What Happened? – The Trading Halt

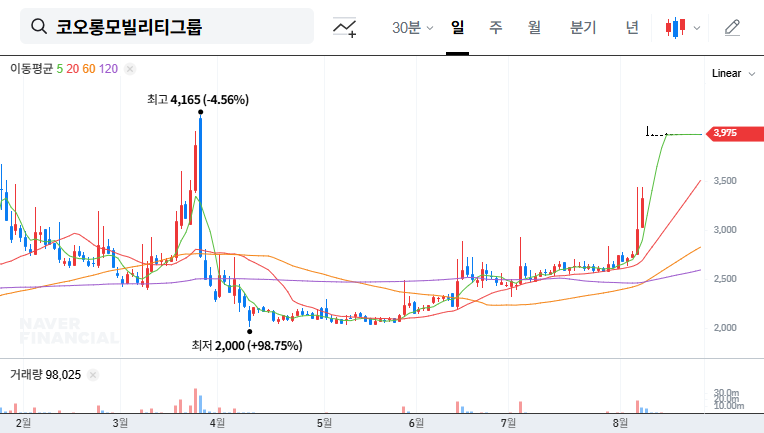

Kolon Mobility Group’s stock trading was halted on September 23, 2025, due to being designated as a short-term overheating and investment warning item. This is an investor protection measure following recent sharp fluctuations in stock prices.

Why Did This Happen? – Fundamental Analysis

While Kolon Mobility Group achieved sales growth and returned to profitability in the first half of 2025, high debt-to-equity ratio (284%) and declining operating profit margin remain challenges. Corporate governance changes, such as treasury stock cancellation and share exchange, can be positive in the long run, but may increase short-term stock price volatility. The continued high interest rates and exchange rates can be burdensome for Kolon Mobility Group, an importer of vehicles.

- Strengths: Sales growth, return to profitability, extensive sales network

- Weaknesses: High debt-to-equity ratio, low operating profit margin, macroeconomic uncertainty

What Should We Do? – Investment Strategy

Caution and observation are advised at this time. Due to the high possibility of increased stock price volatility after trading resumes, a cautious approach is necessary. Investors should monitor the announcement of 2025 second-half earnings and changes in macroeconomic variables to confirm whether fundamentals are improving. The progress of corporate governance restructuring and the performance of the eco-friendly vehicle segment are also important observation points.

Investor Action Plan

- Short-term: Closely monitor stock price trends after trading resumes, avoid hasty investments

- Mid- to long-term: Make investment decisions after comprehensively considering factors such as earnings improvement, debt management, and corporate governance changes

What are Kolon Mobility Group’s main businesses?

Kolon Mobility Group primarily focuses on importing and selling automobiles (BMW, Volvo, Audi, MINI, etc.), along with certified pre-owned cars, A/S maintenance, and audio sales.

What will happen to the stock price after the trading halt?

Immediately after trading resumes, stock price volatility is likely to increase depending on investor sentiment. Both positive and negative factors exist, so a cautious approach is necessary.

Should I invest in Kolon Mobility Group?

The current recommendation is ‘caution/observation’. It is advisable to make investment decisions after comprehensively considering factors such as improvement in fundamentals, macroeconomic variables, and changes in corporate governance.