1. What Happened? LB Investment Reduces STW Stake to 5.11%

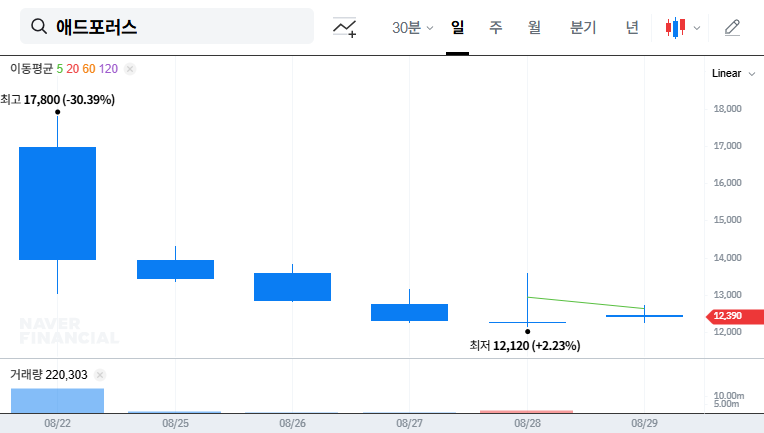

STW debuted on the KOSDAQ market on September 19, 2025. However, celebrations were cut short when LB Investment (LB Technology Finance Fund No. 1) announced a change in its stake to 5.11%, dampening market sentiment. This reduction came through on-market sales coinciding with the KOSDAQ listing. A total of 231,714 shares were sold by September 22.

2. Why Did This Happen? Analyzing LB Investment’s Sell-off

While LB Investment stated the purpose as ‘simple investment,’ the timing of the sale immediately after the KOSDAQ listing suggests profit-taking. However, a look at STW’s fundamentals offers alternative interpretations. Based on the 2024 consolidated audit report, STW improved its financial structure, including a shift to positive equity and a decrease in debt ratio, but suffered an expanded net loss due to derivative valuation losses. This unstable profit structure may have influenced LB Investment’s decision to recoup its investment.

3. What’s Next? Short-term and Mid-to-Long-term Stock Forecasts

In the short term, downward pressure on the stock price is expected due to LB Investment’s large sell-off. However, in the mid-to-long term, STW’s fundamental improvements will determine the stock’s direction. While the improved financial structure is positive, continued derivative valuation losses hinder profitability. The possibility of further sell-offs, the impact of macroeconomic indicators, and investor sentiment must also be considered.

4. What Should Investors Do? Investment Strategy Suggestions

- Short-term investors: A cautious approach is necessary, closely monitoring the absorption of LB Investment’s sold shares and the extent of the price decline. Considering the possibility of further sell-offs, it is advisable to identify short-term rebound opportunities or wait for the downward trend to stabilize before investing.

- Mid-to-long-term investors: Focus on profitability improvements. Carefully analyze the scale and cause of derivative valuation losses and STW’s efforts to address them. Continuously monitor the company’s business diversification strategy, new business performance, and efforts to enhance accounting transparency.

Frequently Asked Questions

What is the reason for LB Investment’s stake change?

Officially, the purpose was stated as ‘simple investment,’ but the timing of the sale right after the KOSDAQ listing suggests a high likelihood of profit-taking. STW’s unstable profit structure might have also played a role.

What is the outlook for STW’s stock price?

Downward pressure is expected in the short term, but in the mid-to-long term, improvements in STW’s fundamentals will determine the stock’s direction. While the financial structure has improved, profitability remains uncertain.

How should investors respond?

Short-term investors need a cautious approach, considering the possibility of further sell-offs. Mid-to-long-term investors should carefully analyze profitability improvements, business diversification, and accounting transparency.