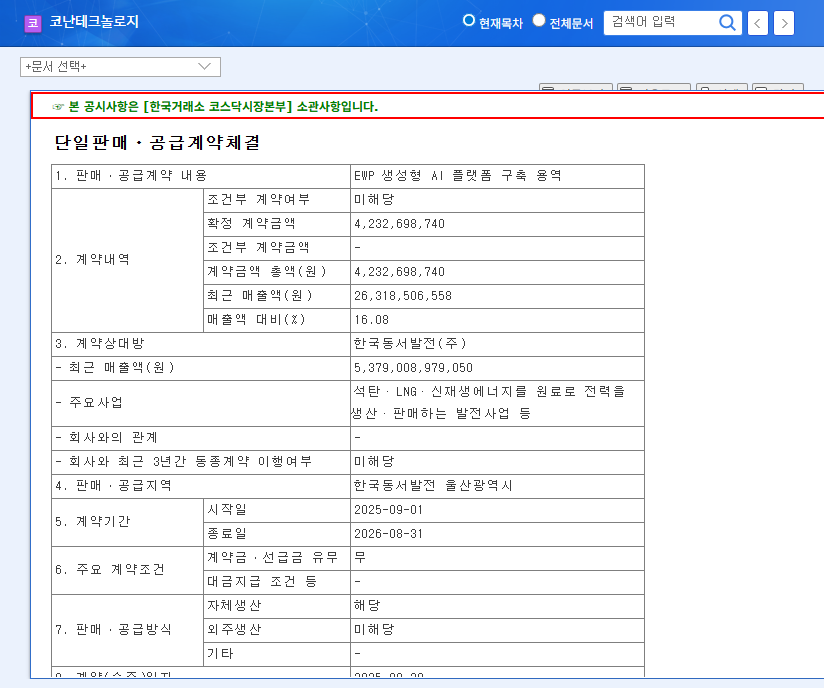

Recent market disclosures regarding a KONAN TECHNOLOGY INCORPORATION shareholding change have prompted questions among investors. When a major shareholder’s stake appears to decrease, it can signal uncertainty. However, a surface-level reading often misses the critical context. This comprehensive analysis will dissect the official filing, explain the technical reasons behind the shift—which are not related to a direct stock sale—and evaluate the company’s underlying fundamentals to provide a clear, actionable investment thesis.

We’ll explore why this change is tied to Bond with Warrants (BW) and what that means for the company’s management and future outlook, helping you make an informed decision about KONAN TECHNOLOGY stock.

Decoding the Official Filing: A 0.67% Shift in Shareholding

On October 31, 2025, a ‘Report on Large Shareholding Status’ was filed concerning KONAN TECHNOLOGY INCORPORATION. According to the Official Disclosure, the total ownership stake held by key reporting person Kim Young-seom and related parties decreased from 37.90% to 37.23%. While this 0.67 percentage point reduction might seem concerning at first glance, the devil is in the details.

The Real Reason: It’s Not a Sell-Off, It’s About Warrants

Understanding Bond with Warrants (BW)

The primary driver of this shareholding change is not a direct sale of stock on the open market. Instead, it stems from technical adjustments related to Bond with Warrants (BW). A BW is a type of corporate debt that gives the holder the right (or warrant) to purchase a company’s stock at a specific price within a certain timeframe. The filing indicates the change is due to the exercise, expiration, or other contractual shifts involving these warrants. This is fundamentally an accounting and structural adjustment, not a reflection of lost confidence from management.

Management Influence Remains Strong

Crucially, the stated purpose for holding the shares remains ‘management influence.’ This reinforces the interpretation that the core leadership’s control and strategic direction are unaffected. The change should be viewed as financial housekeeping rather than a bearish signal from insiders.

KONAN TECHNOLOGY INCORPORATION presents a classic case for investors: balancing immense long-term growth potential in AI against significant short-term financial pressures.

A Deep Dive into KONAN TECHNOLOGY’s Fundamentals

The Bull Case: Catalysts for Growth

Despite market noise, the company’s core technological strengths are compelling, particularly in the booming AI sector. An AI stock analysis reveals several positive drivers:

- •Leadership in Text AI: The launch of advanced LLM-based solutions like Konan RAG-X positions the company at the forefront of generative AI applications.

- •Stable Defense AI Revenue: A dedicated Defense AI division secures long-term, stable revenue through government project orders, providing a financial cushion.

- •New Business Expansion: Ventures into on-device AI for PCs and appliances open up massive new consumer and enterprise markets.

- •Growing Order Backlog: A backlog of KRW 24.6 billion indicates strong future revenue potential.

The Bear Case: Navigating Financial Headwinds

The optimism is tempered by clear short-term challenges highlighted in the H1 2025 report:

- •Revenue and Profitability: The company reported a significant revenue decrease to KRW 7.5 billion and a substantial operating loss of KRW 8.4 billion.

- •Increased Leverage: The debt-to-equity ratio has risen to 176.4%, indicating increased financial risk that needs to be managed carefully.

Investor Action Plan: Observe and Monitor

Given the context, this shareholding change should be considered market noise. The more significant drivers for KONAN TECHNOLOGY stock will be its ability to convert its technological edge and order backlog into profitable growth. Macroeconomic factors, such as interest rate trends and currency fluctuations as reported by sources like Bloomberg, will also play a role in investor sentiment.

Our investment opinion is Observe. Investors should look past this filing and focus on the company’s forthcoming performance. The H2 2025 earnings report will be a critical indicator of whether the company is successfully navigating its financial challenges. For more information on evaluating similar companies, see our guide on how to analyze emerging tech stocks.

Frequently Asked Questions (FAQ)

Why did KONAN TECHNOLOGY’s shareholding percentage decrease?

The stake held by major shareholders decreased slightly due to technical reasons involving the exercise or expiration of Bond with Warrants (BW) and the addition of related parties, not because of a large-scale stock sale.

Does this change weaken management’s control over the company?

No. Since the change is an accounting-related fluctuation and the stated purpose of holding shares remains ‘management influence,’ it’s understood that effective management control is not compromised.

What is the current financial health of KONAN TECHNOLOGY INCORPORATION?

The company has strong long-term growth potential in AI but is facing short-term financial hurdles, including revenue decline, operating losses, and a higher debt-to-equity ratio as of H1 2025.

What is the investment recommendation for KONAN TECHNOLOGY stock?

An ‘Observe’ stance is recommended. Investors should focus on fundamental business performance, such as upcoming earnings reports and new project execution, rather than this minor shareholding adjustment. The H2 2025 performance will be a key factor to watch.