The recent news of Kwangdong Pharmaceutical acquiring a significant stake in Samhwa Crown & Closure has sent ripples through the investment community. This strategic move, officially aimed at ‘establishing continuous business cooperation,’ raises a critical question for current and potential investors: Is this the catalyst that will unlock new value for Samhwa Crown stock?

This comprehensive investment analysis will dissect the implications of this partnership, evaluate Samhwa Crown’s current financial health, and outline actionable strategies for navigating the opportunities and risks that lie ahead. We will explore whether the collaboration can revitalize the company’s struggling core business and amplify the success of its growing divisions.

The Deal: Kwangdong Pharmaceutical’s Strategic Investment

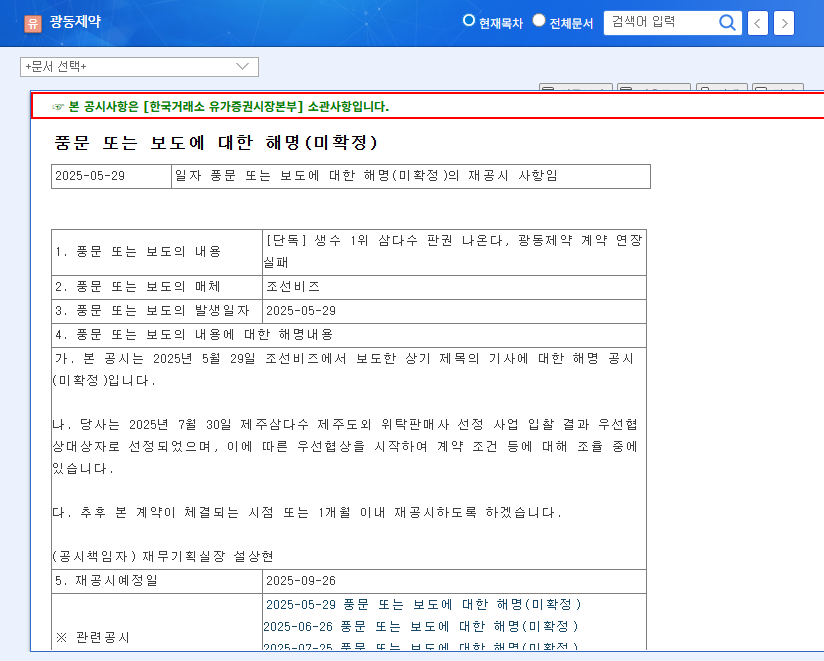

On October 1, 2025, Kwangdong Pharmaceutical, a major player in the Korean beverage and pharmaceutical market, formally announced its acquisition of 118,000 shares in Samhwa Crown. This transaction, executed via an after-hours block trade, secured them a 5.48% stake in the packaging specialist. According to the official disclosure, the purpose extends beyond a simple financial investment, signaling a deeper strategic alignment.

For a verified account of the transaction, investors can refer to the Official Disclosure on DART. This move is pivotal, as it connects a major consumer of packaging materials with a key supplier, creating a fertile ground for synergy.

Samhwa Crown Fundamentals: A Tale of Two Divisions

To understand the potential impact of this partnership, we must first assess Samhwa Crown’s current state. The company presents a mixed but intriguing financial picture, characterized by divergence between its primary business segments.

Strengths and Growth Drivers

- •Thriving Plastic Container Division: Capitalizing on the global K-Beauty phenomenon, this division has become a significant growth engine, showcasing impressive sales figures and market expansion.

- •Improving Financial Stability: The company has successfully reduced its debt-to-equity ratio to a healthier 79%, signaling prudent financial management and a more stable foundation for future growth.

- •Shareholder-Friendly Policies: Consistent efforts to enhance shareholder value, such as treasury stock acquisitions, demonstrate a commitment to its investors.

Weaknesses and Inherent Risks

Despite the positives, significant headwinds remain, primarily concentrated in the company’s traditional business line.

- •Declining Profitability in CAP Division: The core closure (CAP) business has seen its operating profit plummet by nearly 45%. This is largely due to margin compression from rising raw material costs (like aluminum and plastic resins) and increased SG&A expenses.

- •Macroeconomic Pressures: Global inflation and reduced consumer disposable income pose a threat to the beverage and cosmetics industries, which could indirectly impact demand for Samhwa Crown’s products. For more context, you can review our detailed analysis of the packaging industry trends.

- •Input Cost Volatility: The company’s bottom line is highly sensitive to fluctuations in foreign exchange rates and the prices of key raw materials, creating earnings unpredictability.

The core investment thesis for Samhwa Crown hinges on whether the new partnership with Kwangdong Pharmaceutical can effectively mitigate the risks in the CAP division while accelerating growth in the plastics division.

Analyzing the Samhwa Crown & Kwangdong Pharmaceutical Synergy

The long-term value of this deal will be determined by tangible business synergies. Here’s where the most significant potential lies:

- •Securing a Stable Revenue Stream: Kwangdong Pharmaceutical is a major consumer of bottle caps for products like Vita 500. This partnership could transform into a long-term supply agreement, providing Samhwa Crown’s CAP division with stable, predictable order volumes and helping to offset market volatility.

- •Joint R&D and Innovation: Collaboration on new product development—such as innovative, eco-friendly, or specialized caps for new beverage lines—could give Samhwa Crown a competitive edge and improve margins.

- •Cost Efficiency and Optimization: A closer relationship could streamline the supply chain, leading to cost reductions and improved production efficiency, directly addressing the profitability issues in the CAP division. Insights from industry reports, like those from Packaging World, often highlight the benefits of vertical integration.

- •Improved Corporate Governance: The presence of a significant corporate shareholder can enhance management transparency and accountability, which is often viewed favorably by the market.

An Investor’s Guide to Samhwa Crown Stock

Short-Term Outlook (1-3 Months)

In the short term, the news itself provides positive momentum. However, a sharp, sustained rally is unlikely until concrete details of the cooperation emerge. The stock may experience sideways movement with a slight upward bias. A cautious approach is warranted; investors might consider observing from the sidelines or initiating a small position while awaiting further developments.

Mid to Long-Term Outlook (6+ Months)

The long-term trajectory depends entirely on execution.

- •Bull Case: If the partnership leads to tangible improvements in the CAP division’s profitability and the plastic container segment maintains its growth, a fundamental re-rating of the stock is highly probable. In this scenario, gradually increasing one’s position on positive news would be a viable strategy.

- •Bear Case: If the synergy fails to materialize or macroeconomic headwinds worsen, the initial excitement will fade, and the stock’s performance will likely revert to being driven by its underlying, challenged fundamentals. Risk management and waiting for clear signs of a turnaround would be the prudent course.

Key Milestones to Monitor

Investors should keep a close watch on the following catalysts:

- •Official announcements detailing the scope and terms of business cooperation.

- •Quarterly earnings reports, with a focus on margin trends in the CAP division.

- •News regarding new client acquisitions or international expansion for the plastic container division.