When South Korea’s largest institutional investor, the National Pension Service (NPS), makes a move, the market listens. Recently, the spotlight has turned squarely on Sanil Electric stock after the pension giant significantly increased its holdings. This wasn’t just a minor adjustment; it was a clear signal of confidence that has sent ripples through the investment community.

Is this move merely a short-term play, or does the NPS see a deeper, long-term value proposition in Sanil Electric? This comprehensive analysis will dissect the investment, explore the company’s robust fundamentals, and evaluate the future market outlook to provide you with critical insights for your own investment strategy.

The NPS’s increased stake is more than a transaction; it’s a powerful endorsement of Sanil Electric’s growth trajectory and its pivotal role in the global energy transition.

The Official Announcement: A Deeper Look at the NPS Stake Increase

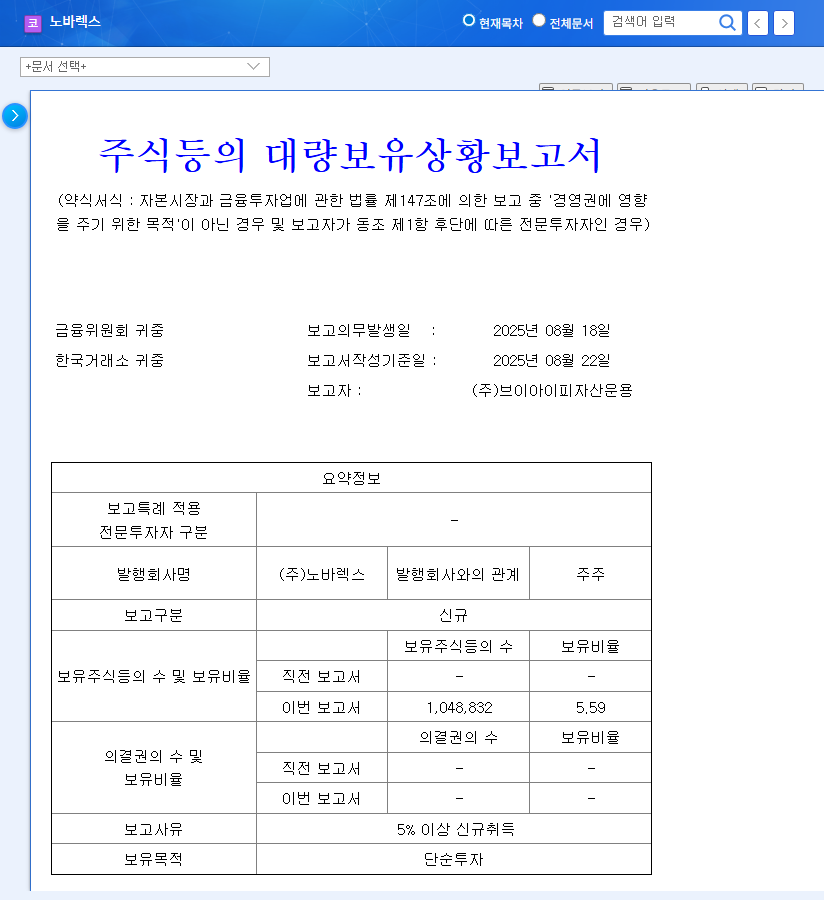

On October 1, 2025, a mandatory disclosure confirmed that the National Pension Service boosted its stake in Sanil Electric from 7.26% to 8.28%—a significant increase of 1.02 percentage points. The official purpose was listed as ‘simple investment,’ which, while sounding passive, is often interpreted by market analysts as a strong vote of confidence in a company’s underlying value and future prospects. You can view the Official Disclosure on DART for verification. This action by a major institutional player is widely seen as a bullish signal for the Sanil Electric stock.

Why Sanil Electric? A Deep Dive into the Fundamentals

The NPS’s decision appears to be firmly rooted in Sanil Electric’s exceptionally strong corporate fundamentals and its strategic positioning in high-growth markets. The company’s performance in the first half of 2025 was nothing short of remarkable.

Explosive Growth and Enhanced Profitability

The numbers speak for themselves. Sanil Electric has demonstrated a powerful combination of revenue growth and margin expansion, a clear indicator of a healthy, well-managed business.

- •Staggering Revenue Growth: Revenue for the first half of 2025 soared to 227.084 billion KRW, a massive 55% increase year-over-year.

- •Surging Operating Profit: Even more impressively, operating profit leaped by 75% during the same period, showcasing incredible operational leverage and efficiency.

- •Improved Margins: The operating profit margin expanded to an impressive 36.87%, signaling that the company is not just selling more, but is doing so more profitably.

Dominance in the Global Arena & Future Growth Engines

Sanil Electric is not just a domestic player; it’s a global powerhouse. With an export ratio of 96% and over 75% of sales generated from the United States, the company has masterfully capitalized on global trends. The urgent need to replace aging power grids and expand renewable energy infrastructure in the U.S., as detailed by sources like the U.S. Department of Energy, provides a massive, long-term tailwind. To further solidify its future, the company has launched strategic initiatives:

- •Renewable Energy Venture: The establishment of its subsidiary, ‘Sanil Energy Co., Ltd.’, marks a direct entry into the renewable energy generation business.

- •Capacity Expansion: A new second factory is under construction to meet soaring global demand.

- •Technological Investment: R&D efforts are focused on next-generation products like ultra-high voltage transformers and offshore wind power solutions, securing its competitive edge. Interested readers may want to explore our guide on investing in renewable tech.

Market Impact of the NPS Investment

The National Pension Service investment acts as a powerful catalyst. It validates the company’s strategy and can trigger a chain reaction in the market. Firstly, it boosts confidence among other institutional and foreign investors, potentially leading to increased capital inflows. Secondly, this institutional backing synergizes with the company’s strong fundamentals, potentially accelerating its growth trajectory. This ‘simple investment’ signals a positive medium-to-long-term outlook, which can create sustained upward pressure on the Sanil Electric stock price.

Key Considerations and Risks for Investors

Despite the overwhelmingly positive outlook, prudent investors must remain aware of external variables. As a major exporter, Sanil Electric is exposed to exchange rate fluctuations, although its active hedging strategies provide a significant buffer. Volatility in raw material prices also poses a potential risk to margins. Finally, the broader macroeconomic environment, including global interest rate policies and geopolitical tensions, requires continuous monitoring. The uncertainty surrounding the Alborz Cable equity investment due to Iranian sanctions is a specific point that warrants attention.

The Bottom Line: An Investor’s Takeaway

The National Pension Service’s increased stake in Sanil Electric is a compelling development backed by a foundation of stellar financial performance, strategic global positioning, and forward-looking investments in renewable energy. While external risks exist, the company’s robust fundamentals and the strong institutional endorsement suggest a promising future. For investors looking for exposure to the global energy transition and infrastructure modernization, the Sanil Electric stock presents a case that is increasingly hard to ignore.