1. INVENI Announces KRW 100 Billion Funding Plan: What’s Happening?

INVENI announced it is reviewing various options regarding treasury shares to enhance long-term shareholder value, including the potential issuance of exchangeable bonds worth KRW 100 billion. While not yet finalized, details will be solidified through future board resolutions.

2. Background and Purpose of Funding: Why?

INVENI is restructuring its business portfolio as it transitions into an investment holding company. The KRW 100 billion funding is speculated to be for treasury stock acquisition, cancellation, enhancing shareholder return policies, or securing resources for aggressive investments and portfolio expansion. While showing signs of a turnaround with projected profits in 2024, raising capital in a high-interest environment could be burdensome despite maintaining its AA- credit rating.

3. Impact on Investors: So What?

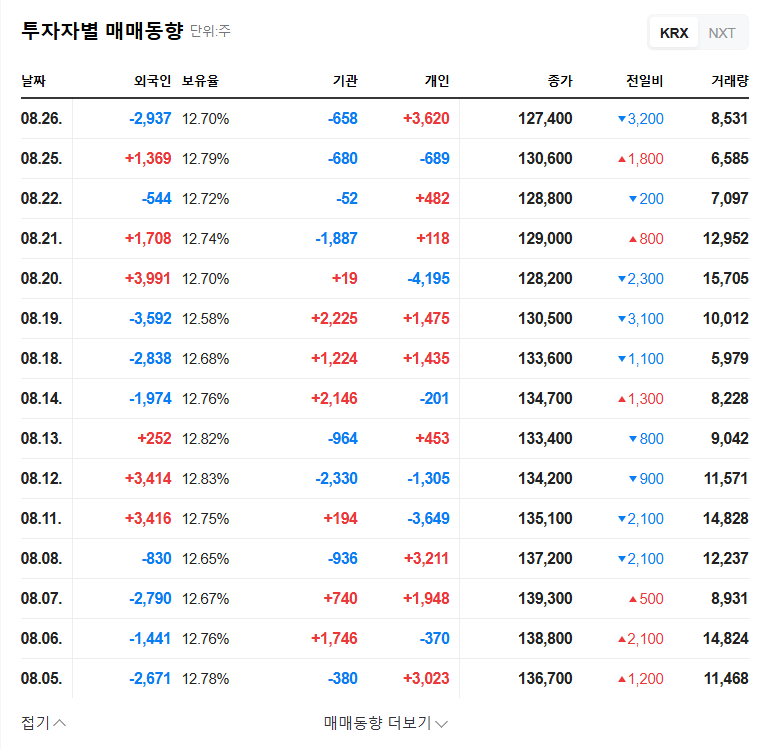

- Short-term Impact: The funding announcement may cause short-term stock price volatility. Expectations of capital expansion coexist with concerns about shareholder value dilution, and the market will react sensitively to future disclosures.

- Long-term Impact: The purpose and use of the funds will determine the long-term stock price trend. Efficient investment and strengthened shareholder return policies will have a positive impact, while the opposite could have a negative effect.

4. Investor Action Plan

- Close Monitoring: Pay close attention to INVENI’s board resolutions, specific plans for treasury shares, and further disclosures on the purpose and use of the funds.

- Track Investment Performance: Continuously monitor whether INVENI’s investment performance as an investment holding company leads to actual fundamental improvements.

- Consider Macroeconomic Conditions: Make investment decisions considering the high-interest rate environment and global economic uncertainties.

INVENI Funding FAQs

Why is INVENI raising capital?

INVENI is considering raising capital for treasury stock management and investment portfolio expansion as it transitions to an investment holding company.

How will the KRW 100 billion funding impact the stock price?

Short-term volatility is expected, while the long-term impact depends on the purpose and utilization of the funds.

What should investors pay attention to?

Investors should closely monitor the company’s announcements and investment strategies, and consider the macroeconomic environment when making decisions.

Leave a Reply