KS Industry’s $20 Billion Convertible Bond Offering: What Happened?

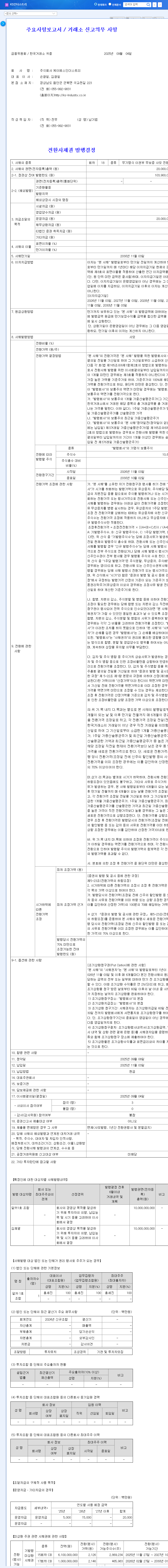

KS Industry announced on September 4, 2025, a private offering of $20 billion in convertible bonds (CBs). The conversion price is set at ₩1,837, slightly higher than the current market price of ₩1,770, with a payment date of November 3, 2025.

Why the Convertible Bond Offering?

KS Industry is facing challenges due to sluggish performance in its core business of manufacturing ship components. With operating losses widening, securing funds for investments in new businesses like AI and topological insulators has become crucial. This CB offering aims to secure funding for these new ventures and improve the company’s financial structure.

What is the Impact of the Convertible Bond Offering?

- Positive Impacts:

- Accelerated investment in new businesses (AI, topological insulators, etc.)

- Improved financial structure and stability

- Negative Impacts:

- Potential stock dilution due to the conversion of CBs (31.85% of the total offering)

- Possibility of conversion price adjustments downwards due to the set floor price (₩1,286), potentially increasing the company’s financial burden.

What Should Investors Do?

Investing in KS Industry hinges on the success of its new ventures. Caution is advised due to potential short-term stock volatility. Investors should carefully monitor the following factors before making investment decisions:

- Conversion trends of the convertible bonds

- Concrete progress and performance of new businesses

- External factors such as global economic conditions, shipbuilding industry outlook, interest rates, and exchange rates

Frequently Asked Questions (FAQ)

What are KS Industry’s main businesses?

KS Industry’s core business is manufacturing ship components. Recently, they have been expanding investments in new areas like cosmetics, AI, and topological insulators.

How will the funds from this convertible bond offering be used?

The funds will primarily be used for investments in new businesses such as AI and topological insulators.

How will this convertible bond offering impact the stock price?

In the short term, it is expected to improve financial stability through fundraising. However, in the long term, there is a possibility of stock dilution due to the conversion of the bonds.