1. What Happened?

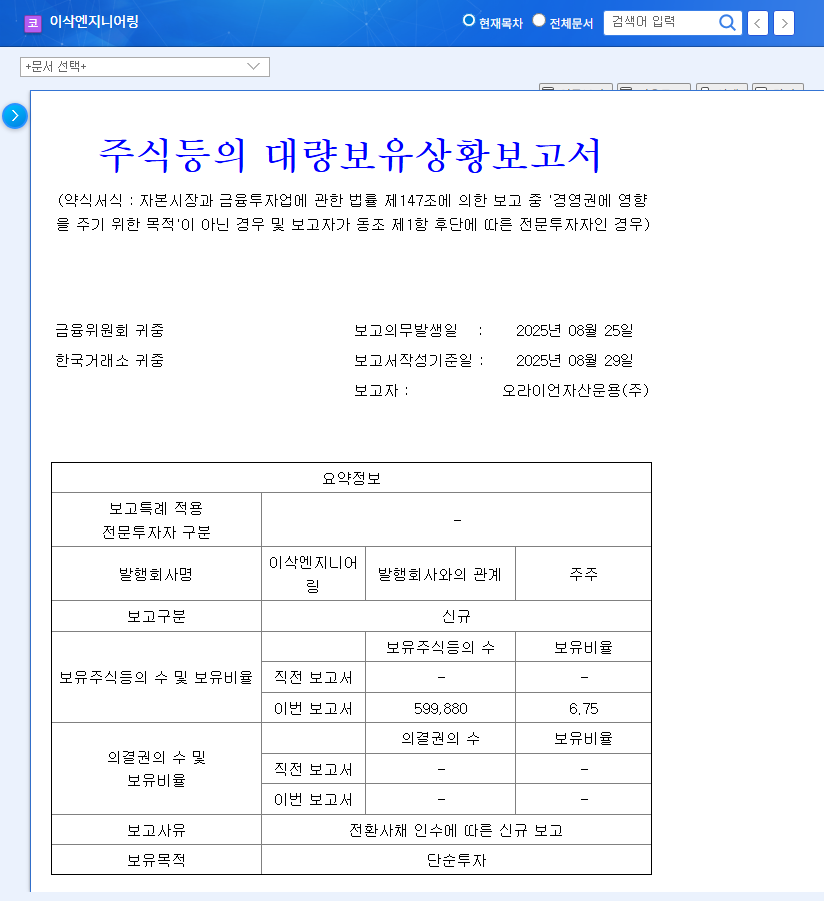

ISAAC Engineering issued convertible bonds (CBs), and an asset management company acquired these bonds, resulting in a 6.75% stake in the company. This acquisition was stated to be for investment purposes.

2. Why Does It Matter?

This change in ownership could impact ISAAC Engineering’s funding and growth strategy. While the investment may signal market confidence, the potential dilution of shares upon conversion of the CBs poses a risk.

3. What’s Next? – Opportunities and Risks

Positive Aspects

- • Increased Investor Confidence: The investment by the asset management firm can be seen as a positive signal for ISAAC Engineering.

- • Growth Potential: The acquired funds could be used to invest in new businesses, such as smart factories and power facility predictive diagnostic solutions.

Negative Aspects

- • Potential Financial Burden: With already high debt-to-equity ratios, the conversion of CBs could exacerbate the company’s financial strain.

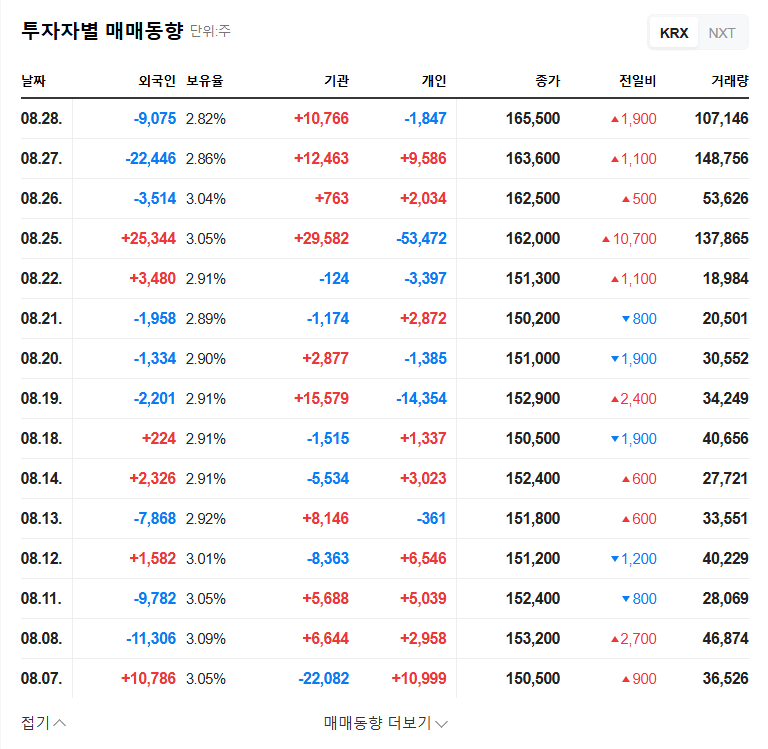

- • Increased Stock Volatility: Significant changes in ownership can lead to increased stock price volatility.

- • Declining Profitability in Existing Businesses: The continuing decline in sales and operating losses require urgent attention and improvement.

4. What Should Investors Do?

Investors should carefully consider the following factors and avoid being swayed by short-term stock fluctuations:

- • The likelihood and timing of CB conversion

- • Growth and profitability of new businesses

- • Turnaround potential of existing businesses

- • The company’s efforts to improve its financial structure

A comprehensive assessment of these factors is crucial for making informed investment decisions.

FAQ

What are convertible bonds (CBs)?

Convertible bonds (CBs) are hybrid securities that offer investors the features of both bonds and stocks. They pay interest like bonds but can be converted into the issuing company’s stock before maturity. Investors can profit from stock price appreciation by converting to shares or receive interest payments if the stock price declines.

How will this CB issuance affect ISAAC Engineering’s stock price?

In the short term, improved investor sentiment could drive the stock price upward. However, the potential for share dilution upon CB conversion could put downward pressure on the price in the long run. The company’s financial performance will ultimately be the key determinant of its stock price trajectory.

What are ISAAC Engineering’s main businesses?

ISAAC Engineering provides industrial automation solutions, digital factory solutions, industrial IoT platforms, and extra-high voltage power facility predictive diagnostic solutions. The company is currently focusing on its smart factory business to drive growth.