1. Bodytec Med Acquires Seoul Building for ₩18.9 Billion

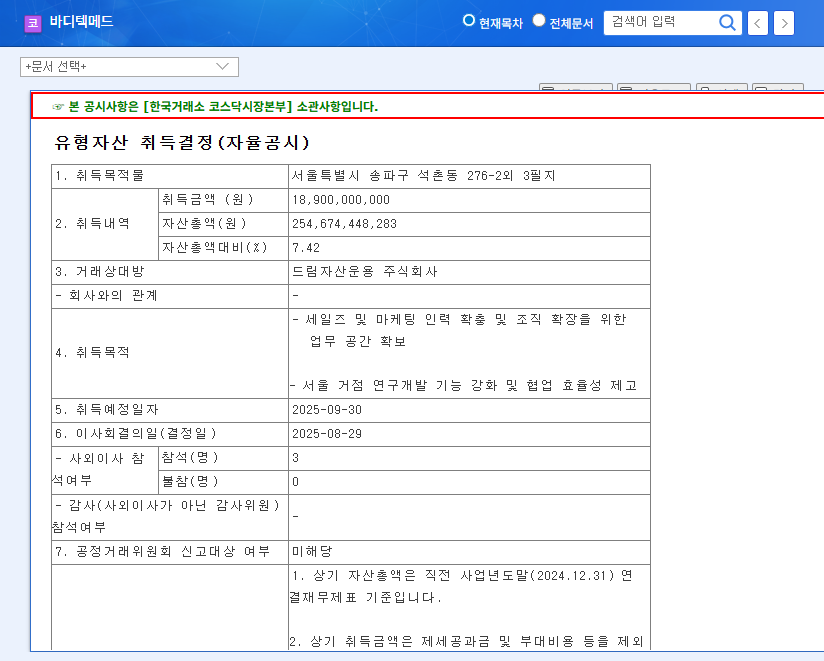

Bodytec Med has decided to acquire a property located in Seokchon-dong, Songpa-gu, Seoul for ₩18.9 billion. The acquisition is scheduled for September 30, 2025.

2. Investment Rationale: A Strategic Move for Growth

This investment will allow Bodytec Med to establish a Seoul base, expand its sales and marketing workforce, strengthen its research and development (R&D) capabilities, and facilitate organizational growth. This is seen as a strategic investment for future growth, going beyond simply securing office space. It is also expected to attract top talent and enhance the company’s brand recognition by strengthening its presence in Seoul.

3. Financial Impact Analysis: Short-Term Burden vs. Long-Term Growth

While the ₩18.9 billion investment may lead to short-term cash outflow, it is not expected to pose a significant burden considering Bodytec Med’s current financial health. In the long term, it is projected to positively impact corporate value by improving operational efficiency and strengthening R&D.

4. Action Plan for Investors

This investment can be interpreted as a positive signal, reflecting Bodytec Med’s growth potential. Investors should focus on the long-term growth prospects rather than short-term stock price fluctuations. It’s crucial to continuously monitor the realization of future business performance and develop investment strategies accordingly.

Why did Bodytec Med acquire the building?

The building acquisition aims to secure office space, expand the sales and marketing team, strengthen R&D capabilities, and facilitate organizational growth.

How will this investment affect Bodytec Med’s stock price?

While the short-term impact may be minimal, it is expected to contribute to long-term growth and positively influence the stock price.

What is the investment amount?

The investment amount is ₩18.9 billion.