1. What Happened? The $3.1M Deal

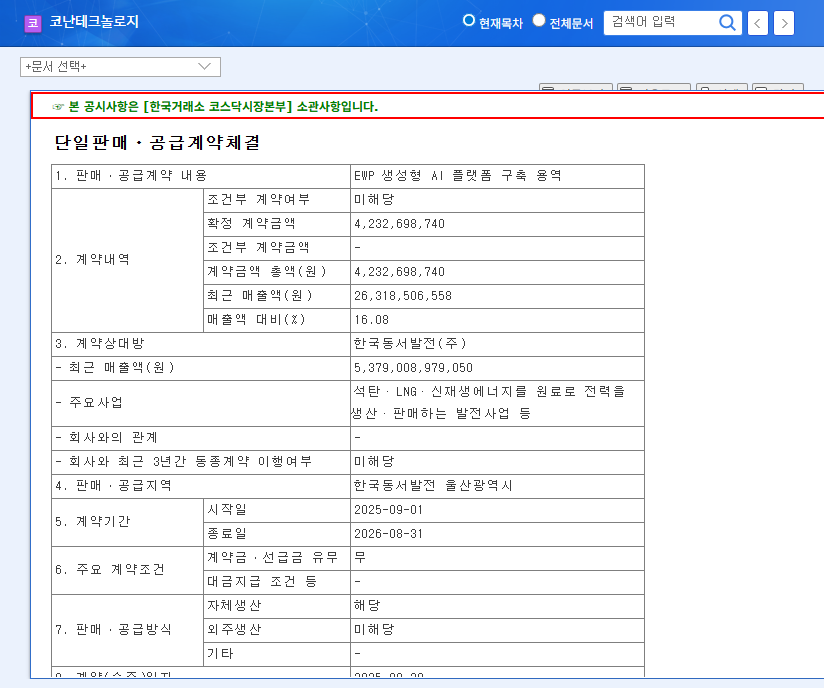

Konan Technology secured a $3.1 million contract with Korea East-West Power to build their EWP generative AI platform. This represents a significant portion of Konan’s projected revenue for the first half of 2025.

2. Why Does it Matter? Implications and Fundamental Analysis

This contract validates Konan’s Text AI technology, specifically the competitiveness of its Konan LLM-based solutions. Securing a reference in the public sector is a crucial stepping stone for future contracts.

- Positives: Accelerated Text AI growth, public sector reference, increased revenue stability

- Negatives/Neutral: Limited short-term profitability improvement, existing financial burdens remain

3. What’s Next? Stock Forecast and Investment Strategies

A positive short-term stock impact is expected. However, the long-term trajectory depends on successful contract execution, further contract wins, and the company’s ability to improve its financial health.

4. Investor Action Plan

Investors should look beyond the immediate stock bump and monitor the company’s fundamentals. Pay close attention to the potential for further public sector contracts, profitability during contract execution, and efforts to improve financial health.

Why is this contract important for Konan Technology?

This contract validates Konan’s Text AI technology and secures a public sector reference, increasing the likelihood of winning future contracts.

What is the contract value?

$3.1 million.

Will this contract solve Konan Technology’s financial issues?

The short-term financial impact may be limited, and sustained efforts are needed for long-term financial health improvement.