As global markets navigate economic uncertainty, a comprehensive KOREA ZINC INC. stock analysis is critical for investors. As a global leader in the non-ferrous metals industry, KOREA ZINC (KRX: 010130) stands at a crossroads, facing headwinds in its core business while aggressively pursuing future growth engines. This deep-dive analysis, based on H1 2025 reports and regulatory filings, explores the company’s financial health, new ventures, and the risks that lie ahead. The insights within are drawn from publicly available information, including the company’s Official Disclosure, providing a transparent view for formulating a prudent investment strategy for 2025 and beyond.

H1 2025 Performance: A Tale of Two Businesses

The first half of 2025 presented a challenging environment for KOREA ZINC’s traditional operations. The core non-ferrous metal manufacturing and sales division witnessed a significant downturn, a critical factor in any KOREA ZINC analysis.

Core Business Downturn Amidst Market Headwinds

Revenues for the core division were recorded at KRW 4.85 trillion, a stark decrease of approximately 40% year-over-year. This slump was primarily driven by a combination of falling prices and reduced sales volumes for key metals such as zinc and lead. The persistent weakness in lead prices, in particular, exerted considerable pressure on profitability. Similarly, KGTRAIDING Corp., the company’s import-export arm, reported a 42% revenue drop, reflecting the lower unit prices for zinc, lead, and aluminum on the global market, as tracked by institutions like the London Metal Exchange (LME).

Despite a 40% revenue decline in its core non-ferrous metals business, KOREA ZINC’s strategic pivot to secondary battery materials and renewable energy signals a clear focus on long-term, sustainable growth drivers.

Navigating Corporate and Macroeconomic Volatility

Beyond market prices, the outlook for KOREA ZINC INC. stock is heavily influenced by internal governance and the broader macroeconomic landscape. Recent developments have brought both relief and continued caution.

