Hanwha Vision Q2 2025 Earnings: A Turnaround, But Challenges Remain

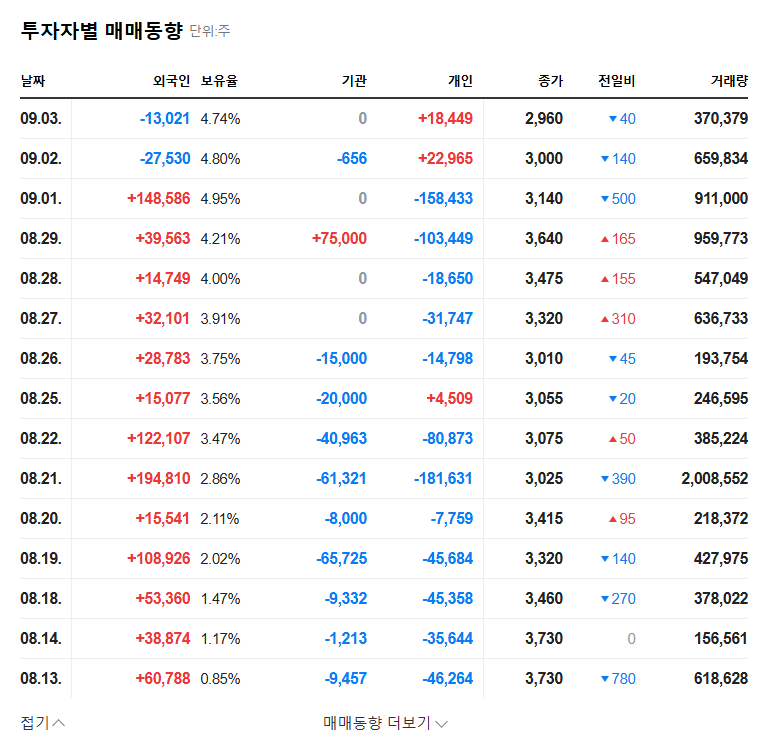

Hanwha Vision reported consolidated revenue of KRW 908.9 billion and operating profit of KRW 100.5 billion in the first half of 2025, marking a return to profitability. While the security division’s impressive growth fueled this turnaround, the struggles of the industrial equipment and semiconductor design divisions persist.

