The upcoming iM Financial Group IR event, scheduled for November 17, 2025, is a pivotal moment for investors. In a financial landscape marked by volatility and uncertainty, this event offers a crucial window into the company’s strategic direction and resilience. Stakeholders are keenly awaiting insights that could redefine the company’s valuation and chart its course for the future. This comprehensive iM Financial Group analysis will dissect the key factors at play, from its fundamental health to the macroeconomic pressures it faces, providing the investment insights you need.

We will explore the group’s performance, the outlook for its key subsidiaries, and the critical questions management must answer to inspire market confidence. Whether you’re a current shareholder or considering a position, this deep dive will equip you with a robust framework for evaluating the information presented at the iM Financial Group IR.

Core Financial Health: A Stability Analysis

As of the first half of 2025, iM Financial Group has demonstrated a solid financial footing. Key metrics underscore this stability: a net income of 309.3 billion KRW, an ROA of 0.64%, and an ROE of 10.30%. Perhaps most importantly, its BIS total capital ratio stands at an impressive 14.76%, signaling excellent capital soundness. This robust base is critical as the group navigates economic headwinds. For more detailed financial data, investors can consult the Official Disclosure filed with DART.

Performance Deep Dive: The Subsidiaries

The group’s overall performance is a sum of its parts. A closer look at each subsidiary reveals a mix of strengths and areas requiring strategic attention:

- •iM Bank: The crown jewel. Following its transition to a city bank, it remains the primary growth engine with a net income of 256.4 billion KRW and a stellar BIS ratio of 17.52%. Its performance will be a key highlight of the iM Financial Group IR.

- •iM Securities: While posting a healthy net income of 54.1 billion KRW, its reliance on derivatives and fund-related profits introduces volatility. The strategy for creating synergy with asset management and IB operations needs clarification.

- •iM Life Insurance: The adoption of IFRS17 and K-ICS standards has increased its insurance liabilities. Investors will be looking for a clear path to managing these new capital requirements while pursuing value-centric growth.

- •iM Capital: Asset quality is the main concern here, with a non-performing loan ratio of 3.09%. While portfolio diversification is positive, robust risk management strategies are paramount.

- •iM Asset Management: Despite growing assets under management (AUM), profitability remains a challenge in a fiercely competitive market. A strategy for improving margins is essential.

Navigating the Macroeconomic Climate

The 2025 global economy faces significant downward pressure from sustained high interest rates and geopolitical uncertainty. South Korea’s economic outlook has been similarly revised. This environment presents both challenges and opportunities for the financial sector, a topic that will surely be central to the IR. For a broader view, reports from sources like Reuters on global economic trends provide valuable context.

Key concerns include potential deterioration in asset quality for banks as vulnerable borrowers struggle, and persistent default risks in real estate Project Financing (PF) affecting securities firms. The group’s strategy for mitigating these systemic risks, particularly its high loan proportion (61.3%) and exposure to Net Interest Margin (NIM) volatility, will be under intense scrutiny.

The core challenge for iM Financial Group is to demonstrate how its diversified model can weather macroeconomic storms while unlocking new avenues for growth beyond its core banking operations. The upcoming IR is their platform to make that case.

Investor Action Plan: What to Watch for at the IR

This IR is a critical opportunity for management to build trust and articulate a compelling vision. As an investor, your analysis should focus on the substance behind the presentation. For further reading, consider our in-depth guide to South Korea’s banking sector.

Key Questions for Management:

- •Profitability Beyond Banking: What are the concrete, actionable strategies to improve the profitability of the securities, insurance, and asset management divisions?

- •Risk Management: How is the group proactively managing the risks associated with real estate PF and rising delinquency rates at iM Capital?

- •Future Growth Engines: Beyond stabilizing current operations, what is the roadmap for growth? This includes digital transformation, fintech expansion, and ESG initiatives.

- •Shareholder Returns: What is the firm’s commitment to a consistent and transparent shareholder return policy, including dividends and buybacks?

The specificity and credibility of the answers to these questions will likely determine the market’s reaction. A convincing presentation could significantly enhance the iM Financial Group stock outlook, while ambiguity could lead to negative sentiment. Careful attention is warranted.

Frequently Asked Questions (FAQ)

When is the iM Financial Group IR event?

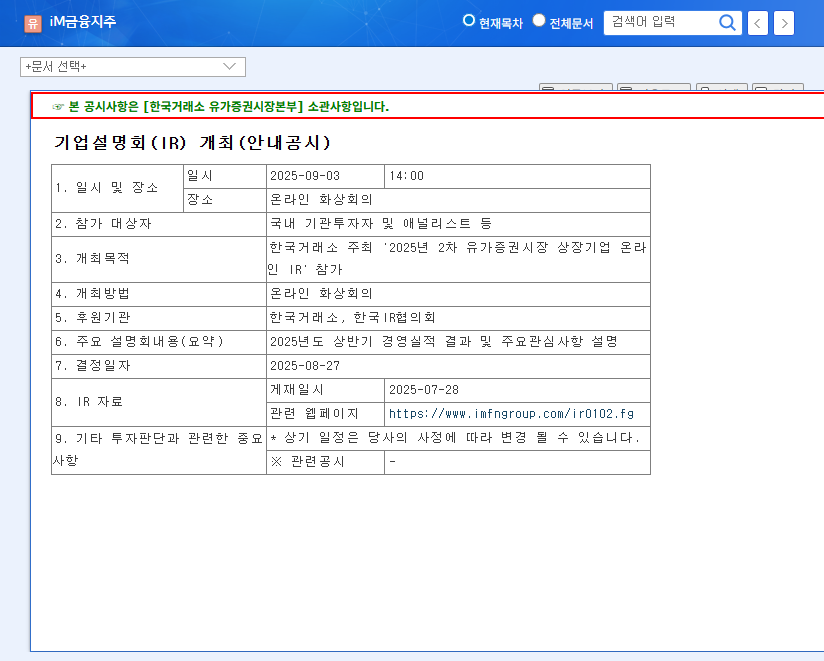

The Corporate Investor Relations (IR) event for iM Financial Group Co., Ltd. is scheduled to take place on November 17, 2025.

What are the main topics of the IR?

The event will cover recent financial performance, the strategic outlook for key business segments, and the group’s plans for navigating macroeconomic challenges and securing future growth.

How might this IR affect the iM Financial Group stock price?

The impact can be significant. A clear, convincing vision for growth and risk management could boost investor confidence and positively affect the stock price. Conversely, a lack of clarity or unconvincing strategies could have a negative impact.