What is the Treasury Stock Disposal?

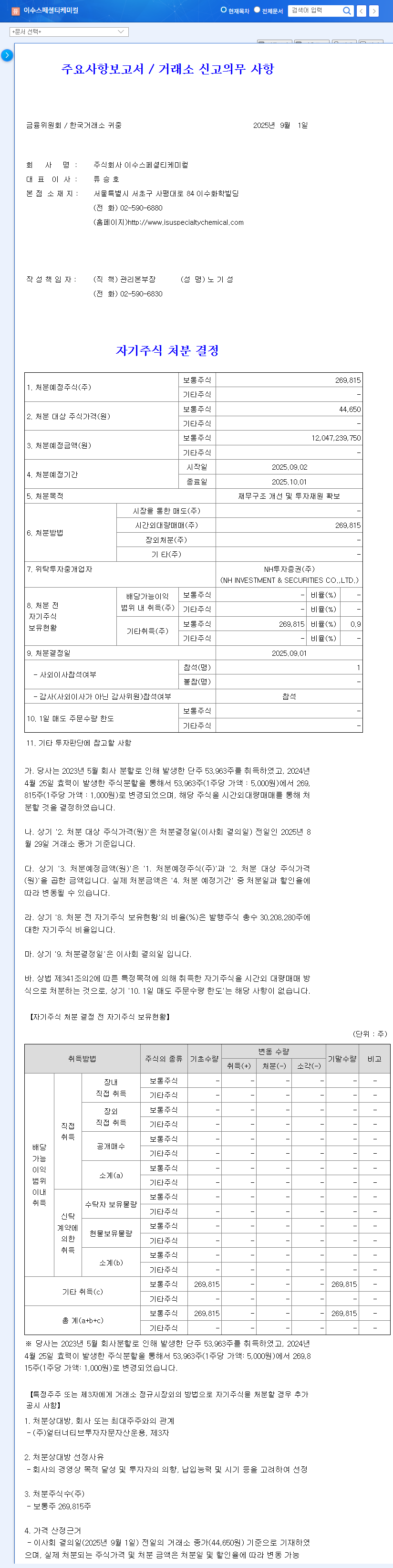

ISU Specialty Chemicals has decided to dispose of 269,815 shares (12 billion KRW) of treasury stock to improve its financial structure and secure investment funds. NH Investment & Securities is mediating the disposal.

What are the Reasons and Objectives?

The company has presented two main objectives. First, to improve the financial structure, including reducing the debt ratio. Second, to secure investment funds for future growth engines, such as the solid-state battery material (lithium sulfide) business. Currently, expectations are high for ISU Specialty Chemicals’ solid-state battery material business, and the company is increasing the possibility of commercial production by expanding its demo plant and supplying samples to customers. In addition, the company maintains a stable market position in its existing core businesses, such as TDM, IPA, and Special Solvent in the fine chemical sector. In particular, TDM is one of the world’s top three manufacturers and has high export competitiveness.

Impact on Investors:

- Positive Aspects: Improvement of financial structure and securing future growth engines can be expected to lead to an increase in long-term corporate value. In the short term, securing liquidity of 12 billion KRW is positive for alleviating financial burden.

- Considerations: Treasury stock disposal involves the possibility of equity dilution. Also, the market may interpret it as a negative signal in the short term. Therefore, investors need to carefully review the company’s plans for using the funds and its future growth potential.

Investment Strategies:

Investors should pay close attention to the following:

- Growth potential of the solid-state battery business (expansion of lithium sulfide mass production scale and securing customers)

- Improvement in the performance of the fine chemical sector (increase in IPA operating rate and strengthening of the high-value-added product portfolio)

- Strategies to respond to changes in the external environment (exchange rate and oil price volatility)

- Trends in improving financial soundness (plans for using disposal funds and debt repayment plans)

Does treasury stock disposal have a negative impact on stock prices?

In the short term, there is a possibility of a stock price decline due to the dilution effect caused by the increase in the number of shares. However, in the long term, corporate value may rise through financial structure improvement and growth investment.

How will the disposed funds be used?

ISU Specialty Chemicals plans to use the funds for financial structure improvement and investment in the solid-state battery material business.

What is ISU Specialty Chemicals’ core business?

They produce fine chemical products such as TDM, IPA, and Special Solvent. TDM, in particular, is globally competitive. The company is pursuing the solid-state battery material business as a future growth engine.

Leave a Reply