Partial Resolution in Management Dispute

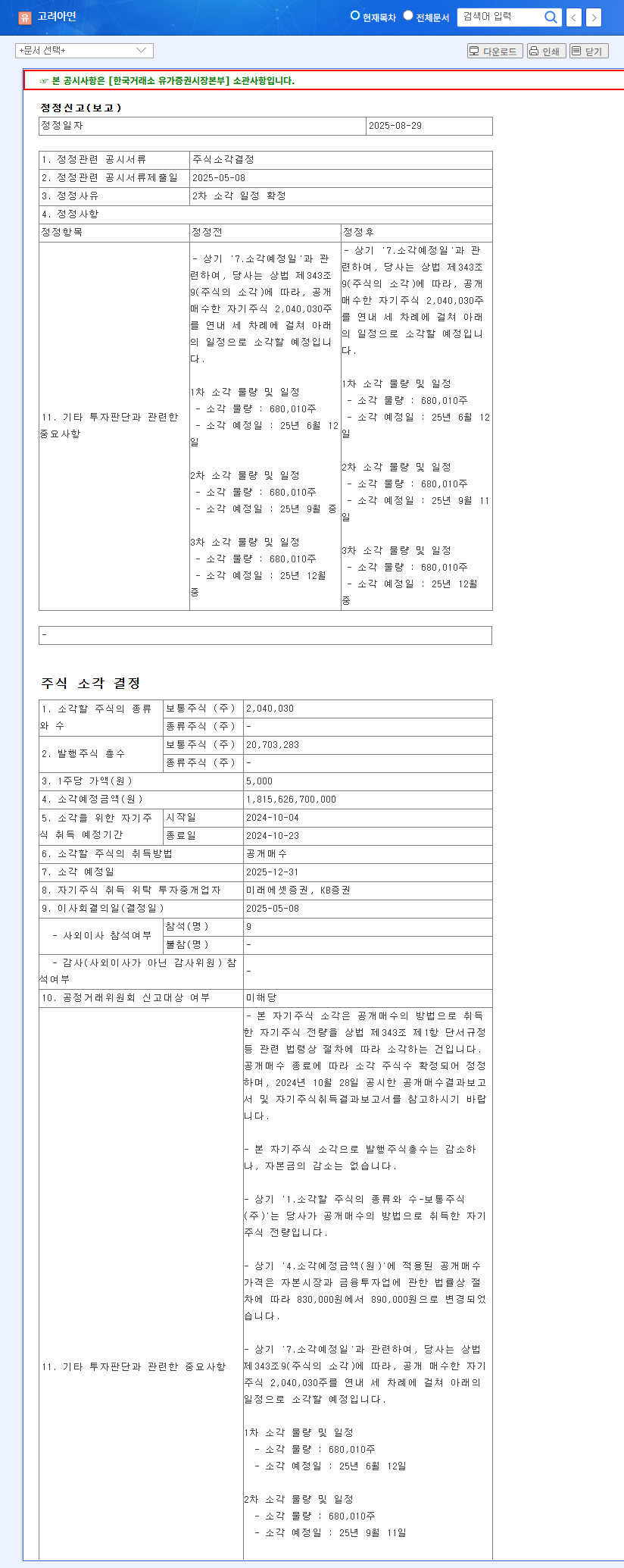

A significant overhang of uncertainty began to clear following a key ruling from the Seoul High Court (2025ra2350). The court’s decision to rescind a suspension order on several resolutions from a prior shareholder meeting has been interpreted as a positive step. While the core dispute with Youngpoong Corp. remains, this ruling eases immediate governance concerns and may signal a more stable path forward, a crucial element for investor confidence.

Impacts of Global Financial Conditions

The global interest rate environment remains a key variable. With the U.S. and Europe holding rates steady to combat inflation, and South Korea maintaining its benchmark rate, corporate financing costs are under pressure. This environment affects everything from borrowing costs to investor sentiment, which investors can learn more about in our guide to the Korean stock market.

- •Precious Metals Surge: Geopolitical tensions and central bank buying fueled a massive rally, with gold and silver prices surging approximately 39% and 26%, respectively. This provides a significant boost to KOREA ZINC’s precious metals segment.

- •Non-Ferrous Weakness: In contrast, zinc and lead prices remained subdued due to sluggish global industrial demand, particularly from China, and oversupply issues.

- •Cost Pressures: Rising international crude oil prices and volatile freight indices present ongoing challenges for production and logistics costs.

Pivoting to Future Growth Engines

Perhaps the most compelling part of the KOREA ZINC 2025 story is its strategic diversification into high-growth sectors. The company is actively working to secure its future beyond traditional smelting.

Expansion into Battery Materials and Renewable Energy

KOREA ZINC is making significant strides in two key areas aligned with global megatrends:

- •Secondary Battery Materials: Subsidiaries like Kemco Co., Ltd. are positioning to supply IRA-compliant nickel sulfate for the EV market. Despite a temporary slowdown, the long-term potential of this market is immense and is expected to become a core growth driver.

- •Renewable Energy & Hydrogen: Through Ark Energy in Australia, the company is building a renewable energy portfolio. This not only aligns with ESG goals but also aims to generate long-term, stable profits, hedging against the volatility of commodity markets.

Investment Thesis: A Neutral Stance with Cautious Optimism

Considering all factors, the investment outlook for KOREA ZINC INC. stock warrants a “Neutral” rating. The company’s strong financial foundation (AA+ credit rating) and strategic pivot are highly positive. However, significant risks temper the immediate upside.

Key Risks and Investor Action Plan

Investors should maintain a cautious approach and monitor the following key areas:

- •Management Dispute: Track the outcomes of ongoing lawsuits, as they can impact corporate governance and stability.

- •New Business Performance: Watch for tangible revenue contributions and profitability milestones from the battery and energy divisions.

- •Market Volatility: Pay close attention to commodity prices and currency fluctuations. A 10% change in exchange rates, for instance, could impact net profit by approximately KRW 217.3 billion.

- •Macroeconomic Shifts: Monitor global inflation trends and interest rate policies, as they will directly influence the non-ferrous metals market.

In conclusion, while KOREA ZINC has undeniable long-term potential, the combination of a struggling core business and external uncertainties requires a patient and watchful investment strategy. The success of its diversification will ultimately determine the future trajectory of its stock value.

Disclaimer: This analysis is for informational purposes only and is not intended as financial advice. Investment decisions should be made based on personal research and consultation with a qualified financial advisor.