In a global energy market defined by volatility and transition, stability is the ultimate currency. This makes the recent KoreaGasCorporation contract with Korea Midland Power Co., Ltd. (KOMIPO) a landmark event for investors and industry analysts. By securing a massive 1.5 trillion KRW (approx. $1.15 billion USD) long-term natural gas supply agreement, KOGAS has not only fortified its revenue stream but also sent a powerful signal about its market leadership and strategic direction for the next decade.

This article provides an in-depth analysis of this pivotal KOGAS long-term deal, exploring its specific terms, its impact on the company’s financial health, and the critical takeaways for anyone considering a KOGAS investment. We’ll unpack what this means for future growth and stability in an ever-evolving energy landscape.

Deconstructing the ₩1.5 Trillion KOGAS Deal

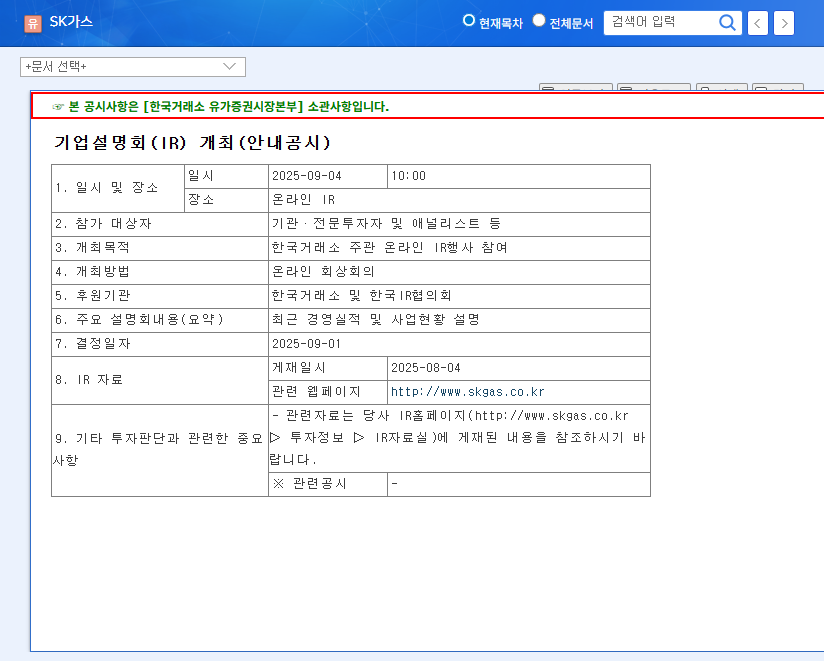

On the surface, the numbers are impressive, but the strategic depth of the agreement is where the real value lies. KOGAS has formalized an individual tariff-based natural gas sales contract specifically for power generation, a core component of its business. The specifics of the agreement were confirmed in an Official Disclosure filed with Korea’s Financial Supervisory Service.

Key Contract Details

- •Contract Value: 1.5191 trillion KRW (approx. $1.15 billion USD), representing a significant revenue stream.

- •Contract Duration: A 10-year term, running from January 1, 2027, to December 31, 2036.

- •Supply Destination: Incheon Combined Cycle Power Plant, a critical piece of infrastructure.

- •Revenue Impact: The deal accounts for 3.96% of the company’s recent revenue, providing a stable, predictable base for years to come.

Strategic Significance: Beyond the Bottom Line

This contract is more than just a large transaction; it’s a strategic maneuver that reinforces KOGAS’s role as the cornerstone of South Korea’s energy infrastructure. Securing long-term demand from a major domestic power producer like Korea Midland Power mitigates risks associated with fluctuating domestic demand and reinforces KOGAS’s market dominance.

By locking in a decade of predictable cash flow, KOGAS can more confidently allocate capital towards future-facing growth initiatives, such as hydrogen energy and LNG bunkering, while maintaining a robust financial foundation.

The deal is also timely. As nations navigate the energy transition, natural gas is widely seen as a critical bridge fuel. According to the International Energy Agency (IEA), natural gas will play a vital role in balancing power grids and supporting the integration of renewables. This long-term natural gas supply agreement ensures KOGAS remains central to this transition.

