What’s Happening? Hana Financial Group’s IR Announcement

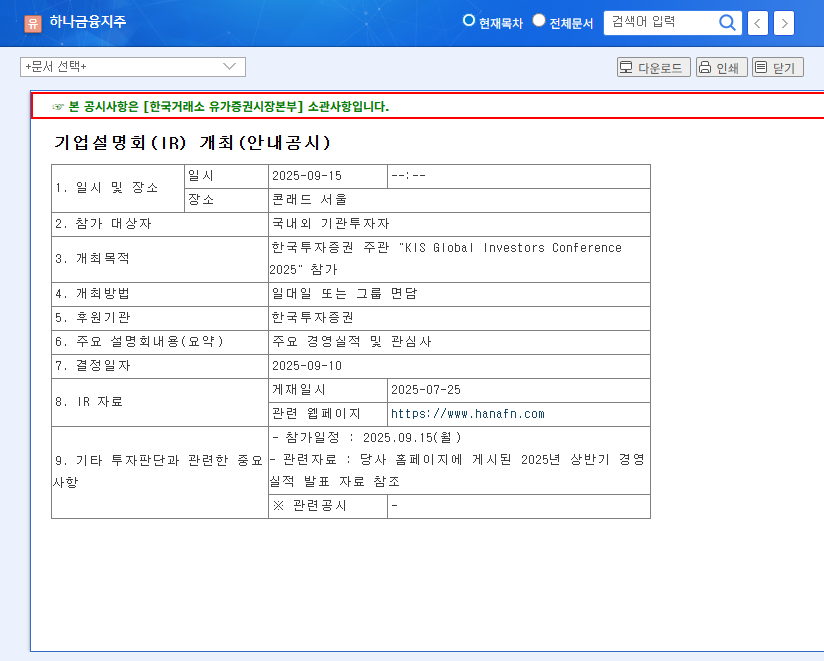

Hana Financial Group will hold an IR session on September 15, 2025, participating in the “KIS Global Investors Conference 2025” hosted by Korea Investment & Securities. The presentation will cover key management performance results and address market concerns.

Why is this IR Important? Market Expectations and Fundamental Analysis

The market is focusing on Hana’s overall management performance, future growth strategies, capital soundness, and shareholder return policies. As the recent financial statement correction disclosure doesn’t directly impact fundamentals, the IR’s focus will likely be on explaining the company’s intrinsic value creation capabilities.

- Projected Performance Improvement from 2024: Expected recovery in sales and profit indicators, improvement in operating and net profit margins, and stable ROE.

- Macroeconomic Factors: US interest rate freeze, KRW/USD exchange rate increase, fluctuations in oil and gold prices, and rising bond yields could all impact Hana Financial Group.

What’s the Impact? Analyzing the IR’s Influence and Investor Strategies

The IR can positively impact information transparency and investor sentiment but may also lead to disappointment if expectations are unmet. Investors should consider macroeconomic variables such as interest and exchange rate fluctuations, changes in oil and gold prices, and rising bond yields.

- Positive Impacts: Enhanced information transparency, improved investor sentiment, increased interest from participating institutions.

- Potential Negative Impacts: Disappointment if expectations are unmet, highlighting sensitive issues.

What Should Investors Do? Key Investment Points

- KPI-based Performance Presentation: Focus on key KPI achievements compared to past performance and concrete execution plans for future growth strategies.

- Strategies for Macroeconomic Uncertainty: Examine risk management and stable profitability strategies in response to interest rate and exchange rate fluctuations, geopolitical risks, etc.

- ESG Management and Social Responsibility Activities: Assess long-term sustainability and social value creation capabilities.

- Shareholder Return Policy: Check dividend payout ratio, treasury stock buyback/retirement plans, etc.

FAQ

What are the key takeaways to watch for in this IR?

Along with the announcement of key management performance results, information regarding future growth strategies, capital soundness, and shareholder return policies will be important.

What is the outlook for Hana Financial Group’s future performance?

Sales and profit indicators are expected to recover and grow from 2024, and operating and net profit margins are also projected to improve.

How will macroeconomic factors affect Hana Financial Group?

Interest and exchange rate fluctuations, changes in oil and gold prices, and rising bond yields can all impact Hana Financial Group’s profitability and investment portfolio.