1. Kia’s September IR: What to Expect

This IR, taking place overseas, will focus on ESG performance and roadmap, H1 2025 earnings updates, and H2 business strategies. Expect detailed information on Kia’s transition to electric vehicles, strong RV and eco-friendly car sales, and future technology development.

2. Kia’s H1 2025 Performance: Why It Matters

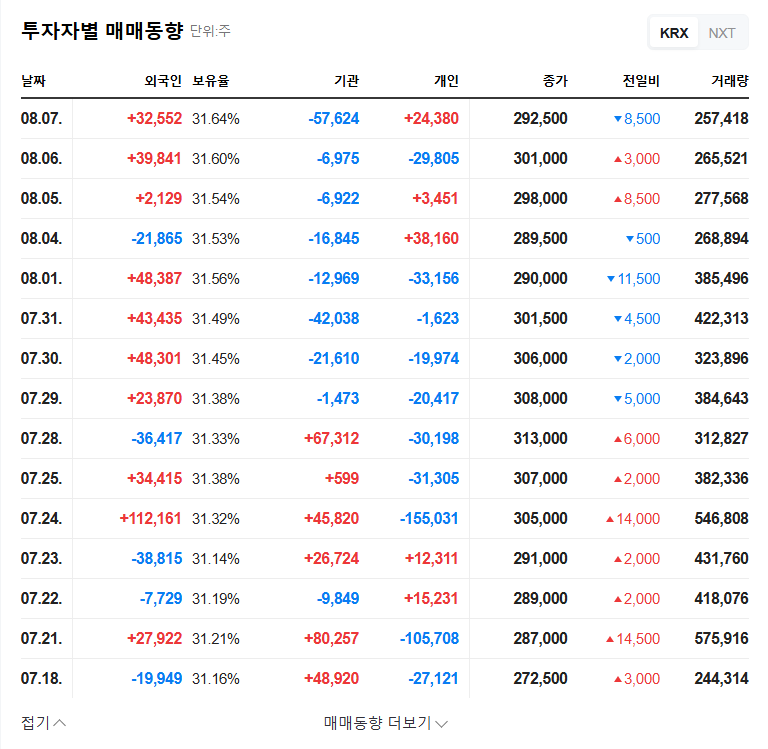

- Positives: Solid revenue growth (6.7% increase), maintained double-digit operating profit margin (10.1%), strong RV and eco-friendly car sales, expanded global production capacity, increased R&D investment.

- Negatives: Decrease in operating profit compared to the same period last year (18.3% decrease), low Mexico plant utilization rate, decline in China market share, exchange rate fluctuation risks, new business investment risks.

H1 performance is a critical indicator of potential growth in the second half and beyond. Consider both positive and negative factors comprehensively for informed investment decisions.

3. Key IR Takeaways and Investment Strategy: What to Do

- ESG Management: Concrete achievements and a clear roadmap are expected to enhance investment attractiveness. Pay attention to carbon emission reduction and sustainable supply chain management.

- Management Updates: Statements regarding strategies for the struggling China market, expansion into emerging markets beyond the US, and concretization of PBV and future mobility businesses will significantly impact investor sentiment.

- Overseas IR: This presents an opportunity to build trust with global investors and attract further investment.

4. Investor Action Plan

Kia’s solid fundamentals and future growth drivers enhance its investment appeal. However, uncertainties remain, including intensifying competition in the China market and geopolitical risks. Carefully analyze the IR announcements, assess the company’s strategic direction and risk management capabilities, and make prudent investment decisions.

FAQ

How is Kia performing in terms of ESG?

Kia is strengthening its eco-friendly management, focusing on its transition to electric vehicles. They have set specific targets for carbon emission reduction and sustainable supply chain management. Detailed achievements and roadmap will be revealed during the IR.

What is Kia’s strategy for the China market?

Kia’s market share in China is declining due to intensifying competition in the EV market. The IR is expected to provide a detailed explanation of their strategy to address this challenge.

Should I invest in Kia?

Kia possesses strong fundamentals and future growth drivers, but risks such as intensifying competition in the China market exist. Analyzing the IR announcements and making careful investment decisions is recommended.