1. What Happened? JPMorgan Acquires 5.16% Stake in Protina

JPMorgan Asset Management has acquired 513,000 shares of Protina, securing a 5.16% stake. While categorized as a passive investment, the move by a global investment giant is expected to significantly influence market perception.

2. Why Did JPMorgan Invest in Protina? Strong Fundamentals and Growth Potential

- Proprietary Technology: Protina possesses a competitive edge in the drug discovery and companion diagnostics market with its proprietary SPID platform technology. Its AI-driven antibody design technology is particularly noteworthy as a future growth engine.

- Rapid Revenue Growth: Protina has demonstrated remarkable growth, with a 194% year-over-year increase in revenue in the first half of 2025. Long-term contracts with major clients and expansion into international markets are expected to create a stable revenue base.

- Active R&D: Continuous investment in R&D, including securing key research personnel, winning government grants, and filing patents, strengthens Protina’s technological competitiveness.

- KOSDAQ Listing: Protina’s successful listing on the KOSDAQ exchange in July 2025 through the special technology listing process has enhanced its corporate value and facilitated investment attraction.

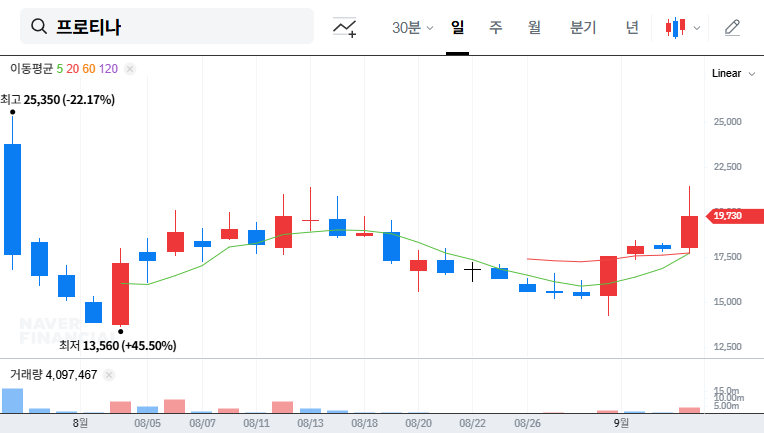

3. JPMorgan’s Investment: What are the Implications? Improved Investor Sentiment and Stock Price Momentum

JPMorgan’s investment is expected to boost market confidence in Protina and improve investor sentiment. This is likely to translate into upward momentum for the stock price. The possibility of further investment from JPMorgan cannot be ruled out, potentially serving as a long-term growth catalyst.

4. What Should Investors Do? Positive Outlook Requires Risk Management

Given Protina’s promising growth outlook, it appears to be an attractive investment opportunity. However, continuous monitoring of potential risk factors, including profitability, cost management, and exchange rate volatility, is crucial. Investors should also stay informed about market conditions and adjust their investment strategies accordingly.

What percentage of Protina’s shares did JPMorgan acquire?

JPMorgan acquired a 5.16% stake in Protina.

What is Protina’s main business?

Protina is engaged in drug discovery and companion diagnostics based on its SPID platform technology.

What are the key factors to consider when investing in Protina?

Potential risks such as profitability, cost management, and exchange rate fluctuations should be considered.