The latest financial release from HYUNDAI STEEL COMPANY has sent ripples through the investment community. The Q3 2025 earnings report revealed figures that fell short of market expectations, sparking immediate concerns about the company’s short-term health. However, a deeper analysis suggests that beneath this temporary setback lies a foundation for significant long-term growth and strategic repositioning.

This comprehensive guide will dissect the Hyundai Steel earnings for Q3 2025, explore the complex factors contributing to the results, and provide a clear-eyed view of the full-year outlook and the powerful growth drivers shaping its future. For investors, understanding this context is crucial for navigating the current volatility and making informed decisions about Hyundai Steel stock.

Q3 2025 Earnings: The Numbers and The Shock

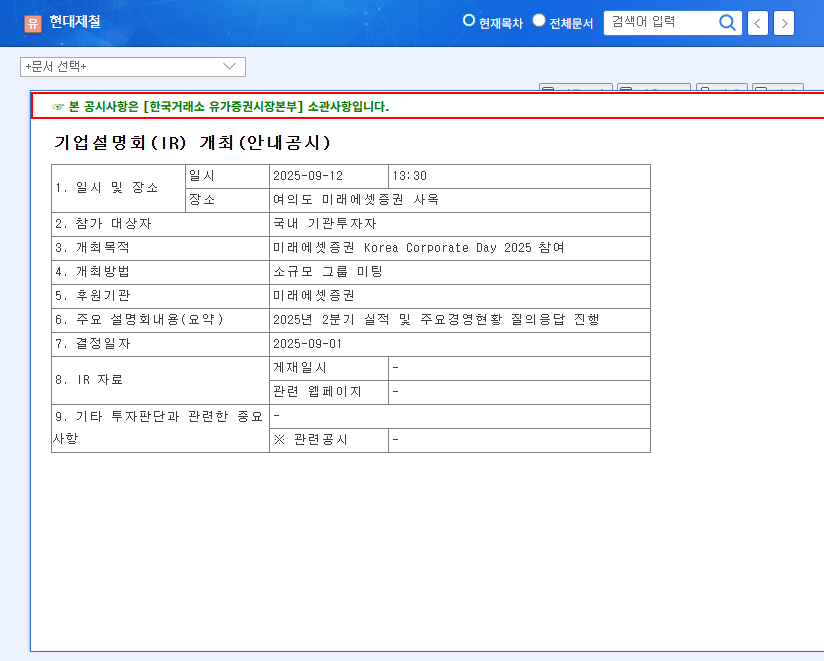

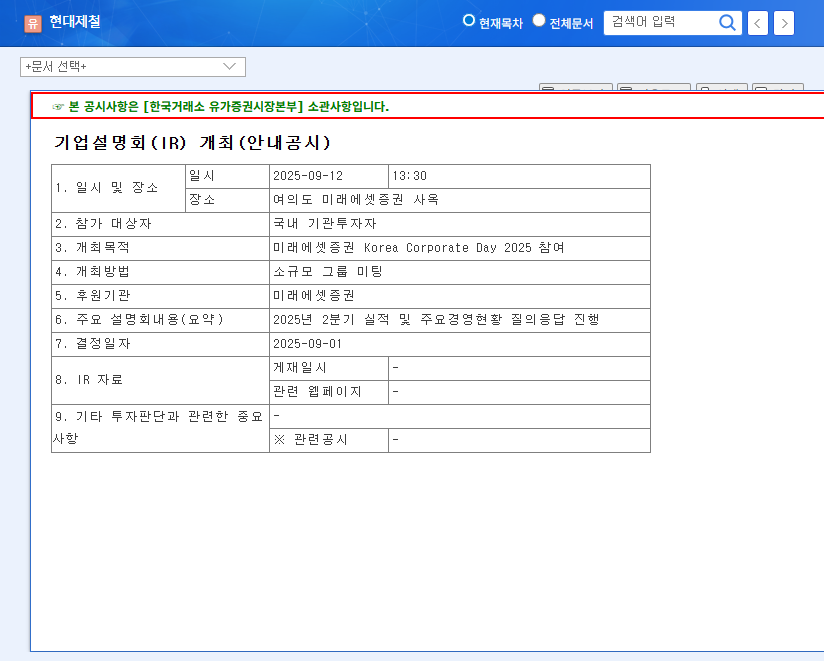

HYUNDAI STEEL COMPANY announced its preliminary Q3 2025 results, which presented a mixed but ultimately disappointing picture when measured against market consensus. These figures, detailed in their Official Disclosure, require careful examination.

