Hyundai E&C’s $32B Iraq Desalination Plant Contract: What Happened?

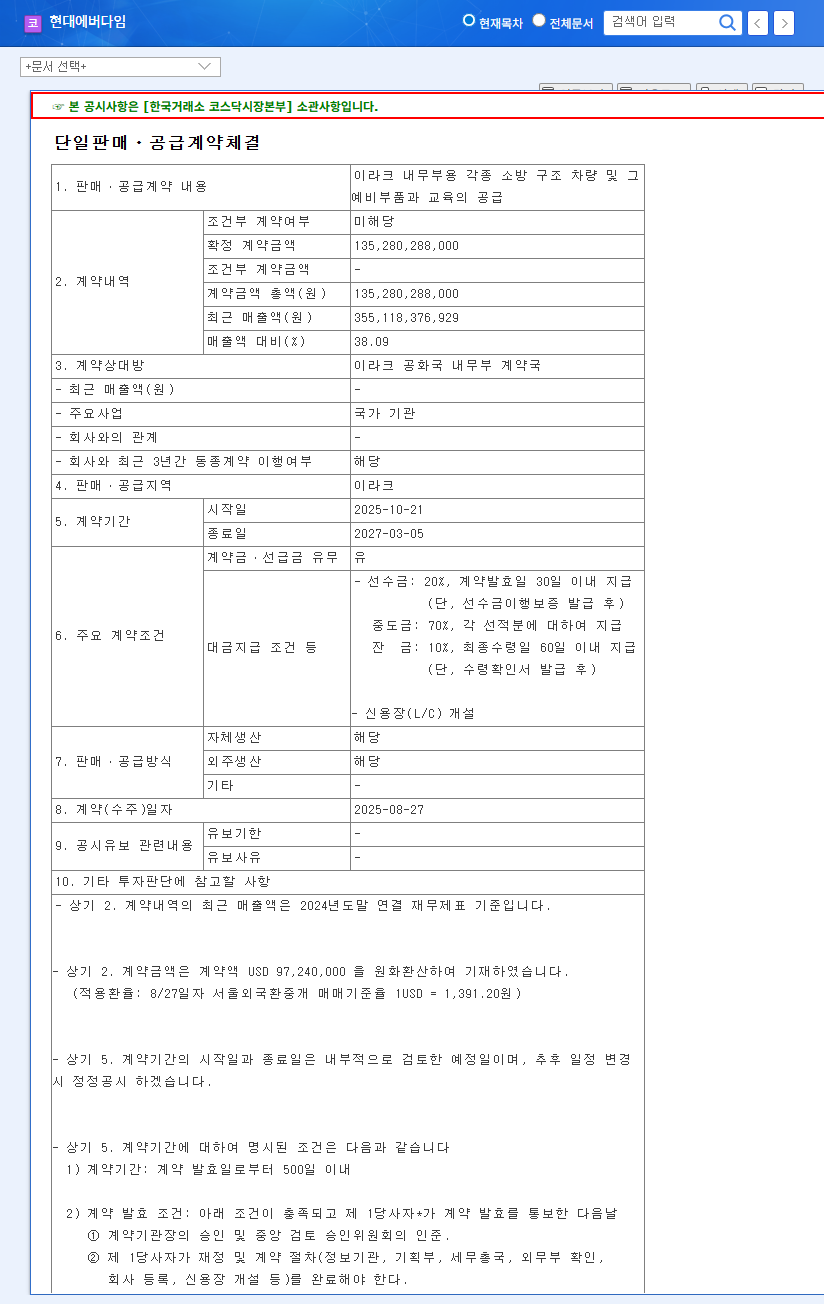

On September 15, 2025, Hyundai E&C signed a contract with TOTALENERGIES EP RATAWI HUB SAS for a desalination plant project in Iraq, valued at $32 billion. This substantial contract represents 13.4% of Hyundai E&C’s revenue and will run for approximately four years and one month, from November 30, 2025, to December 30, 2029. The desalination plant, to be built in the Basra region, will serve as crucial infrastructure for the energy industry.

Why is this Contract Significant?

This contract is a significant achievement, demonstrating Hyundai E&C’s competitiveness in overseas projects. It’s expected to strengthen the company’s presence in the Middle East, opening doors to further opportunities. The project contributes to a diversified business portfolio, ensuring a stable revenue base and accelerating growth in the plant/new energy sector. Hyundai E&C’s robust financial health (AA- rating) will facilitate securing the necessary funding for this large-scale project.

Impact on Investors

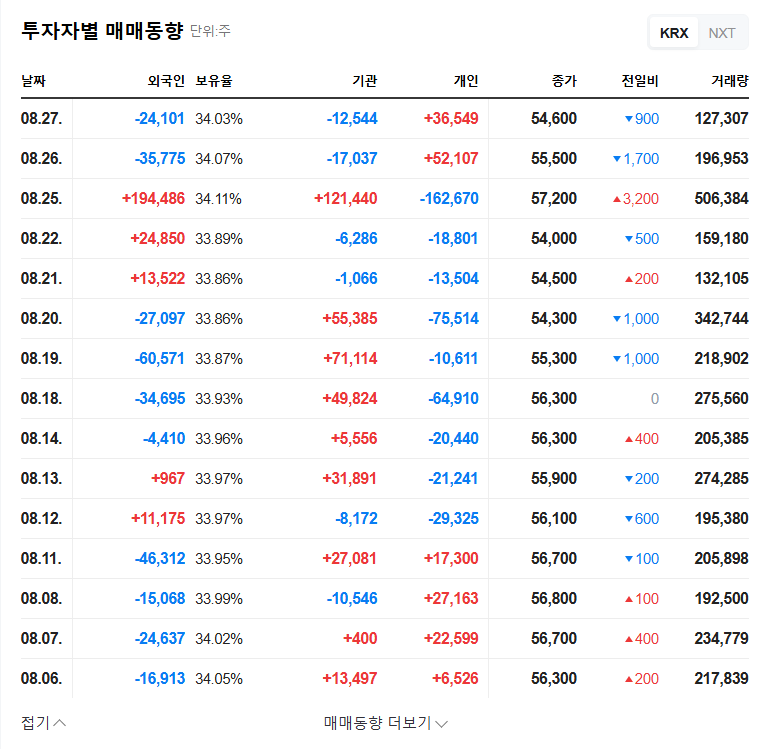

This contract presents both opportunities and challenges for investors. On the positive side, it promises increased overseas order backlog, diversification of the business portfolio, and reinforced financial stability. However, investors must consider geopolitical risks in Iraq, volatility in raw material prices and exchange rates, and potential unforeseen challenges during the project’s long duration.

What Should Investors Do?

Experts currently recommend a ‘Hold’ position, advising close monitoring of the project’s progress, Hyundai E&C’s financial performance, and any changes in geopolitical risks. Before making any investment decisions, carefully assess the business environment in Iraq, Hyundai’s hedging strategies for raw material prices and exchange rate fluctuations, and the outcomes of any relevant lawsuits or arbitrations.

Frequently Asked Questions (FAQ)

Will this contract positively impact Hyundai E&C’s stock price?

While a positive long-term impact is anticipated, short-term volatility is possible due to geopolitical risks in Iraq.

What are the key risks investors should consider?

Investors should carefully monitor Iraq’s political instability, fluctuations in raw material prices and exchange rates, and potential unforeseen risks during the project’s execution.

What is the outlook for Hyundai E&C’s stock price?

While this contract is a positive factor, the stock price can fluctuate depending on various factors like macroeconomic conditions and project progress. Staying informed through expert analysis and news updates is recommended.