NH Investment & Securities Acquires 1.55% Stake in KUKDO Chemical (September 3, 2025)

NH Investment & Securities announced on September 3, 2025, the acquisition of a 1.55% stake in KUKDO Chemical. This acquisition resulted from EB (Convertible Bond) acquisition and transfer activities, with the stated purpose being ‘simple investment.’

Impact of the Stake Acquisition on KUKDO Chemical

- Positive Aspects: Increased market attention and potential influx of buying power. Heightened interest in EB issuance and potential future stock conversion.

- Neutral/Limited Aspects: ‘Simple investment’ purpose suggests no intention of management participation. The small stake (1.55%) limits direct impact on stock price. Limited direct connection to KUKDO Chemical’s fundamentals.

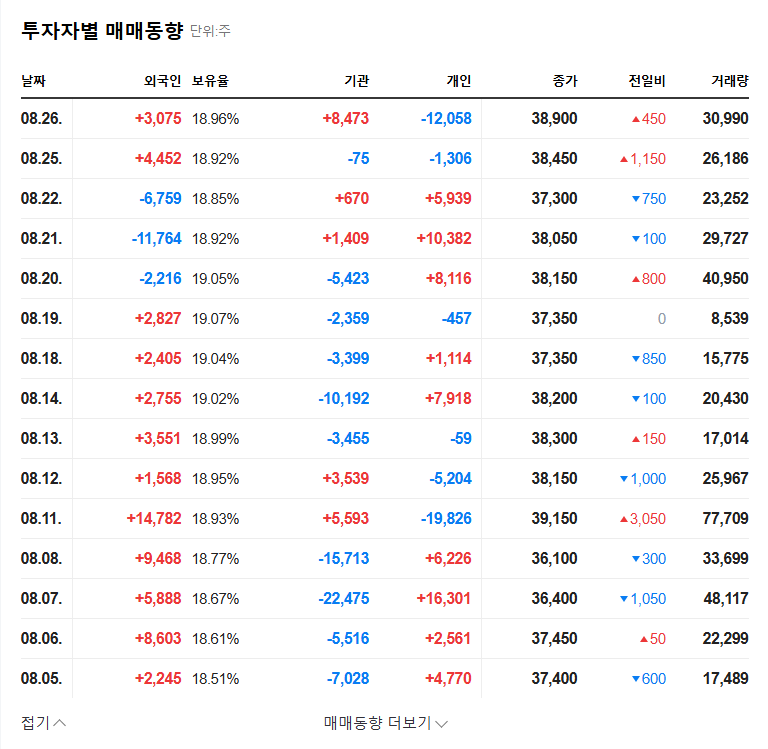

- Potential Negative/Cautionary Aspects: Possibility of overhang issues upon future conversion of EB to shares. Potential short-term price volatility due to supply and demand imbalances.

KUKDO Chemical Fundamentals and Future Outlook

KUKDO Chemical recorded solid performance in the first half of 2025, driven by strong epoxy resin performance and reduced losses in the polyol segment. However, potential global economic slowdown and raw material price volatility remain risk factors.

Action Plan for Investors

- Monitor Short-term Price Volatility: Observe NH’s further stake changes and market reactions.

- Assess EB Conversion Potential and Overhang Risk: Continuously monitor the potential conversion of EB to shares and the resulting overhang risk.

- Focus on Fundamental Analysis: Analyze KUKDO’s earnings, new business performance, and macroeconomic factors.

Frequently Asked Questions (FAQ)

Will NH’s stake acquisition positively impact KUKDO Chemical’s stock price?

Short-term market attention may drive price increases, but long-term impact depends on KUKDO’s fundamentals.

What are Convertible Bonds (EB)?

Convertible bonds are bonds that can be converted into the issuing company’s shares after a certain period.

What is an overhang, and why is it important?

An overhang represents a large number of shares that could potentially be sold. This potential for increased supply can negatively impact stock prices.