What Happened at Koh Young?

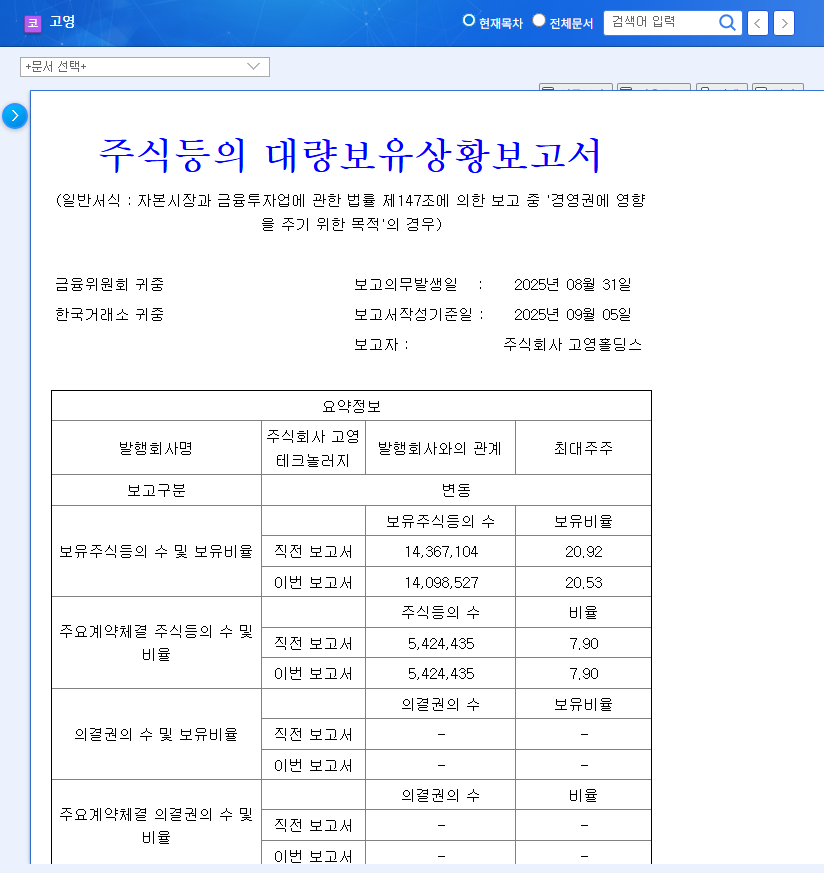

On September 5, 2025, a public announcement revealed that Sung Jeong-gyu, an insider of Koh Young Holdings, sold 5,170 shares of Koh Young stock on the open market. This resulted in a slight decrease in Koh Young Holdings’ stake from 20.92% to 20.53%.

Why Is the Stake Sale a Concern?

While the decrease in stake itself is not substantial, combined with the weak performance in the first half of 2025, it could negatively impact investor sentiment. Caution is warranted, particularly because sales by major shareholders and insiders can raise concerns about the company’s future. The sale on the open market could also put downward pressure on the stock price in the short term.

What Should Investors Do?

- Monitor Further Stake Changes: Closely monitor any further stake changes by Koh Young Holdings and Sung Jeong-gyu. Continued selling could increase uncertainty regarding management control.

- Check for Fundamental Improvements: Verify whether there are fundamental improvements, such as sustained growth in the 3D SPI business, a rebound in the 3D AOI business, and visible results in the medical robot business.

- Consider Macroeconomic Factors: Analyze the impact of macroeconomic variables like interest rates, exchange rates, and global IT market trends on Koh Young.

- Adopt a Conservative Investment Approach: Given the current market conditions and the company’s fundamentals, a conservative approach to investment is recommended. It is advisable to wait for clear signals of fundamental improvement before making investment decisions.

Frequently Asked Questions

What is the reason for Koh Young Holdings’ stake sale?

According to the public announcement, the change in stake is due to a decrease in special relations and over-the-counter sales. The specific reason for the sale has not been disclosed.

What will be the impact of this stake sale on Koh Young’s stock price?

While the decrease in stake itself is not significant, coupled with the current weak earnings, it could lead to worsening investor sentiment and downward pressure on the stock price in the short term. The long-term impact will depend on whether fundamentals improve and whether there are further stake changes.

Should I invest in Koh Young?

Considering the current market situation and the company’s fundamentals, a conservative approach is recommended. It’s best to wait for clear signs of fundamental improvement before making investment decisions.