Investors are closely watching Kumho Petrochemical Co., Ltd. as it navigates a complex H1 2025, marked by conflicting financial signals and a significant move by a major institutional investor. While the company posted robust revenue growth, a simultaneous decline in operating profit has raised questions. Compounding this uncertainty, the news that South Korea’s National Pension Service (NPS) has reduced its substantial stake has sent ripples through the market, leaving many to wonder about the company’s underlying strength.

This comprehensive Kumho Petrochemical analysis will dissect the company’s recent performance, financial health, and the broader market environment. By examining the facts from the latest reports and understanding the implications of the NPS sell-off, we aim to provide practical insights to help you make informed investment decisions in this volatile period.

H1 2025 Performance: A Story of Growth and Squeezed Margins

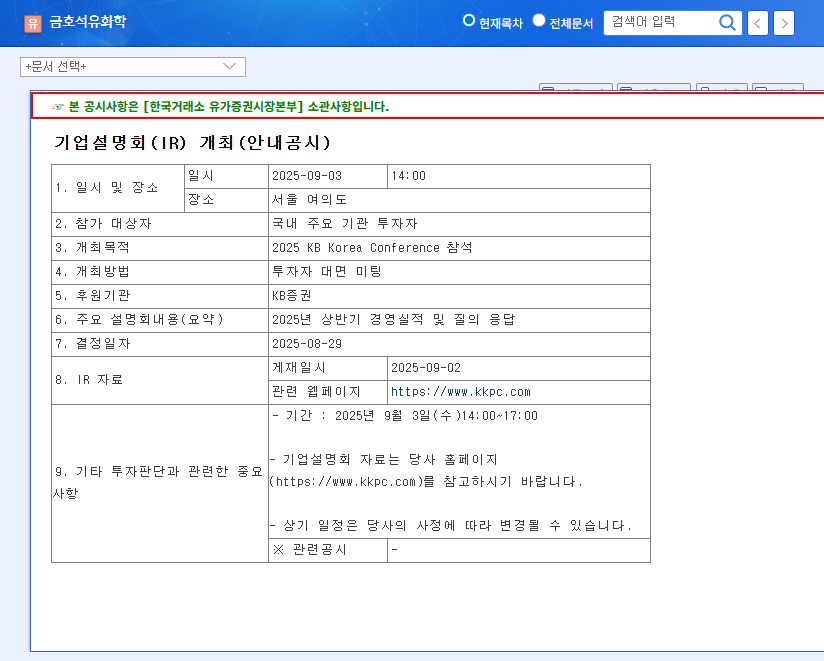

In the first half of 2025, Kumho Petrochemical demonstrated external growth, with consolidated revenue climbing by 4.6% year-on-year to KRW 3.6816 trillion. This top-line growth suggests resilient demand in key areas. However, the narrative shifts when looking at profitability. The company’s operating profit fell by 6.0% to KRW 185.8 billion, indicating that rising costs or pricing pressures are eroding margins. This divergence between revenue and profit is a central concern for the current Kumho Petrochemical stock valuation. The full details can be reviewed in the company’s official filing (Source: Official Disclosure).

The Elephant in the Room: Understanding the NPS Sell-Off

Perhaps the most impactful news was the NPS sell-off. The National Pension Service, one of the world’s largest pension funds, reduced its stake in Kumho Petrochemical from 10.85% to 9.77%. While a roughly 1% reduction may seem small, any move by an investor of this magnitude is scrutinized heavily. The market often interprets such a sale as a signal of waning confidence from a well-informed institutional player, potentially triggering a wider sentiment shift and placing short-term downward pressure on the stock price. Investors must now question whether this is a strategic portfolio rebalancing or a reaction to a perceived weakness in the company’s future outlook.

Deep Dive: Business Segment Performance

The company’s mixed results are a reflection of varying performance across its diverse business segments.

- •Synthetic Rubber: A bright spot. This segment capitalized on lower raw material prices and successful unit price increases to boost both sales and operating profit. Recovering demand in the latex market provided an additional tailwind.

- •Synthetic Resin: Faced significant headwinds from an oversupply of low-cost Chinese products and weak domestic demand, leading to lower sales volumes. However, aggressive pricing strategies helped mitigate the impact on revenue and profitability.

- •Specialty Chemicals: Showed impressive year-on-year growth in both revenue and sales, driven by increased raw material self-sufficiency and an expanded sales strategy.

- •Carbon Nanotubes (CNT): This growth-oriented segment struggled due to the slowdown in EV sales and a downturn in the construction sector. The company is now pivoting to promote CNTs for other conductive applications.

Despite the positive top-line growth, the decline in operating profit and struggles in key segments like Synthetic Resin and CNT are critical red flags that investors must not overlook in their Kumho Petrochemical analysis.

Financial Health & Macroeconomic Headwinds

A Stable Financial Foundation

On a positive note, Kumho Petrochemical’s financial stability has improved. The debt-to-equity ratio was reduced to a very healthy 35.4%, and operating cash flow remained strong at KRW 332.7 billion. This solid balance sheet provides the company with resilience and flexibility. However, key shareholder metrics like Earnings Per Share (EPS) and Return on Equity (ROE) both declined year-on-year, reinforcing the profitability challenge.

Persistent External Risks

The petrochemical industry outlook remains clouded by macroeconomic uncertainty. Volatility in currency exchange rates (EUR/KRW, USD/KRW), geopolitical risks affecting oil prices, and shifting global interest rate policies all pose significant challenges. While stabilizing freight costs are a positive, supply chain integrity remains a concern. For a deeper understanding of these global factors, resources like the World Bank’s economic outlook can provide valuable context.

Action Plan for Investors

Navigating an investment in Kumho Petrochemical stock requires a balanced and watchful approach. Here are key factors to monitor:

- •Profitability Turnaround: Watch for clear strategies and results related to improving operating margins and managing costs effectively.

- •Growth Engine Recovery: Keep a close eye on the CNT segment. Any signs of a rebound or successful diversification could be a powerful catalyst.

- •Institutional Investor Flow: Continue to track the holdings of the NPS and other major institutions. Further selling could signal deeper concerns.

- •Shareholder Value Initiatives: Monitor progress on the company’s planned treasury stock cancellation and ESG efforts, which could enhance long-term value. For more on this, see our guide to analyzing industrial stocks.

Frequently Asked Questions (FAQ)

Q1: What were Kumho Petrochemical’s H1 2025 earnings like?

A1: In H1 2025, revenue increased by 4.6% year-on-year, but operating profit decreased by 6.0%, indicating a decline in profitability despite sales growth.

Q2: Why did the National Pension Service (NPS) sell its stake in Kumho Petrochemical?

A2: The NPS reduced its stake from 10.85% to 9.77%. While the stated reason is often portfolio adjustment, the market frequently interprets such a move by a major institution as a short-term bearish signal.

Q3: How is the financial health of Kumho Petrochemical?

A3: The company’s financial health is strong. As of H1 2025, the debt-to-equity ratio improved to a low 35.4%, and it maintains stable operating cash flow, indicating solid financial stability.

Q4: What should investors watch for when considering Kumho Petrochemical stock?

A4: Investors should focus on the company’s ability to improve operating profit, the performance of its growth segments like CNT, macroeconomic factors, and any further moves by institutional investors like the NPS.

Disclaimer: This content is based on publicly available information and is for informational purposes only. It is not intended as investment advice or a recommendation. All investment decisions should be made based on the investor’s own judgment and responsibility.