1. Background and Scale of the Contract Termination

The supply contract for LevoticsCR tablets was terminated due to a breach of contract by MCQ Medical. This will result in an estimated ₩696 billion revenue loss for Korea United Pharm, exceeding its estimated 2024 revenue.

2. Impact Analysis of the Termination

This termination will directly impact sales and profitability, and it is expected to create downward pressure on stock prices, increase uncertainty in future earnings forecasts, and alter the competitive landscape in overseas markets. The current high-interest rate environment may also exacerbate financial health concerns.

3. Korea United Pharm’s Fundamentals and Growth Potential

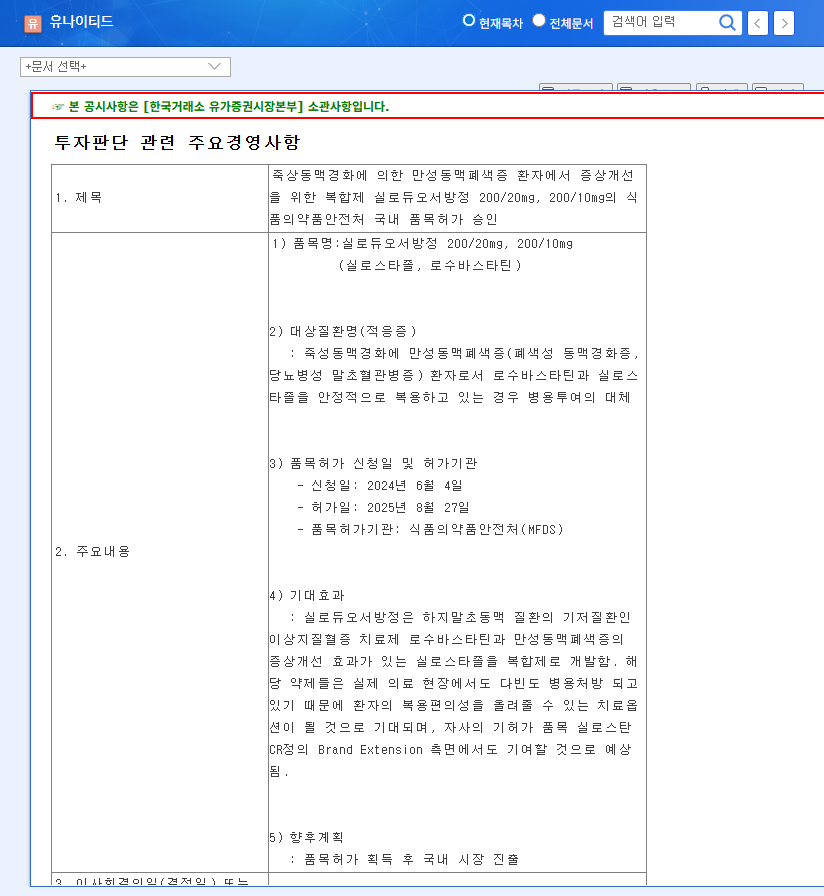

Korea United Pharm has shown robust growth, exporting to over 40 countries based on major modified new drugs such as SilostanCR, ArtMac CombiGel, and GastinCR. Its high R&D investment ratio and diverse new drug development pipeline are considered future growth drivers. However, recent declines in semi-annual sales and EPS trends, along with an increase in debt ratio, are causes for concern.

4. Action Plan for Investors

While a short-term stock price decline seems inevitable, Korea United Pharm has the potential to overcome this crisis based on its R&D capabilities and existing product portfolio. Investors should note the following:

- Monitor the company’s announcements regarding plans to address the revenue gap and carefully review its overseas business diversification strategy and financial soundness management plan.

- Re-evaluate the company’s fundamentals and growth potential from a long-term perspective and establish an appropriate investment strategy.

Frequently Asked Questions

What is the main reason for the contract termination?

The primary reason is MCQ Medical’s breach of contract. Refer to the official announcement for further details.

What is the expected impact of the termination on the stock price?

Downward pressure on the stock price is anticipated in the short term. The loss of 26.5% of revenue could send a negative signal to the market.

What is the future outlook for Korea United Pharm?

While challenges are expected in the short term, there is a possibility of recovery based on their strong R&D pipeline and existing product portfolio.