1. What Happened with SK Square?

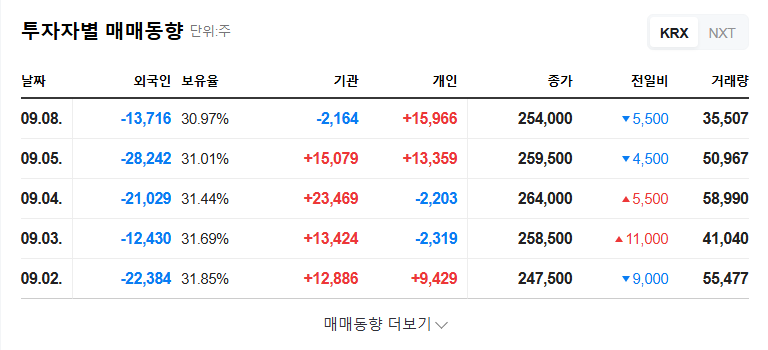

After the market closed on September 10, 2025, a large block of 44,625 SK Square shares was traded for ₩7.8 billion. The substantial foreign buying and selling activity on the same day is also noteworthy.

2. Why Did This Happen?

Positive Factors: SK Square reported impressive growth in Q2 2025, with consolidated operating profit reaching ₩305.3 billion, a 177.8% year-on-year increase. This strong performance was fueled by the profit from its stake in SK Hynix (₩1.46 trillion) and the robust performance of its investment business segment. Additionally, a low debt-to-equity ratio of 9.84% demonstrates a stable financial structure.

Negative Factors: The operating losses of some subsidiaries, such as 11st and SK Planet, remain a concern. Furthermore, macroeconomic uncertainties, including high interest rates and exchange rate volatility, could weigh on investor sentiment.

3. What’s Next for SK Square?

The after-hours block trade may increase short-term price volatility. However, SK Square’s fundamentals remain strong, and its long-term growth potential is still high. Future stock performance is likely to depend on SK Hynix’s earnings, the improvement in subsidiary profitability, and the overall macroeconomic environment.

4. What Should Investors Do?

Instead of reacting to short-term market fluctuations, investors should focus on SK Square’s fundamentals and long-term growth potential. Before making any investment decisions, it’s crucial to thoroughly research relevant information and consider your own risk tolerance. Reviewing analyst reports and market consensus can also be helpful in making informed investment decisions.

FAQ

What are SK Square’s main businesses?

SK Square operates in Investment, Commerce (11st), Platform (SK Planet, One Store, Dreamus Company), Mobility (Tmap Mobility, FSK L&S), and Other (Incross) businesses.

What does an after-hours block trade mean?

An after-hours block trade refers to a large volume of shares traded outside of regular trading hours and can indicate the intentions of specific investors.

Should I invest in SK Square?

Investment decisions are ultimately personal, but SK Square’s strong fundamentals and growth potential are worth considering. However, macroeconomic uncertainties and the underperformance of some subsidiaries pose risks. Thorough research and consulting with a financial advisor are recommended before investing.