The latest ILDONG HOLDINGS earnings report for Q3 2025 presents a complex picture for investors. While the company celebrated a significant return to profitability, underlying financial metrics and subsidiary performance reveal persistent risks that cannot be ignored. This comprehensive ILDONG HOLDINGS stock analysis will dissect the preliminary results, evaluate the company’s fundamental health, and provide a strategic outlook for potential investors.

ILDONG HOLDINGS Q3 2025 Earnings: Key Figures at a Glance

On November 6, 2025, ILDONG HOLDINGS CO.,LTD released its preliminary consolidated financial results, signaling a potential turning point. The market is buzzing about the shift from loss to profit, a welcome sign after a challenging period. Here are the core numbers from the report (Source: Official DART Disclosure):

- •Revenue: KRW 150.4 billion. This figure represents a slight increase from the previous quarter but a decrease compared to the same period last year.

- •Operating Profit: KRW 6.5 billion. A successful and significant turnaround to profitability, marking a major highlight of the quarter.

- •Net Profit: KRW 1.0 billion. The company also returned to black in net profit, substantially narrowing the loss from the previous year.

While the headline numbers are encouraging, a deeper ILDONG HOLDINGS financial analysis is necessary to understand the full story behind this turnaround and the challenges that lie ahead.

The Q3 2025 results are a tale of two realities: the holding company’s core strength and cost-cutting measures are driving profitability, yet the heavy debt load and underperforming subsidiaries remain significant anchors on long-term growth.

Fundamental Deep Dive: Strengths vs. Financial Risks

To make an informed decision about an investment in ILDONG HOLDINGS, we must look beyond one quarter’s results and examine the company’s foundational health.

The Bright Spots: Core Business and R&D Pipeline

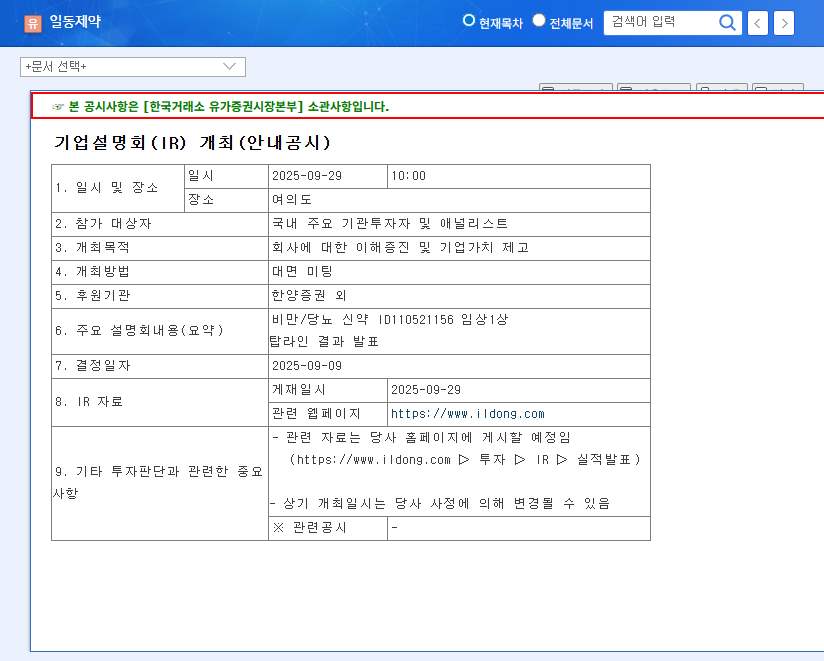

The holding company’s separate financial statements paint a much rosier picture. The core holding business demonstrated stable revenue growth (up 4.4%) and robust operating profit growth (up 12.0%). This stability is crucial. Furthermore, key subsidiary ILDONG Pharmaceutical has promising developments, including the COVID-19 treatment ‘Xocova’, which has gained approval in Japan. Success in global markets for such new drugs could be a major catalyst for future ILDONG HOLDINGS earnings.

The Red Flags: Debt and Subsidiary Drag

The consolidated financials reveal the company’s primary weaknesses. The most alarming figure is the high debt ratio of 236%. A high ratio like this indicates significant financial leverage and risk, making the company vulnerable to interest rate hikes and economic downturns. For more on this, investors should read up on understanding key financial ratios. Key risk factors include:

- •High Leverage: The 236% debt-to-equity ratio signals a heavy reliance on borrowing to finance assets.

- •Maturing Debt: Convertible bonds are set to mature in November 2025, creating an immediate redemption burden and potential for share dilution.

- •Subsidiary Losses: Many subsidiaries outside the core pharmaceutical arm are recording operating losses, which negatively impact the consolidated results.

- •Non-operating Factors: Liabilities from derivatives and foreign exchange losses are further eroding net profit.

Stock Outlook & Investment Strategy

Short-Term Market Reaction (1-3 Months)

In the short term, the market is likely to react positively to the headline news of a profit turnaround. This could lead to a modest rebound in the stock price. However, savvy investors, as highlighted by sources like Reuters Business, will quickly look at the underlying financial health. The high debt and declining year-over-year revenue will likely temper excitement, leading to potential volatility or a ‘wait-and-see’ sentiment without further strong catalysts.

Mid-to-Long-Term Growth Prospects (>3 Months)

The long-term trajectory of an investment in ILDONG HOLDINGS hinges on management’s ability to execute on several key fronts:

- •Deleveraging: A clear, aggressive strategy to reduce the 236% debt ratio is paramount.

- •New Drug Commercialization: The global performance of ‘Xocova’ and other pipeline drugs must translate into tangible revenue growth.

- •Portfolio Optimization: The company needs to either turn around or divest its underperforming subsidiaries that are dragging down consolidated results.

Actionable Investment Advice

Based on this ILDONG HOLDINGS stock analysis, investors should adopt a cautious and strategic approach.

For Short-Term Traders: The recent positive news may offer a brief window of opportunity, but the underlying risks suggest high volatility. A cautious approach focused on clear entry and exit points is advised. The stock is not yet a ‘buy and hold’ based on fundamentals alone.

For Long-Term Investors: A position should only be considered after the company demonstrates tangible progress in improving its financial health. Closely monitor future ILDONG HOLDINGS earnings calls for updates on debt reduction plans, subsidiary restructuring, and the commercial success of its drug pipeline. Until then, it remains a high-risk, potential high-reward play best kept on a watchlist.