What’s Happening with Kodako (046070)?

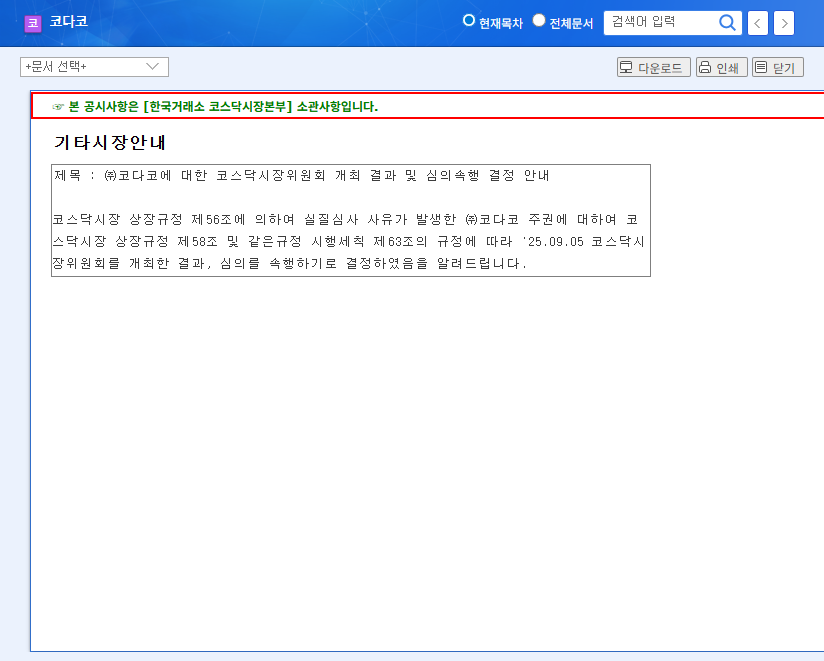

The KOSDAQ Market Committee decided on September 5, 2025, to continue the delisting review for Kodako. This is a critical issue that could determine the company’s survival.

Why is Kodako in this situation?

Kodako is currently undergoing rehabilitation proceedings and received a “disclaimer of opinion” in its audit report. This raises serious questions about the company’s financial soundness and transparency. High debt ratios and continued losses further darken the company’s prospects for recovery.

What should investors do?

- Short-term impact: Increased stock price volatility, potential surge in trading volume and sell-off, deterioration of investor sentiment.

- Mid- to long-term impact: Possibility of delisting, restrictions on corporate activities, accelerated deterioration of fundamentals.

Macroeconomic uncertainties could further exacerbate Kodako’s situation.

Investor Action Plan

- Suspend investment: New investments should be carefully considered after confirming the review results and the company’s response.

- Strengthen risk management: Existing investors need to strengthen risk management, considering the possibility of principal loss.

- Obtain additional information: Carefully analyze all disclosed information, including review results and the company’s position.

FAQ

Is Kodako’s delisting confirmed?

Not yet, but the decision to continue the review increases the likelihood of delisting.

What are Kodako’s chances of recovery?

Kodako is undergoing rehabilitation proceedings, but the disclaimer of opinion raises significant uncertainty.

What should investors do?

New investments should be put on hold, and existing investors should strengthen risk management. It’s crucial to closely monitor all disclosed information.