The outlook for HD HYUNDAI MIPO stock (KRX: 010620) has surged following a monumental ‘Earnings Surprise’ in its provisional Q3 2025 results, announced on November 3, 2025. The company didn’t just meet market expectations; it shattered them, posting figures in revenue, operating profit, and net income that signal robust fundamentals and exceptional future growth potential. This performance raises critical questions for investors: what is the engine behind this success, and is now the time to invest in HD HYUNDAI MIPO stock for the long term?

This comprehensive analysis delves into the core drivers of HD HYUNDAI MIPO’s stunning quarterly performance, examines the company’s fortified market position, and provides a forward-looking perspective on its investment potential, including a clear-eyed view of potential risks. We’ll explore why this latest HD HYUNDAI MIPO earnings report is more than just numbers—it’s a strategic blueprint for success in the modern shipbuilding era.

Q3 2025 Earnings: A Landmark ‘Surprise’

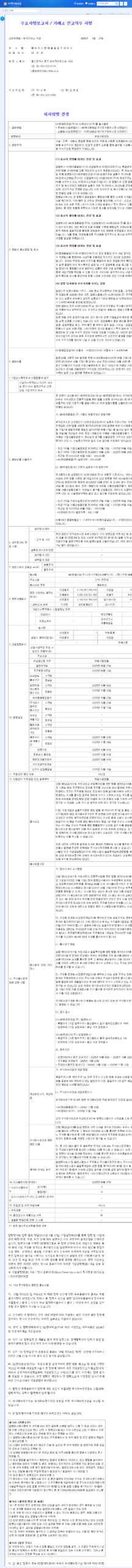

HD HYUNDAI MIPO’s provisional operating results for the third quarter of 2025 were nothing short of astonishing, dramatically outperforming market consensus. These remarkable figures were officially released in the company’s public disclosure. (Source: Official DART Report). The key financial metrics tell the story:

- •Revenue: KRW 1,278.5 billion, a significant 9% above the forecast of KRW 1,175.1 billion.

- •Operating Profit: KRW 190.5 billion, an incredible 84% above the forecast of KRW 103.3 billion.

- •Net Income: KRW 176.1 billion, more than double the forecast at 103% above the expected KRW 86.6 billion.

The near-doubling of operating profit and net income compared to projections firmly places this performance in the ‘Earnings Surprise’ category, sparking immediate positive sentiment in the market for shipbuilding stocks.

Key Drivers Behind the Stellar Performance

This success was not accidental. It was the result of a multi-faceted strategy that combined operational excellence with a keen focus on high-growth market segments.

1. Strategic Focus on High-Value Eco-Friendly Vessels

A primary driver of profitability was the company’s increased backlog of high-value-added, eco-friendly ships. With tightening global regulations from bodies like the International Maritime Organization (IMO), the demand for vessels powered by alternative fuels like LPG and methanol has surged. HD HYUNDAI MIPO has expertly positioned itself as a leader in this niche, securing orders that carry significantly higher profit margins than conventional ships. This strategic pivot is a core component of its long-term value proposition.

2. Operational Excellence and Cost Management

Alongside its market strategy, the company executed flawlessly on the production floor. Systematic cost reduction programs, improved process efficiencies, and company-wide cost-saving initiatives directly contributed to the dramatic expansion of operating profit margins. Furthermore, favorable non-operating income and reduced financial costs amplified the bottom-line growth, showcasing prudent financial management.

The Q3 2025 results are a testament to HD HYUNDAI MIPO’s strategic pivot towards high-margin, eco-friendly vessels, effectively insulating it from market volatility and positioning it for sustained future growth.

Investment Outlook for HD HYUNDAI MIPO Stock

This outstanding HD HYUNDAI MIPO earnings report is expected to have a profoundly positive impact on the company’s stock price and long-term corporate value. This performance solidifies its position as a top contender among leading global shipbuilding stocks.

Short-Term and Long-Term Catalysts

In the short term, the massive earnings beat will likely fuel strong buying sentiment, leading to upward revisions of earnings forecasts and target prices from brokerage firms. In the long term, the company’s foundation is stronger than ever. A substantial order backlog of KRW 12,088.9 billion (as of H1 2025) provides revenue stability for years, while its leadership in the green transition of shipping ensures it captures future growth.

Macroeconomic Risks to Consider

Despite the bright outlook, prudent investors should remain aware of external risks:

- •Exchange Rate Volatility: As an export-heavy business, fluctuations in the KRW/USD exchange rate can impact revenue and cost structures.

- •Shipping Market Cycles: Indices like the BDI and CCFI, which have shown recent softness, could signal a slowdown in new vessel orders if the trend continues.

- •Global Economic Conditions: Interest rates, oil prices, and overall global trade health can influence the broader industry environment.

However, HD HYUNDAI MIPO’s robust order book and its specialization in the non-discretionary, regulation-driven eco-friendly market provide a powerful buffer against many of these cyclical pressures.

Conclusion: An Appealing Long-Term Investment

HD HYUNDAI MIPO’s Q3 2025 earnings surprise is a clear validation of its strategic direction. The company has proven its ability to maximize profitability through operational efficiency while capturing the most valuable segment of the shipbuilding market. For investors with a long-term horizon, the HD HYUNDAI MIPO stock presents a compelling case, underpinned by a massive order backlog, technological leadership, and a strengthening financial position. While external risks warrant monitoring, the company’s internal strengths and strategic positioning make it a formidable player set for continued success.