In a significant move for the K-drama industry, PANENTERTAINMENTCO.,LTD. (팬엔터테인먼트) has officially announced a massive KRW 15.2 billion drama production and supply contract with Munhwa Broadcasting Corporation (MBC). This deal is a potential game-changer for the company, which has faced recent performance headwinds. For investors and industry watchers, this news raises a critical question: Is this the catalyst that will propel the PANENTERTAINMENT stock back into the spotlight? This comprehensive analysis will explore the deal’s fine print, its financial implications, and the strategic outlook for the company.

This contract isn’t just a revenue boost; it’s a powerful reaffirmation of Pan Entertainment’s status as a premier storyteller in a globally competitive market. Securing a deal of this magnitude with a major broadcaster like MBC signals strong confidence in their creative and production capabilities.

The Landmark MBC Drama Deal: A Closer Look

On November 13, 2025, PANENTERTAINMENTCO.,LTD. filed a disclosure detailing a contract for the production and supply of a new drama titled "<The Brilliant Season of You>" with MBC. The key details are as follows:

- •Contract Value: KRW 15.2 billion (approximately $11.5 million USD).

- •Significance: The value represents an astounding 43.8% of the company’s recent annual revenue, highlighting its immense financial impact.

- •Contract Period: November 13, 2025, to June 30, 2026. This timeline indicates that revenue will be recognized across two fiscal years.

- •Official Source: The complete details can be verified through the official regulatory filing. Click to view DART report.

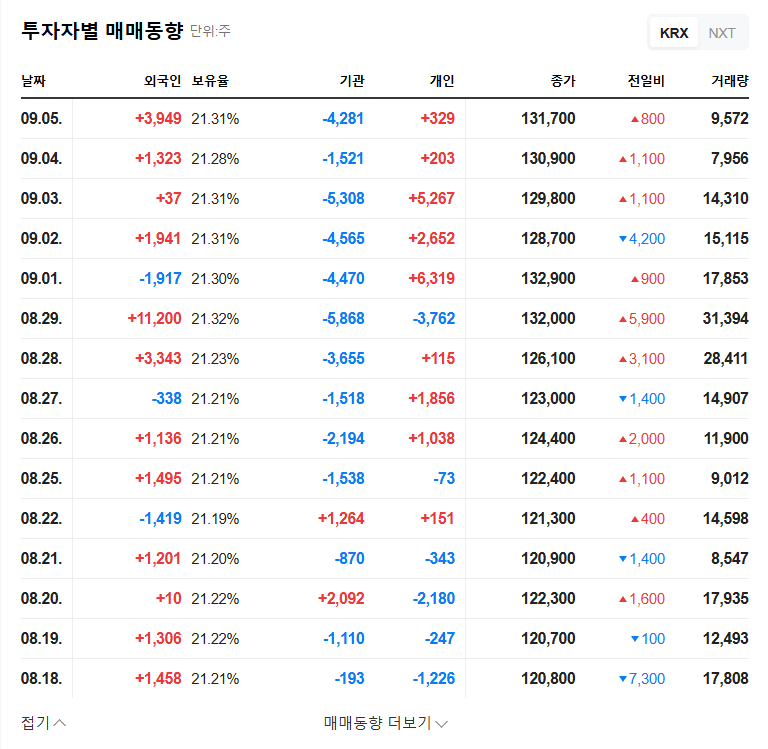

Impact on PANENTERTAINMENT Stock and Financials

A Catalyst for Financial Turnaround

Given that PANENTERTAINMENTCO.,LTD. reported a shift to an operating loss in the first half of 2025, this secured revenue stream is a critical lifeline. The KRW 15.2 billion will provide a significant top-line boost, potentially reversing recent losses and improving profitability metrics. The key for investors will be to monitor production cost management. If the company can maintain healthy margins on this project, the impact on earnings per share (EPS) and overall PANENTERTAINMENT stock valuation could be substantial.

Reaffirming Core Business Strength

Pan Entertainment is a legendary name in K-drama production, with a portfolio that includes global hits like "Winter Sonata" and "Moon Embracing the Sun." This new MBC drama deal re-validates their position as a top-tier production house capable of securing large-scale contracts with major domestic broadcasters. In an era dominated by streaming giants, a strong relationship with a terrestrial network like MBC provides a stable foundation and diversifies distribution channels. For more on this trend, see Variety’s analysis of the global content market.

Investor Action Plan & Future Outlook

While this news is overwhelmingly positive, prudent investors should monitor several key factors moving forward. The ultimate success of this deal hinges on the market reception of "<The Brilliant Season of You>". Here’s what to watch:

- •Production Updates & Buzz: Track pre-release marketing, casting news, and online buzz. High anticipation often translates to strong initial viewership.

- •Viewership Ratings & Ancillary Sales: Once aired, viewership ratings are the primary success metric. High ratings can lead to lucrative secondary revenue from PPL (product placement), OST sales, and international distribution rights.

- •Quarterly Financial Reports: Analyze the company’s cost of goods sold (COGS) and profit margins in their upcoming earnings reports to see how efficiently they are managing the production budget. Learn more about how to analyze entertainment company financials in our guide.

- •Future Pipeline: A successful project often leads to more opportunities. Watch for announcements of new contracts that would signal sustained momentum.

Frequently Asked Questions (FAQ)

What is PANENTERTAINMENTCO.,LTD.’s new contract?

PANENTERTAINMENTCO.,LTD. signed a KRW 15.2 billion contract with MBC to produce and supply the K-drama "<The Brilliant Season of You>" between November 2025 and June 2026.

How might this deal affect the PANENTERTAINMENT stock price?

The deal is expected to be a positive catalyst for the PANENTERTAINMENT stock. It guarantees significant revenue, which could lead to improved profitability and stronger investor confidence, potentially driving the stock price up if the drama succeeds.

What are the main risks for investors?

The primary risk is the performance of the drama itself. If "<The Brilliant Season of You>" fails to attract viewers, the expected financial benefits may not fully materialize. Other risks include potential production cost overruns and broader macroeconomic headwinds affecting the advertising market.