1. What Happened at KG Chemical?

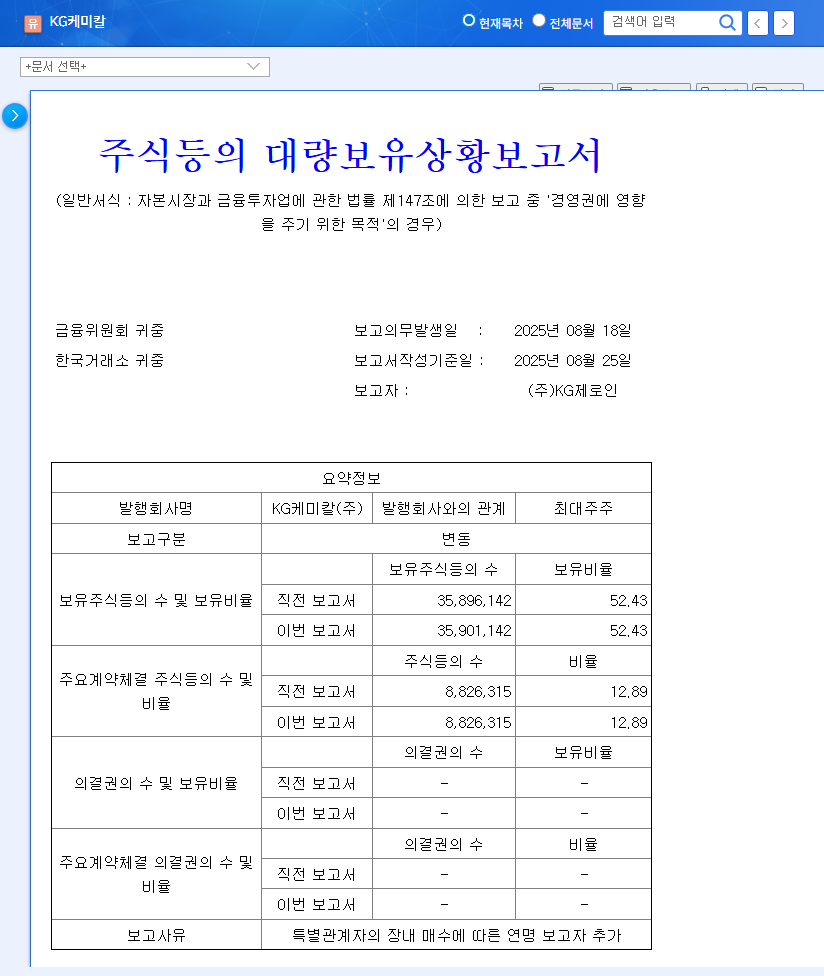

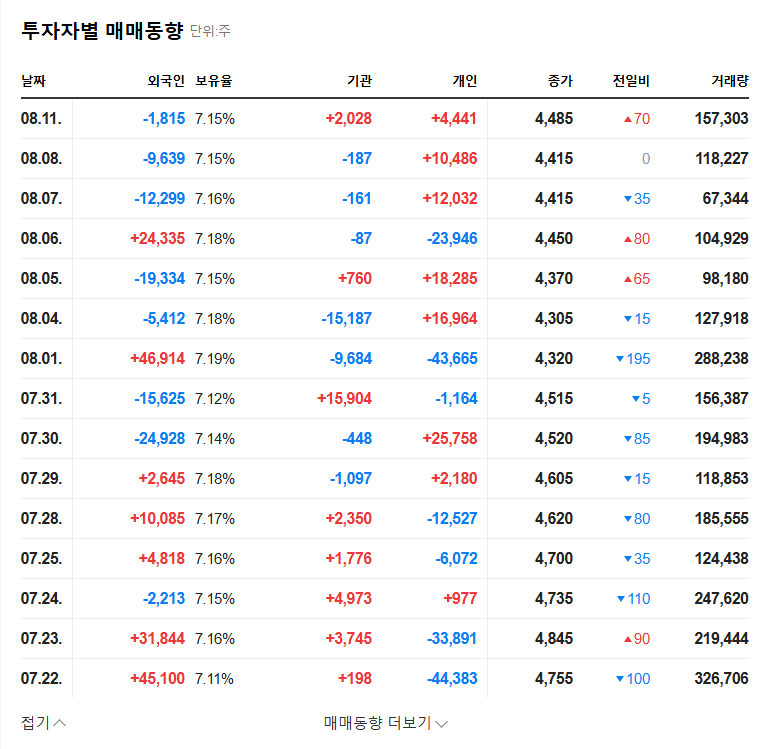

In August, KG Chemical filed an amended business report, providing further details on treasury stock transactions and minority shareholder rights exercises. A large shareholding report was also submitted, indicating a change in major shareholders due to open market purchases for the purpose of influencing management control.

2. Positive Signals and Hidden Risks

- Positive Factors:

- Increased stake by major shareholders suggests greater management stability.

- Efforts towards greater transparency could boost investor confidence.

- Negative Factors:

- Continuing losses since 2022 paint a concerning financial picture.

- Macroeconomic uncertainties, including high interest rates and exchange rate volatility, add to the risks.

3. Investment Strategy for KG Chemical

Investing in KG Chemical requires caution. While governance improvements are welcome, sustained share price appreciation is unlikely without fundamental improvements in profitability. Investors should closely monitor the company’s ability to return to profitability, its relationship with minority shareholders, and macroeconomic developments.

4. Future Outlook and Key Considerations

The future trajectory of KG Chemical’s stock price hinges on its ability to overcome its losses and improve profitability. Investors should pay close attention to management’s business strategies and execution, changes in its relationship with minority shareholders, and shifts in the macroeconomic environment.

Frequently Asked Questions

What are the key takeaways from KG Chemical’s recent filings?

KG Chemical’s amended business report emphasizes transparency, while the large shareholding report signals increased ownership by major shareholders and their intent to influence management.

What is the biggest concern for investors in KG Chemical?

The company’s persistent losses are the most significant concern. Without improvements in financial performance, long-term investment value is questionable.

What is the outlook for KG Chemical’s stock price?

The stock’s future performance depends heavily on whether the company can return to profitability. Continuous monitoring of relevant indicators is crucial.