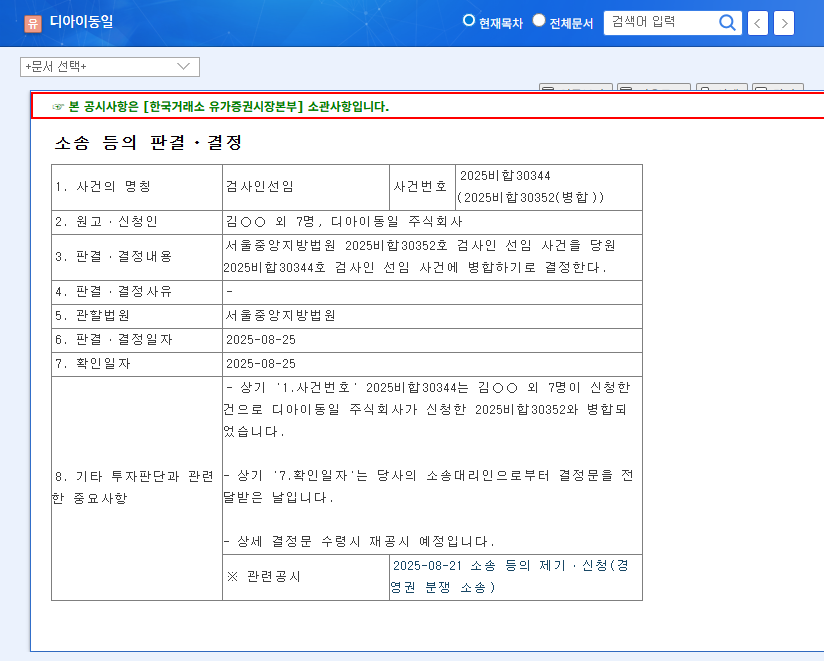

1. What Happened? Consolidation of the ‘Inspector Appointment’ Lawsuit

The lawsuits surrounding the ‘inspector appointment’ for DI Dongil have been consolidated at the Seoul Central District Court. This signifies the merging of two previously ongoing lawsuits into one. The objective of this lawsuit is to ensure management transparency and investigate potential issues within the company.

2. Why Does It Matter? Increased Uncertainty and Potential Impact

The appointment of an inspector introduces uncertainty to corporate management. On the positive side, it holds the potential to enhance management transparency. However, on the negative side, it can lead to time and cost expenditures, damage to the company’s image, and a decline in investor sentiment. Especially considering DI Dongil’s current underperformance, this lawsuit could further negatively impact investor sentiment.

3. So What? Short-Term/Long-Term Impact Analysis

In the short term, the keyword ‘lawsuit’ itself can send a negative signal to the market and potentially lead to downward pressure on the stock price. In the long term, depending on the outcome of the lawsuit, there could be significant fluctuations in the company’s value. If it leads to improved management transparency, it could be positive. Conversely, if serious issues are uncovered, it could deal a critical blow to the company’s value.

4. What Should Investors Do? Key Checkpoints

- Carefully review future disclosures and court rulings for the specific details of the lawsuit.

- Monitor DI Dongil management’s information disclosure and response strategies, and check their efforts to maintain sound financial health.

- Continuously monitor stock price trends and respond to changes in market conditions.

Frequently Asked Questions

What is the appointment of an inspector?

The appointment of an inspector is a system where a court-appointed inspector investigates a company’s business and financial status to ensure management transparency, investigate internal issues, or protect shareholder rights.

How will this lawsuit affect DI Dongil’s stock price?

Short-term downward pressure on the stock price is expected due to increased uncertainty, but the long-term impact depends on the outcome of the lawsuit.

What should investors be aware of?

Investors should understand the details of the lawsuit through future disclosures and court rulings, and monitor DI Dongil’s financial status and management’s response.