Kim Dae-yong Acquires 6.73% Stake in JaeYoung SoluTech – What’s Happening?

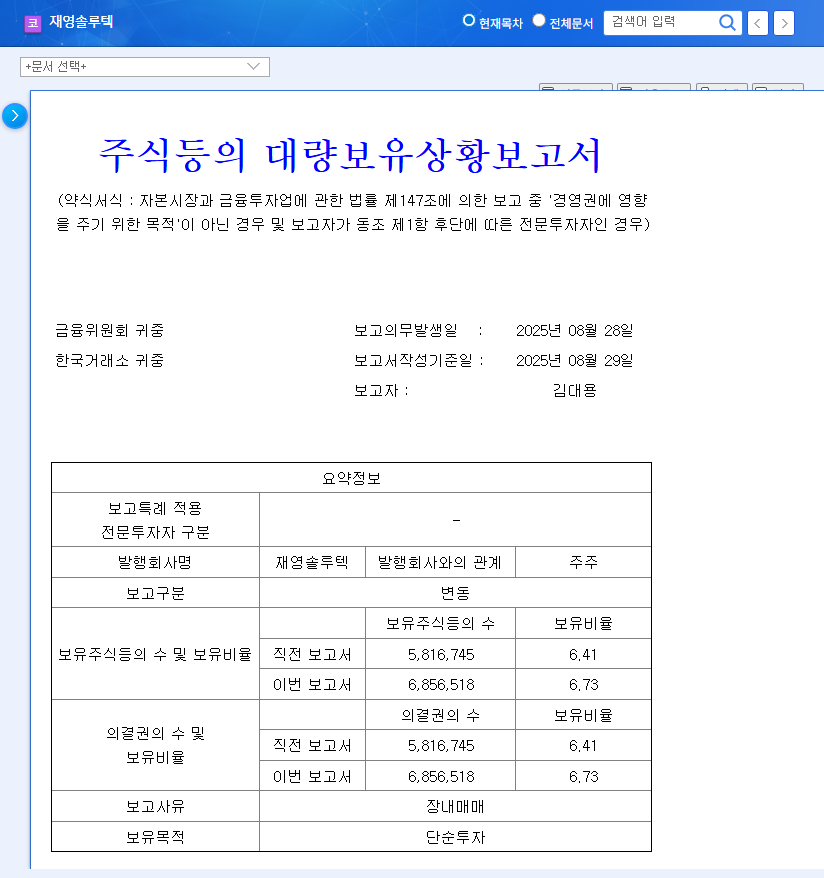

Kim Dae-yong actively traded JaeYoung SoluTech shares between August 22nd and 28th, increasing his stake from 6.41% to 6.73%. Despite alternating between buying and selling, he ultimately increased his holdings.

Stake Increase Amid Weak Earnings – Why?

JaeYoung SoluTech’s performance in the first half of 2025 has been underwhelming. Sales decreased by 35.6% year-over-year, and net income turned negative. The downturn in the nano-optics division is cited as the primary cause. In this context, it’s unclear whether Kim’s stake increase is driven by short-term gains or a belief in the company’s long-term value.

- Positive efforts like the sale of mold business assets and the establishment of a Seoul research center aim to improve financial structure and strengthen R&D, but their impact on fundamental improvement remains to be seen.

Should You Invest Now?

In the short term, the news of Kim’s stake increase alone is unlikely to significantly impact the stock price. The recent poor earnings may even dampen investor sentiment. However, a large investor increasing their stake can be a positive long-term signal, provided it’s accompanied by fundamental improvements within the company.

Investor Action Plan

Investors should carefully monitor the following factors before making any investment decisions:

- Analysis of the reasons behind the weak Q2 earnings

- Visibility of R&D achievements

- Status of relationships with major clients and new order intake

- Kim Dae-yong’s future stake changes

- Macroeconomic environment (exchange rates, interest rates, oil prices, etc.)

The key to investing in JaeYoung SoluTech lies in observing the company’s fundamental improvements. Focus on earnings recovery, strengthening competitiveness, and securing new growth drivers.

Frequently Asked Questions

Who is Kim Dae-yong?

Specific information about Kim Dae-yong isn’t publicly available, but the details of his stake changes are disclosed in the large shareholding report.

What is JaeYoung SoluTech’s main business?

JaeYoung SoluTech is engaged in nano-optics, mold business, etc. They recently sold their mold business assets and are focusing on the nano-optics sector.

Should I invest in JaeYoung SoluTech?

The decision to invest is ultimately your own. Consider the information provided here along with the company’s financial data, market conditions, and your risk tolerance before making a decision.