- •Revenue: Reached KRW 5,734.4 billion. While this marked a 1.95% year-on-year increase, it was -0.64% below the market’s expectation of KRW 5,771.5 billion.

- •Operating Profit: Showed a significant 80.97% year-on-year jump to KRW 93.2 billion, but still missed the consensus of KRW 102.9 billion by -9.43%.

- •Net Profit: The most significant deviation occurred here. The company turned profitable year-on-year with KRW 17.1 billion, but this was a staggering -55.47% below the market’s forecast of KRW 38.4 billion.

The dramatic miss on net profit delivered a pronounced earnings shock, signaling deeper issues with profitability and cost management during the quarter.

Factors Behind the Underperformance

The Q3 earnings slump wasn’t caused by a single issue, but a convergence of challenging internal and external pressures. Understanding these headwinds is key to evaluating the steel market outlook and its impact on the company.

Global and Macroeconomic Pressures

A general economic slowdown across major global markets dampened demand for steel products, a trend exacerbated by anticipated cuts in China’s crude steel production. According to World Steel Association reports, this has created a challenging environment for all major producers. Furthermore, volatile raw material prices and an unfavorable USD/KRW exchange rate significantly increased import and logistics costs, squeezing profit margins.

Strategic Investments and Segment Weakness

A major contributor to the financial pressure is the ongoing construction of a new electric arc furnace in the United States. This strategic, long-term investment carries a substantial upfront cost burden that is currently impacting quarterly earnings. Compounding this, the company’s flat steel segment, a critical part of its business, experienced a sharp decline in profitability, which was the primary driver behind the significant net profit miss.

While the Q3 2025 numbers are a cause for caution, they largely reflect short-term costs for long-term strategic gains. The real story lies in the company’s pivot towards high-value markets and sustainable technology.

Full-Year Outlook and Long-Term Growth Engines

Despite the quarterly setback, the forecast for HYUNDAI STEEL COMPANY for the full year 2025 and beyond contains several powerful catalysts for growth. This is where investors should focus their attention.

Projected Rebound and Shareholder Value

The full-year 2025 operating profit is projected to reach KRW 333.9 billion, with net profit at KRW 333.1 billion—a vast improvement over 2024. This optimism is based on an expected recovery in the steel market and the initial benefits from new investments beginning to materialize. Expected Earnings Per Share (EPS) of KRW 3,776 and Book Value Per Share (BPS) of KRW 69,600 signal a strong potential for enhanced shareholder value.

Strategic Growth Initiatives

- •North American Foothold: The new U.S. electric arc furnace is more than just a factory; it’s a strategic entry into the lucrative North American market, positioning the company to benefit from trends in reshoring and demand for locally sourced materials.

- •High-Value Product Mix: A focus on expanding sales of premium products like low-carbon steel for green construction and ultra-high-strength plates for the electric vehicle (EV) industry will secure higher margins and new growth engines.

- •Future-Proof Technology: Investments in next-generation tech, such as hydrogen reduction steelmaking, are vital for long-term competitiveness and meeting increasingly stringent environmental regulations.

- •ESG Leadership: Strong Environmental, Social, and Governance (ESG) performance, highlighted by accolades like the CDP ‘Carbon Management Sector Honors’, enhances corporate value and attracts a modern class of investors.

Investor Action Plan: A Long-Term Perspective

Given the disappointing Hyundai Steel Q3 2025 results, a knee-jerk reaction might be to sell. However, a more prudent approach involves looking past the immediate noise. Investors should consider the full picture by focusing on the company’s long-term trajectory and fundamental strengths, which you can compare with our comprehensive analysis of the 2025 steel industry trends.

The key is to weigh the current downside risks against the substantial long-term growth potential. Closely monitor progress on the North American expansion, the adoption rate of high-value products, and the broader macroeconomic environment. While short-term volatility is likely, the strategic initiatives underway at HYUNDAI STEEL COMPANY could position it for significant success in the years to come.