What Happened?

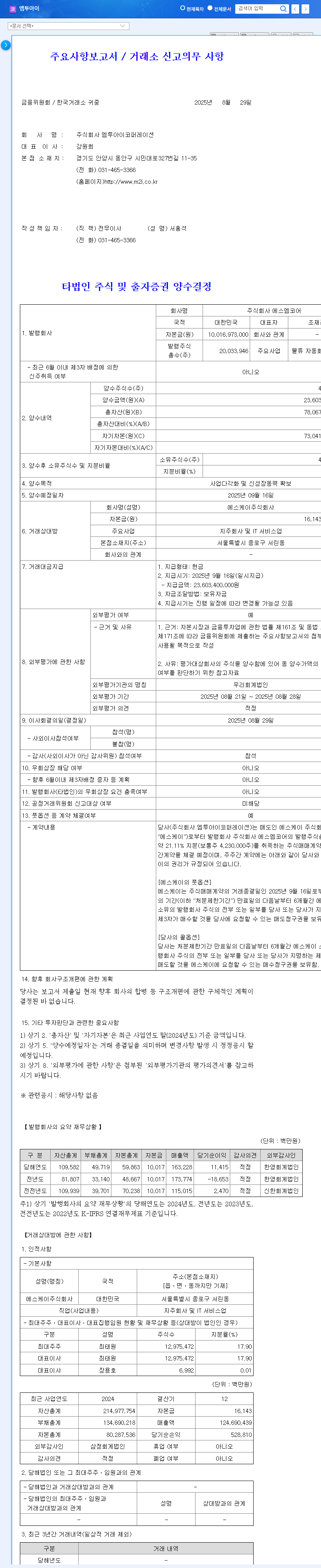

SMCore announced a KRW 20.6 billion contract with Linglong Tire’s Guangxi plant on September 17, 2025, for a PCR G/T project. The contract spans 1 year and 6 months, from September 17, 2025, to March 17, 2027.

Why is This Contract Important?

- Revenue Growth: The KRW 20.6 billion contract will significantly contribute to SMCore’s revenue growth.

- Business Diversification: Building automation equipment for tire factories marks SMCore’s entry into a new industrial sector.

- Order Backlog Boost: The contract secures stable future revenue streams.

- China Market Expansion: Winning a contract in the Chinese market reinforces SMCore’s regional diversification strategy.

How Will This Impact the Stock Price?

This contract is a positive indicator of SMCore’s growth trajectory. While short-term stock price fluctuations are possible, the medium to long-term impact is expected to be positive. However, investors should consider potential risks such as cost of goods sold management, China market risks, and foreign exchange fluctuations.

What Should Investors Do?

Investors should monitor the following factors and develop their investment strategies accordingly:

- Contract implementation progress and profitability

- Potential for additional orders in the tire industry or related sectors

- KRW/USD and KRW/CNY exchange rate fluctuations, raw material prices, and interest rate trends

- Analysis of future financial statements

FAQ

What is SMCore’s main business?

SMCore specializes in logistics automation systems and equipment manufacturing for the semiconductor and secondary battery industries.

What is the size of this contract?

KRW 20.6 billion, which represents 12.59% of SMCore’s revenue.

Who is the counterparty to this contract?

Linglong Tire’s Guangxi plant in China.

Will this contract positively impact SMCore’s stock price?

While short-term fluctuations are possible, the medium to long-term impact is expected to be positive. However, investment decisions should be made cautiously.