Future Growth Drivers: Security’s Strength and New Ventures

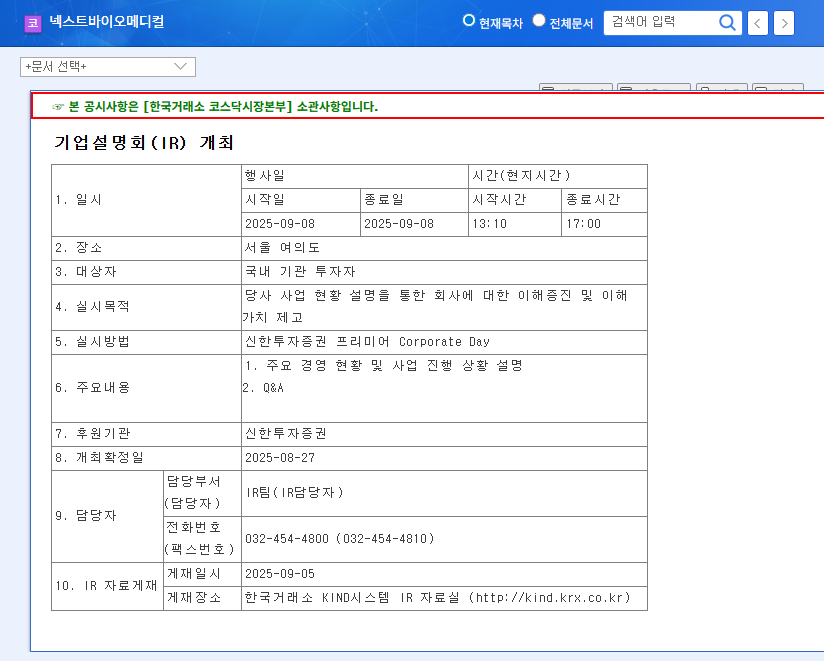

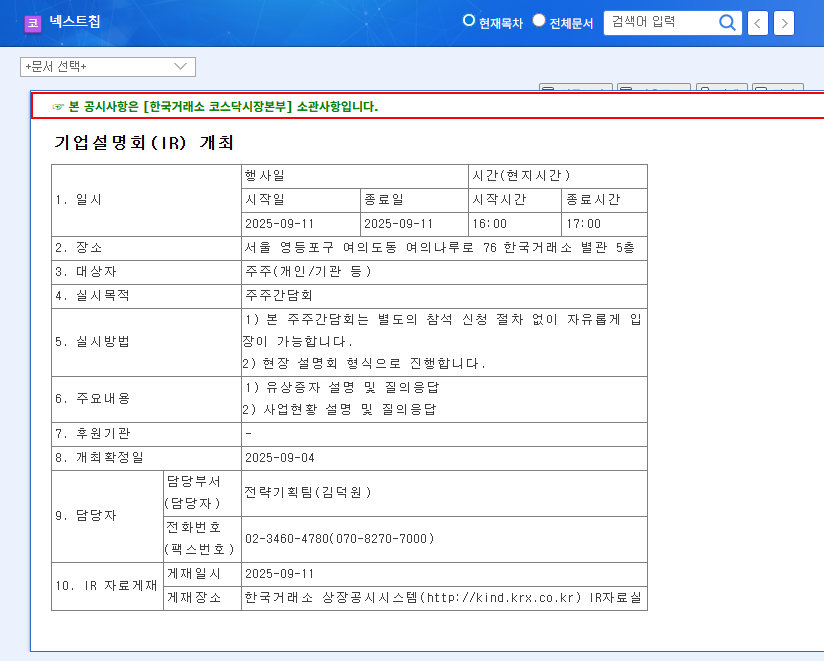

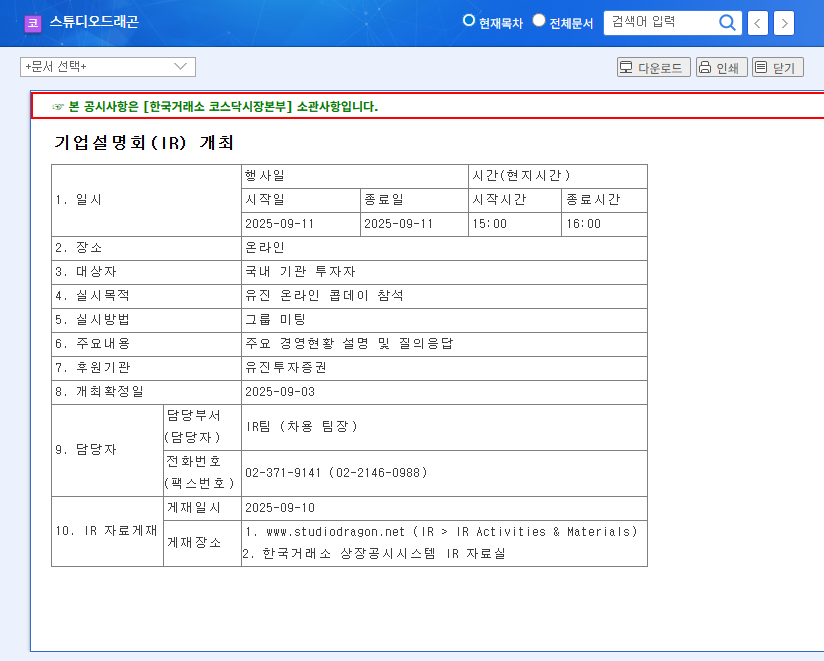

The security division continues to expand globally, driven by AI and cloud-based solutions. However, improving profitability in the industrial equipment division and achieving profitability in the semiconductor design division are crucial for sustained growth. Hanwha Vision is expected to address these challenges in the upcoming IR.

Action Plan for Investors: Analyze the IR and Watch the Market

- Carefully monitor the IR presentation: Pay close attention to Q2 results, growth strategies, and risk management plans.

- Balance growth potential and risk factors: Objectively assess the security division’s growth alongside the risks in other business segments.

- Monitor macroeconomic changes: Keep track of how external factors like exchange rate and interest rate fluctuations impact Hanwha Vision.

- Evaluate the presentation against market expectations: After the IR, consider market reactions and expert analyses to inform your investment decisions.

FAQ

How did Hanwha Vision perform in Q2 2025?

Hanwha Vision reported consolidated revenue of KRW 908.9 billion and operating profit of KRW 100.5 billion in Q2 2025, achieving a turnaround to profitability. The strong performance of the security division was the main driver.

What are Hanwha Vision’s main business segments?

Hanwha Vision operates three main business segments: security, industrial equipment, and semiconductor design.

What should my investment strategy be?

Carefully analyze the IR presentation, balancing the growth potential of the security division with the risks in the industrial equipment and semiconductor design divisions. It’s crucial to monitor macroeconomic changes and evaluate the presentation against market expectations.