Investor Analysis: Opportunities and Risks

For current and potential investors, the KoreaGasCorporation contract presents a compelling mix of stability and future potential, but it’s essential to weigh the associated risks.

Potential Upside for a KOGAS Investment

- •Enhanced Financial Stability: The predictable revenue stream improves financial forecasting and reduces earnings volatility.

- •Foundation for Growth: Stable cash flow frees up resources for investment in high-growth areas like South Korea’s hydrogen economy and the expanding LNG bunkering market.

- •Reaffirmed Market Leadership: This deal solidifies KOGAS’s indispensable position as the nation’s sole wholesale natural gas provider.

Key Risks and Considerations

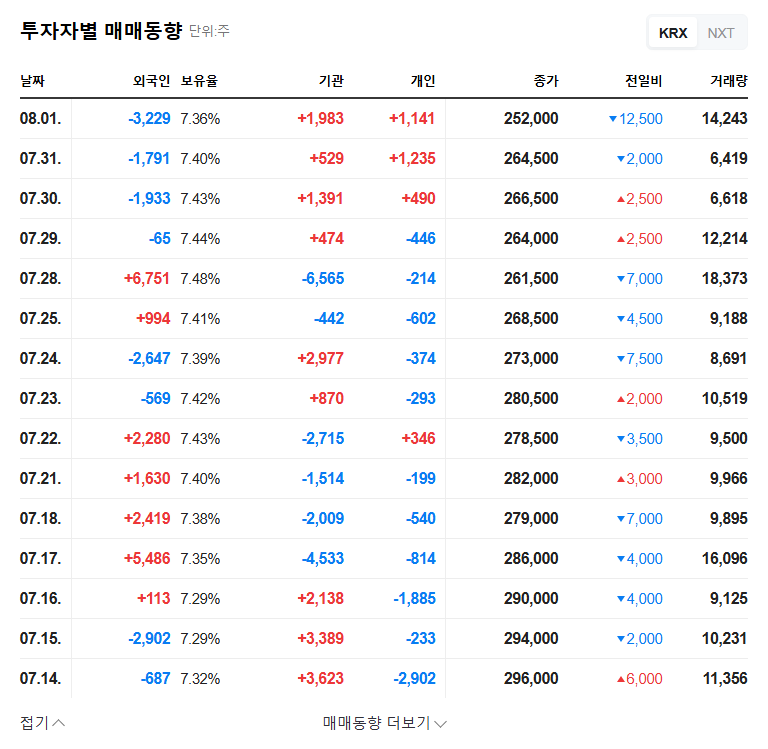

While the contract is a clear positive, investors must remain vigilant. The profitability of this specific tariff agreement is not public, meaning its margin could be impacted by future LNG price swings. Furthermore, as an importer, KOGAS is perpetually exposed to macroeconomic risks, including:

- •Commodity Price Volatility: Sharp increases in international oil and gas prices can compress margins.

- •Foreign Exchange Fluctuations: A weaker Korean Won against the US Dollar increases import costs directly.

- •Market Reaction: The positive news may already be priced into the stock, limiting short-term upside. A long-term investment horizon is key.

Conclusion: A Stable Anchor in a Sea of Change

The 1.5 trillion KRW KoreaGasCorporation contract is a definitive win for the company. It provides a decade of revenue visibility, strengthens its financial position, and reinforces its critical role in the national energy supply chain. For investors, it transforms KOGAS into a more predictable, stable entity capable of weathering market storms while investing in the future of energy. While external risks persist, this deal provides a powerful anchor, making KOGAS a company to watch closely as it navigates the path toward sustainable growth.

Frequently Asked Questions

What is the core of the new KoreaGasCorporation contract?

KOGAS has signed a 10-year natural gas sales agreement with Korea Midland Power, valued at approximately 1.5 trillion KRW, to supply the Incheon Combined Cycle Power Plant from 2027 to 2036.

How does this deal affect KOGAS’s total revenue?

The contract value represents approximately 3.96% of KOGAS’s recent annual revenue, establishing a secure and predictable income stream for the next decade.

What are the primary risks associated with a KOGAS investment?

The main risks are external and macroeconomic. They include volatility in global LNG and oil prices, fluctuations in the KRW/USD exchange rate, and shifts in domestic energy policy, all of which can impact profitability.