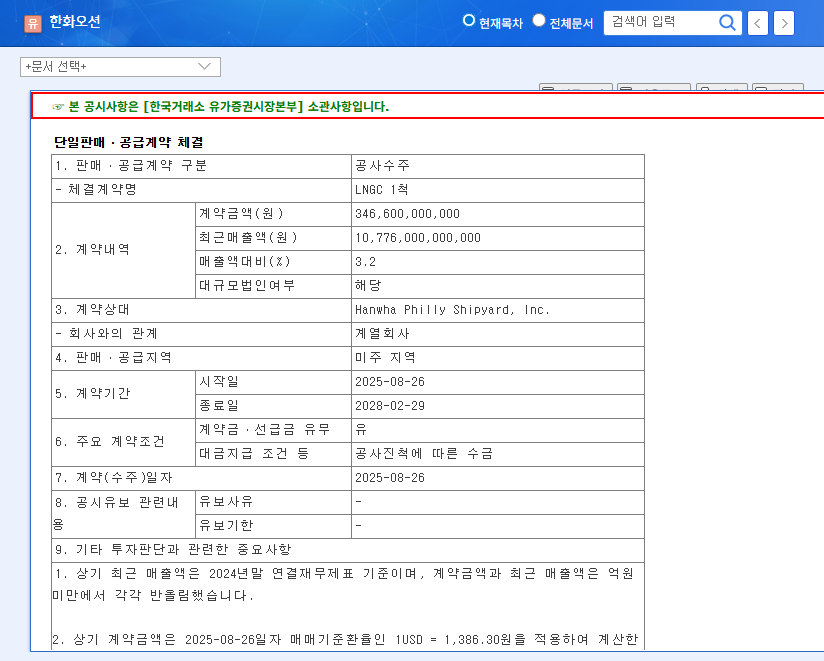

While the bulk sector struggled, Pan Ocean’s strategic diversification into non-bulk areas, particularly its long-term contracts for LNG (Liquefied Natural Gas) carriers, provided some stability. This segment is less susceptible to spot market volatility and represents a critical growth engine. However, in Q3 2025, its positive contribution was not enough to offset the severe downturn in the core business and the external financial pressures.

Stock Outlook and Investor Strategy

The market’s reaction to the Pan Ocean Q3 2025 earnings is expected to be negative in the short term. The substantial profit miss will likely lead to analyst downgrades and a sell-off as investors re-price the stock to reflect lower profitability. However, a sound investment strategy requires a more nuanced, long-term view.

What to Monitor Moving Forward:

- •Global Economic Indicators: The recovery of the shipping market is contingent on a broader global economic rebound. Keep an eye on manufacturing PMI data and trade forecasts from institutions like the International Monetary Fund (IMF).

- •Non-Bulk Segment Growth: Pay close attention to announcements regarding new long-term contracts for LNG carriers or other specialized vessels. This is Pan Ocean’s key to de-risking its business model. For more on this, see our Complete Guide to Shipping Sector Diversification.

- •Cost Management: The company’s ability to control operating expenses, bunker fuel costs, and SG&A will be paramount in protecting margins until revenue recovers.

For now, a cautious approach is warranted. The earnings shock creates uncertainty, and investors should brace for short-term volatility. The key is to avoid panic-selling and instead focus on whether the company’s long-term fundamentals—including its diversification strategy and balance sheet strength—remain intact through this cyclical downturn.