1. What Happened to Irondevice?

Irondevice struggled in the first half of 2025, recording sales of KRW 1.95 billion and an operating loss of KRW 2.625 billion. A sharp decline in sales of its flagship product, the Smart Power Amplifier, was the main cause, impacted by the global economic slowdown and weakened demand in the downstream market.

2. Why Did This Happen?

In addition to the global economic slowdown, the high proportion of R&D expenses and dependence on specific customers also contributed to the decline in performance. However, there are also positive factors such as an increase in government project orders and the development of SiC and GaN compound semiconductor power ICs.

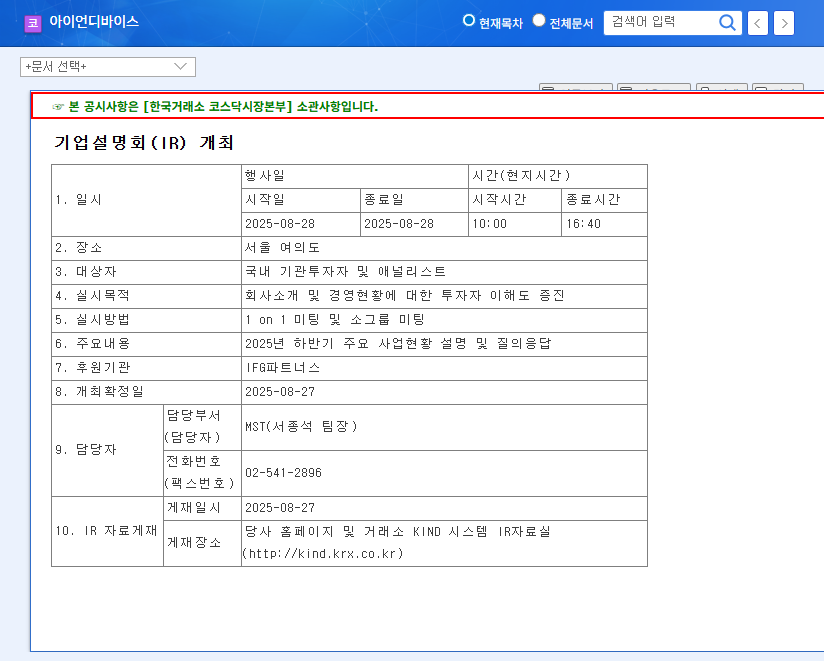

3. Key Points to Watch at the August IR

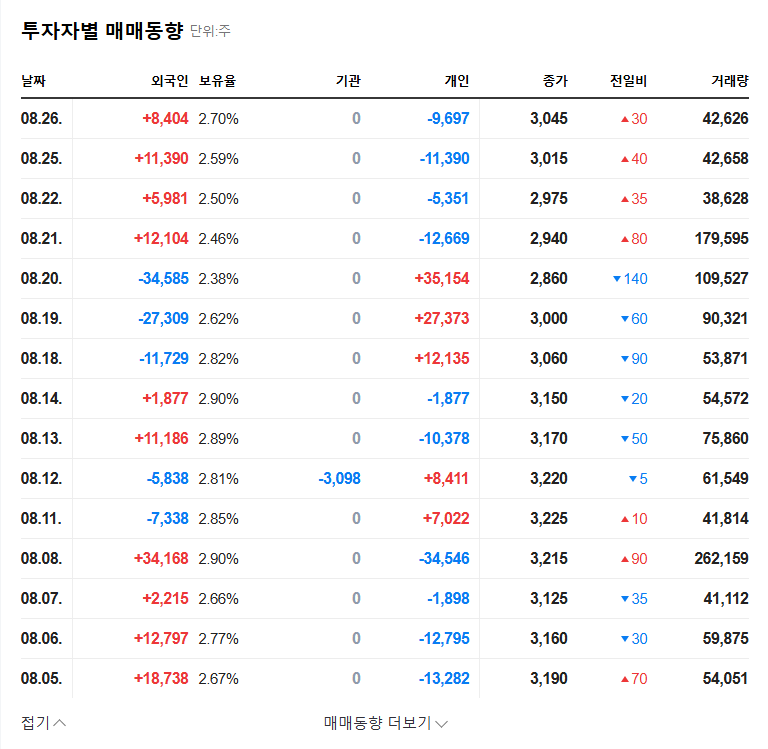

The August 28th IR is expected to provide specific details on H2 2025 earnings forecasts, business recovery possibilities, next-generation business roadmaps, and customer diversification strategies. In particular, the specific roadmap for the compound semiconductor business and the status of government project orders could significantly impact the stock price.

4. What Should Investors Do?

The current investment recommendation for Irondevice is ‘Hold’. It is wise to make investment decisions after carefully observing the results of the IR and subsequent business progress. Pay close attention to whether management’s explanations can alleviate market concerns and present future growth potential.

What is Irondevice’s main product?

Irondevice’s main product is the Smart Power Amplifier. However, sales declined significantly in the first half of 2025.

What is the outlook for Irondevice?

Irondevice has growth potential through participation in government-supported projects and the development of next-generation semiconductor technology. However, it is currently struggling due to poor performance. The results of the August IR and future business performance are expected to have a significant impact on the stock price.

Should I invest in Irondevice?

The current investment recommendation is ‘Hold’. It is advisable to make investment decisions after carefully reviewing the announcements from the August IR and subsequent business progress.