1. KG Steel’s ₩64.2B Startup Investment: What Happened?

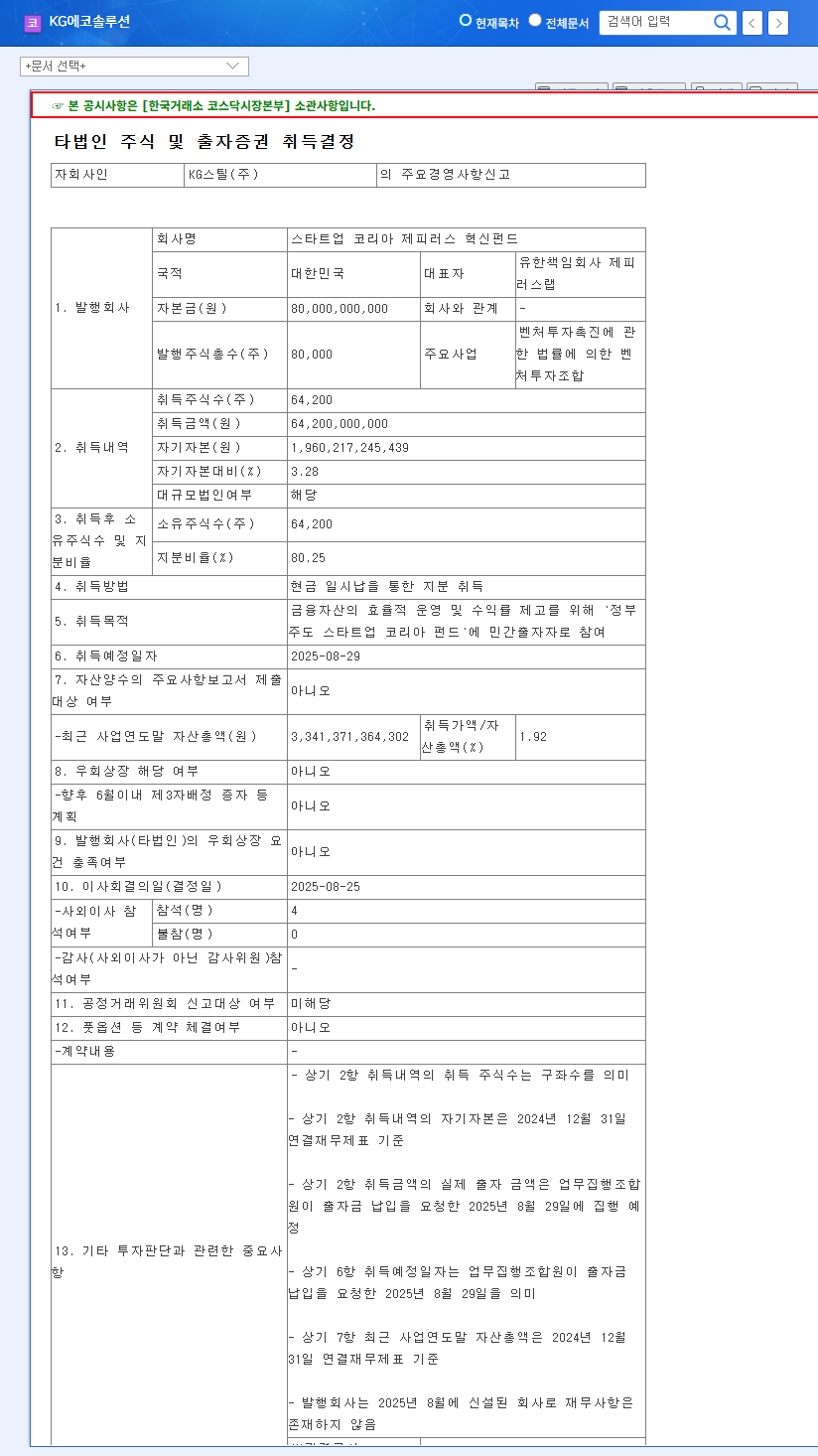

KG Steel, a subsidiary of KG Eco Solutions, has invested ₩64.2 billion in the ‘Startup Korea Zephyrus Innovation Fund.’ This substantial investment represents 80.25% of KG Steel’s stake. KG Group aims to improve the efficiency of its financial asset management and enhance returns through this investment.

2. Why Invest in Startups?: Background and Strategy

KG Eco Solutions has demonstrated positive fundamental improvements through new business ventures and strengthened ESG management. This startup investment is interpreted as part of a new strategy to secure future growth engines.

- Identifying New Growth Drivers: Beyond existing new businesses like bio marine fuel and holding company operations, this investment aims to discover innovative technologies and promising companies to secure long-term growth.

- Portfolio Diversification: This investment is part of a strategy to diversify the portfolio and reduce dependence on specific industry fluctuations, creating a stable foundation for growth.

- Strengthening ESG Management: By participating in a government-led fund and fostering startups, KG Eco Solutions can contribute to social value creation and fostering an innovative ecosystem, thereby strengthening its ESG management.

3. What Investors Should Watch: Opportunities and Risks

While this investment is positive in the long run, investors should keep a few considerations in mind.

- Investment Risk: Startup investments hold high growth potential but also carry significant risks of failure. Thorough due diligence and risk management are crucial.

- Financial Health: Continuous large-scale investments necessitate monitoring KG Group’s financial soundness.

- Market Volatility: A flexible response strategy to the rapidly changing market environment is essential.

4. Investor Action Plan

Investors should continuously monitor the performance of KG Eco Solutions’ startup investments and establish investment strategies in response to market changes. Regularly reviewing the company’s IR materials and public disclosures, and developing a plan to adjust investment portfolios are important steps.

What is the purpose of KG Eco Solutions’ investment in startups?

The investment aims to improve financial asset management efficiency, enhance returns, secure future growth engines, diversify the business portfolio, and strengthen ESG management.

What is the scale of the investment?

KG Steel has invested ₩64.2 billion in the Startup Korea Zephyrus Innovation Fund.

What are the key risk factors of this investment?

Key risks include the inherent volatility and failure risk of startup investments, potential financial burden from continued large-scale investments, and changes in the market environment.