Gison Unveils Growth Potential and Risks at Investor Relations Meeting

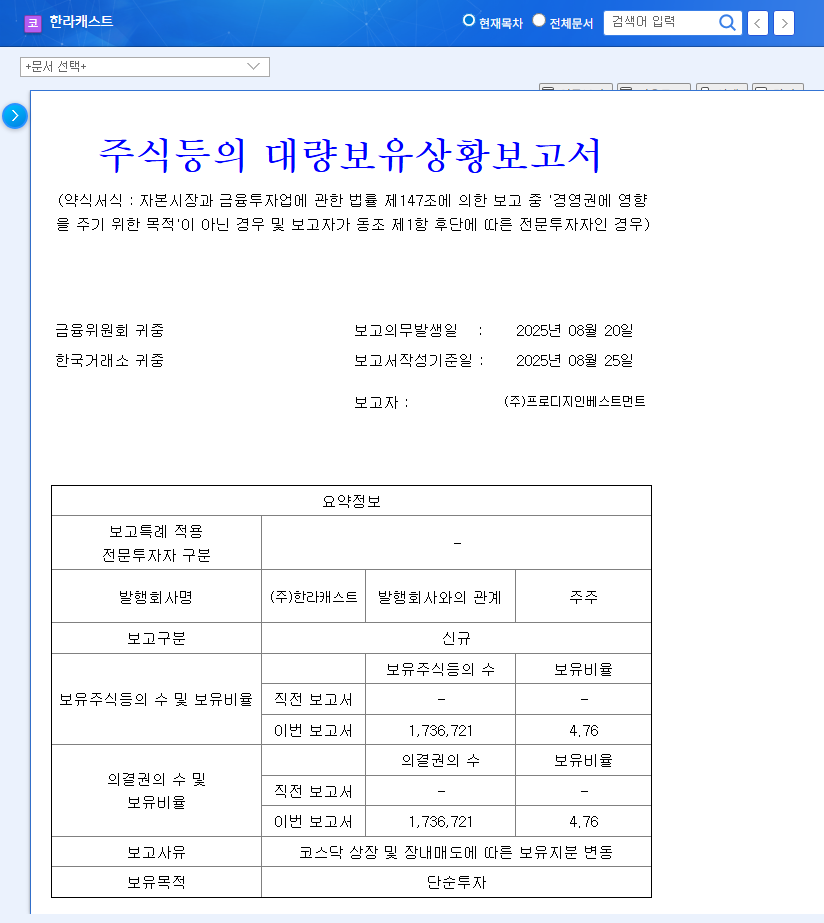

On September 4th, Gison revealed its vision and business strategy at an investor relations meeting. This IR was the first official event after the completion of the merger with Kiwoom No. 8 SPAC, attracting considerable attention from investors.

Wireless Security Solutions Highlighted as Next-Generation Growth Engine

Gison emphasized its future growth potential, introducing its vehicle security system ‘Alpha-V’ and accommodation security system ‘Alpha-CQ’ as its main businesses. Approximately 11.5 billion won in merger funds will be invested in R&D, material procurement, and operating funds, aiming to strengthen business competitiveness and establish a foundation for growth.

The Challenge: Continued Operating Losses

However, Gison has recorded continuous operating losses from 2022 to Q1 2025. Despite sales growth, improving profitability is pointed out as an urgent task. Also, a key evaluation factor is the company’s response strategy to intensifying competition and rapid technological changes in the security solutions market.

Key Checkpoints for Investors

- Profitability Improvement Strategy: Carefully examine the concreteness and feasibility of the profitability improvement plan presented at the IR.

- Competitive Edge: It’s crucial to identify Gison’s unique differentiators and technological advantages compared to competitors.

- Macroeconomic Environment: Analyze the impact of macroeconomic indicators, such as exchange rate and interest rate fluctuations, on Gison’s business.

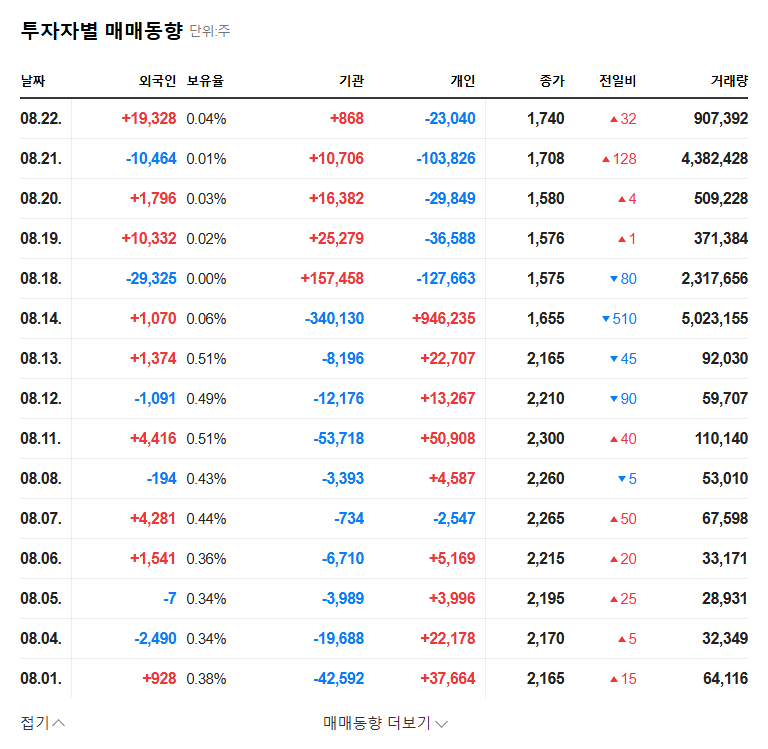

- Financial Health: Continuously monitor the execution of merger funds and cash flow improvement trends.

Continued Observation and Analysis Required

Gison’s IR presented investors with both positive expectations and elements of uncertainty. It is essential to carefully analyze the IR content and continuously observe market conditions before making investment decisions.

Frequently Asked Questions

What are Gison’s main businesses?

Gison’s main businesses are wireless security solutions, including the ‘Alpha-V’ vehicle security system and the ‘Alpha-CQ’ accommodation security system.

What is Gison’s current financial status?

Gison has recorded operating losses in recent years. Despite sales growth, improving profitability is urgent.

What should investors be aware of when considering investing in Gison?

Investors should consider a comprehensive range of factors, including profitability improvement strategies, competitive advantages, and the macroeconomic environment, before making investment decisions.