1. What’s Happening with the Treasury Stock?

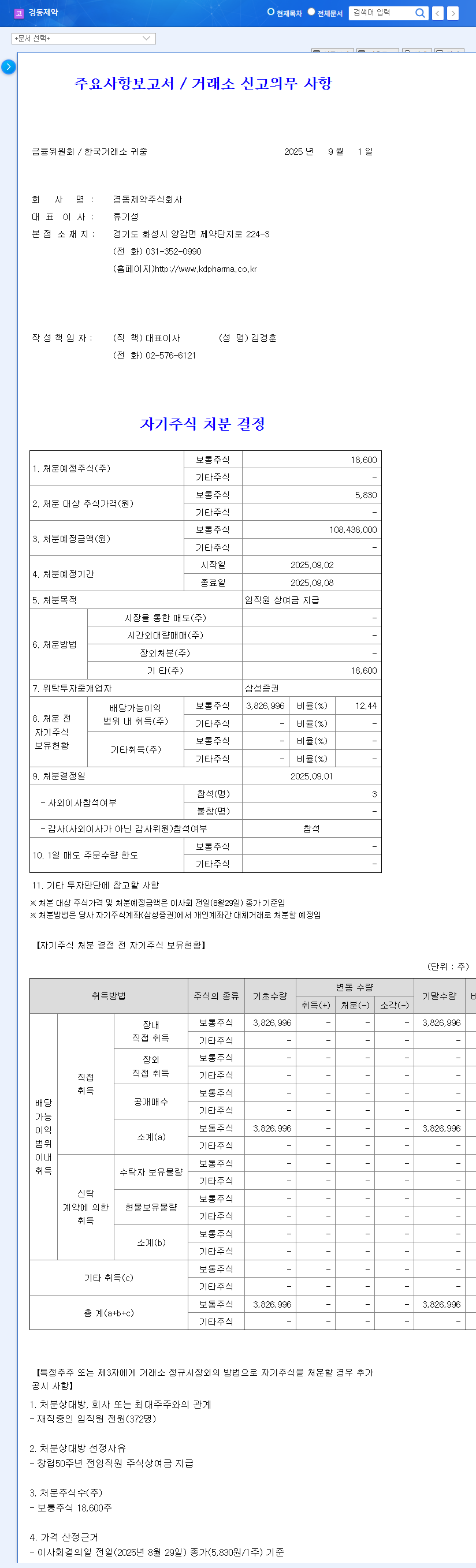

Kyung Dong Pharm will dispose of 18,600 common shares to fund employee bonuses. The number of disposed shares is negligible compared to the total outstanding shares.

2. Why Dispose of Treasury Stock?

This disposal aims to provide employee bonuses and isn’t directly related to enhancing shareholder value or improving financial structure. However, it’s expected to boost employee motivation and morale, potentially leading to improved long-term corporate performance.

3. So, What’s the Impact on Stock Price?

In the short term, the small disposal size is unlikely to significantly impact the stock price. However, in the medium to long term, Kyung Dong Pharm’s fundamental improvements and macroeconomic environment shifts will be the deciding factors. Key variables include new pipeline development, exchange rate volatility response, and litigation risk resolution.

- Positive Factors: Return to profitability in operating income, new complex drug development

- Negative Factors: Financial instrument valuation losses, exchange rate volatility, litigation risk

4. What Should Investors Do?

The current investment recommendation is “Hold.” Instead of focusing on short-term stock fluctuations, investors should continuously monitor the company’s fundamental improvement efforts and risk management capabilities. Pay close attention to future earnings announcements, R&D pipeline progress, and exchange rate/interest rate trends.

Does treasury stock disposal negatively impact stock price?

The small scale of this disposal is expected to have a minimal short-term impact on the stock price. It may even lead to improved long-term performance by boosting employee morale.

What’s the outlook for Kyung Dong Pharm?

While the return to operating profit is positive, uncertainties remain, including financial instrument valuation losses, exchange rate volatility, and litigation risks. New pipeline development and risk management capabilities will be crucial for future stock performance.

What should investors focus on?

Rather than short-term price fluctuations, investors should monitor fundamental improvements, R&D performance, and risk management, particularly exchange rate volatility and litigation risk resolution.