Hanwha Life Announces ESG Roadmap 2.0: Key Takeaways

Hanwha Life approved the ‘2030 ESG Management Strategy and Roadmap 2.0’ at its Sustainability Management Committee meeting in Q3 2025. This strategy includes an analysis of the current status of ESG management, future strategies, and specific implementation plans, which are expected to contribute to enhancing long-term corporate value. The company also demonstrated its active commitment to ESG management by announcing the results of its ‘ReVIBE 2025’ eco-friendly donation campaign and plans to publish its 2025 Sustainability Report.

Carrot’s Plunging Solvency Ratio: Hanwha Life’s Achilles’ Heel?

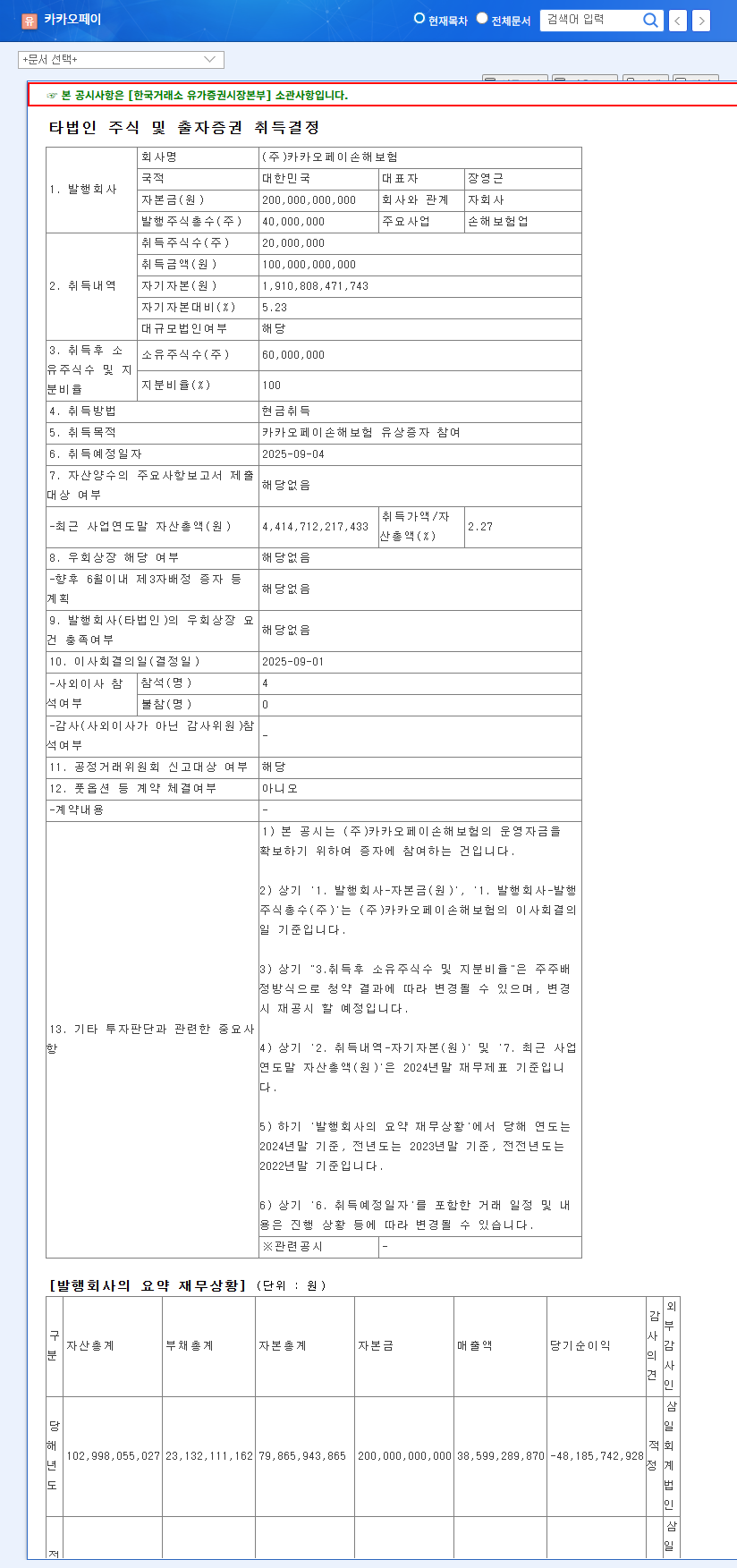

The solvency ratio (K-ICS) of its subsidiary, Carrot General Insurance, plummeted to 67.08% in Q2 2025. This signals serious financial soundness issues and could negatively impact the reputation and financial soundness of the entire Hanwha Life group. It is urgent for Carrot to develop and implement concrete improvement measures, such as capital reinforcement.

Action Plan for Investors: Balancing Opportunities and Risks

Hanwha Life’s strengthening of ESG management is a positive factor from a long-term perspective. However, Carrot’s financial soundness issues are a crucial variable in investment decisions. Investors should closely monitor Carrot’s capital reinforcement plans and their implementation, and make investment decisions by comprehensively considering Hanwha Life’s overall financial soundness and market conditions.

Frequently Asked Questions

What are the key elements of Hanwha Life’s ESG Roadmap 2.0?

It’s a strategy to pursue sustainable growth through ESG management by 2030. Key elements include strengthening eco-friendly management, fulfilling social responsibilities, and improving corporate governance.

How does Carrot’s declining solvency ratio impact Hanwha Life?

Carrot’s declining solvency ratio raises concerns about the financial health of the entire Hanwha Life group. Hanwha Life may need to prepare support measures for Carrot, such as capital reinforcement.

What should investors consider when investing in Hanwha Life?

While the company’s efforts to strengthen ESG management are positive, Carrot’s financial soundness issues are an investment risk. Investors should consider Carrot’s recovery prospects, Hanwha Life’s overall financial condition, and market conditions.